Repare (RPTX) Up 14% as Ovarian Cancer Combo Gets Fast Track Tag

Repare Therapeutics’ RPTX shares jumped 13.9% on Jun 5 after the FDA granted the Fast Track designation to its investigational combination therapy of lunresertib and camonsertib to treat adult patients with CCNE1 amplified, or FBXW7 or PPP2R1A-mutated platinum-resistant ovarian cancer.

The FDA’s Fast Track designation intends to expedite development and review timelines when preliminary nonclinical and clinical evidence indicates that the drug may demonstrate substantial improvement over available therapies to address unmet medical needs for serious or life-threatening conditions.

The Fast Track tag enables close communication between the FDA and sponsor to improve the efficiency of product development to get new therapeutics for patients faster. It also makes innovative therapies eligible for potential accelerated approval and/or priority review, if relevant criteria are met.

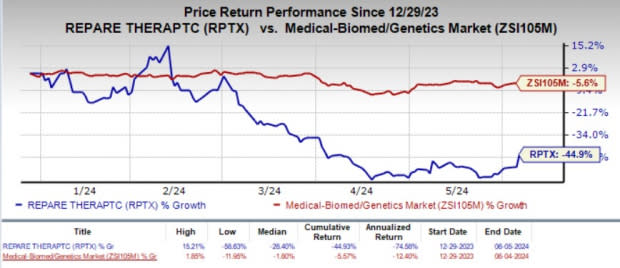

Year to date, shares of Repare have plunged 44.9% compared with the industry’s 5.6% decline.

Image Source: Zacks Investment Research

The company is using its genome-wide, CRISPR-enabled SNIPRx platform to discover and develop highly targeted cancer therapies that cater to genomic instability, including DNA damage repair.

Lunresertib, a PKMYT1 Inhibitor, in combination with camonsertib, an ATR inhibitor, is being evaluated in RPTX’s ongoing phase I MYTHIC Module 2 dose-expansion study for ovarian and endometrial cancer indications.

Top-line data from the MYTHIC Module 2 dose expansion cohorts in approximately 20-30 patients, each with ovarian and endometrial cancer, is anticipated in the fourth quarter of 2024.

Please note that the lunresertib/camonsertib combo already enjoys the FDA’s Fast Track designation in the United States to treat adult patients with CCNE1 amplified, or FBXW7 or PPP2R1A mutated endometrial cancer.

Both candidates, as a monotherapy and/or in combinations, are simultaneously being evaluated in several other early to mid-stage studies for various cancer indications.

Repare’s third clinical-stage candidate is RP-1664, an oral PLK4 inhibitor, which is currently being evaluated in a phase I study to treat patients with advanced solid tumors.

Repare Therapeutics Inc. Price and Consensus

Repare Therapeutics Inc. price-consensus-chart | Repare Therapeutics Inc. Quote

Zacks Rank and Stocks to Consider

Repare currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Compugen CGEN, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73. Year to date, shares of ALXO have plunged 40.9%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $2.93 to $2.46. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.83 to $1.95. Year to date, shares of ANVS have plunged 64%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has increased from 2 cents to 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have gained 5.6%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Repare Therapeutics Inc. (RPTX) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance