Do RHÖN-KLINIKUM's (ETR:RHK) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in RHÖN-KLINIKUM (ETR:RHK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide RHÖN-KLINIKUM with the means to add long-term value to shareholders.

See our latest analysis for RHÖN-KLINIKUM

RHÖN-KLINIKUM's Improving Profits

In the last three years RHÖN-KLINIKUM's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. RHÖN-KLINIKUM's EPS skyrocketed from €0.45 to €0.65, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 43%.

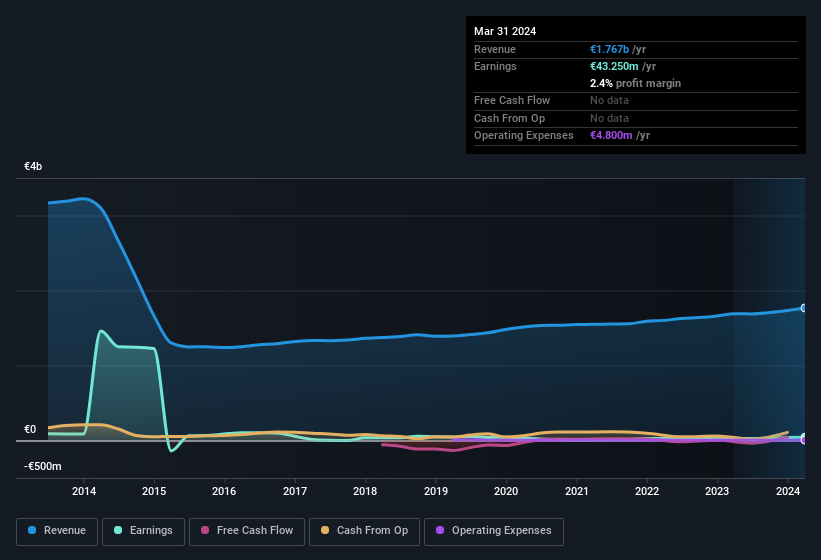

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of RHÖN-KLINIKUM's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. RHÖN-KLINIKUM maintained stable EBIT margins over the last year, all while growing revenue 4.6% to €1.8b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are RHÖN-KLINIKUM Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to RHÖN-KLINIKUM, with market caps between €374m and €1.5b, is around €1.2m.

RHÖN-KLINIKUM's CEO took home a total compensation package of €507k in the year prior to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add RHÖN-KLINIKUM To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into RHÖN-KLINIKUM's strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if RHÖN-KLINIKUM is trading on a high P/E or a low P/E, relative to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of German companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance