Resale condos in prime districts and city-fringe areas see smallest price gap in 22 years: OrangeTee & Tie

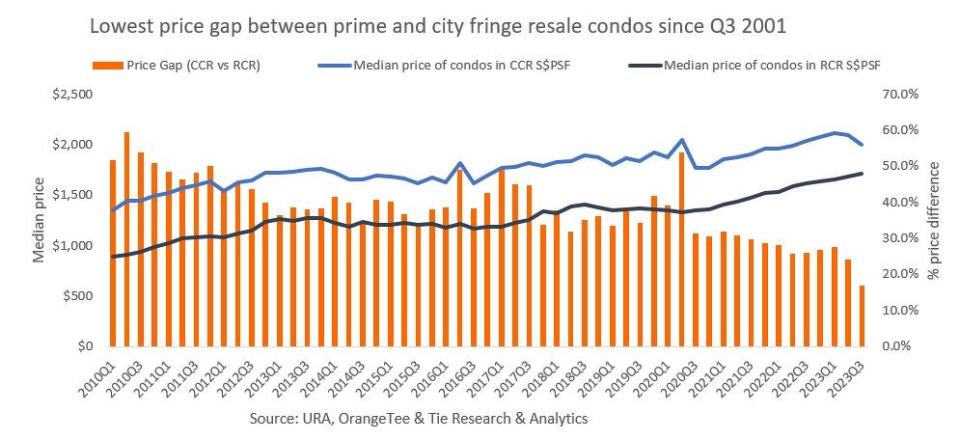

The gap between prices of resale condos in the CCR and the RCR narrowed from 24.1% in 2Q2023 to 17.5% in 3Q2023 (Picture: Samuel Isaac Chua/The Edge Singapore)

SINGAPORE (EDGEPROP) - Luxury condos in the resale market may be more attractive to buyers as prices in the prime district and the city fringe continued to narrow in 3Q2023, according to an October research report by OrangeTee & Tie.

This comes as prices of private resale homes, excluding executive condos (ECs), grew 0.9% q-o-q last quarter to $1,631 psf, reversing from the 0.4% q-o-q decline recorded in 2Q2022. The growth was underpinned by the landed segment, which saw resale prices surge 13.1% q-o-q. In contrast, the resale non-landed segment saw prices dip by 0.9% q-o-q.

Resale prices for private homes in the Outside Central Region (OCR) rose 2.2% q-o-q to $1,421 psf in 3Q2023. In the Rest of Central Region (RCR), prices rose 1.3% to $1,744 psf, while in the Core Central Region (CCR), prices inched up 0.3% q-o-q to $2,087 psf.

The gap between prices of resale condos in the CCR and the RCR continued to narrow, going from 24.1% in 2Q2023 to 17.5% in 3Q2023. This is the smallest gap recorded since 3Q2001, when the price gap between CCR and RCR resale condos stood at 14.5%, observes Christine Sun, senior vice president of research and analytics at OrangeTee & Tie. Comparatively, within the last decade, the price gap was its widest at the onset of the pandemic in 3Q2020, when it stood at 53.9%.

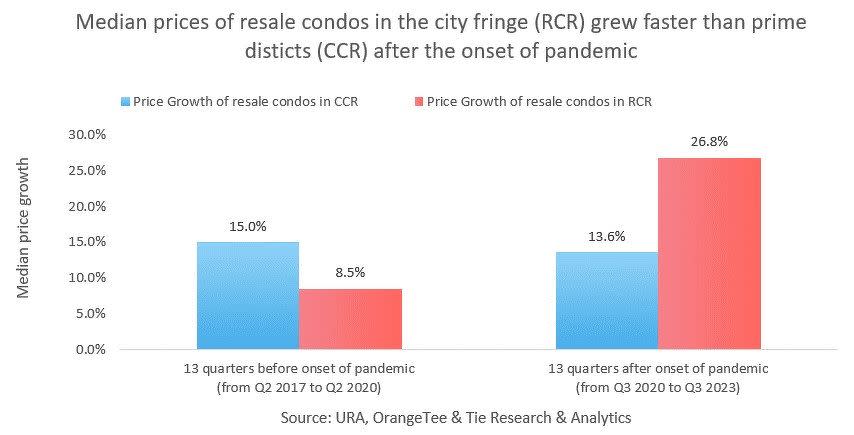

Since then, the price gap has narrowed substantially as resale condo prices in the RCR grew faster than those in the CCR. Since 3Q2020, median prices of resale condos in the CCR grew 13.6% to $2,011 psf, while median prices of resale condos in the RCR climbed 26.8% to $1,711 psf over the same period.

This performance contrasts price trends prior to the onset of the pandemic. From 2Q2017 to 2Q2020, median prices of CCR resale condos rose 15% – faster than the 8.5% growth logged for RCR resale condos over the same time period.

OrangeTee & Tie’s Sun attributes the faster price appreciation in the RCR since the pandemic to more new condos completing in the RCR in recent years, underpinning higher resale prices. Between 2020 and 1H2023, 12,800 condo units obtained their temporary occupation permit, far surpassing the estimated 3,300 units in the CCR. “Moreover, demand is stronger for private homes in the city fringe since they are still more affordable than luxury homes,” adds Sun.

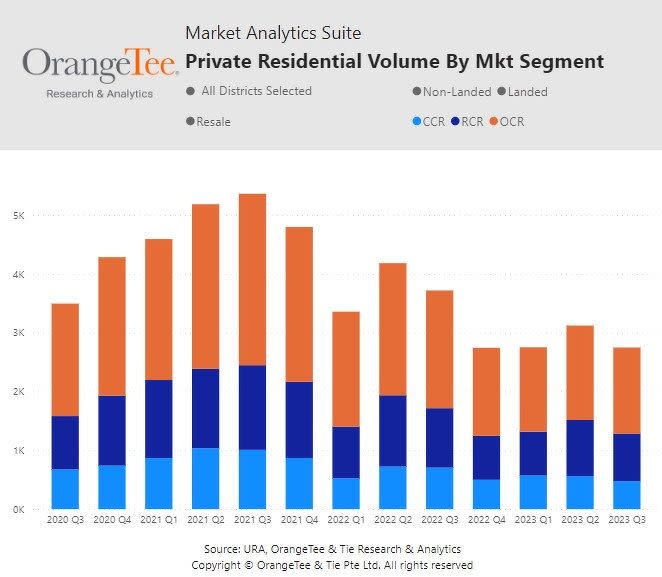

In terms of volume, the number of resale transactions excluding ECs in 3Q2023 fell 12% q-o-q to 2,748 units, owing to slower sales during the seventh lunar month and elevated interest rates. In the CCR, resale volume dipped 15.3% qo-q to 476 units, while the RCR also saw a decline of 15.3% q-o-q to 808 units. In the OCR, resale volume fell 8.8% q-o-q to 1,464 units.

While the narrowing price gap may compel some buyers to look into resale condos in prime areas, Sun believes that demand for condos in the suburbs will stay resilient. “HDB upgraders prefer such homes for their big living spaces and affordability. Others may like resale homes that are well maintained and in ‘move-in’ condition,” she explains.

Read also: ANALYSIS: Which town has the narrowest price gap between private and public housing?

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance