S-REITs: down but not out

S-REITs with foreign assets which face refinancing issues has impacted sentiment

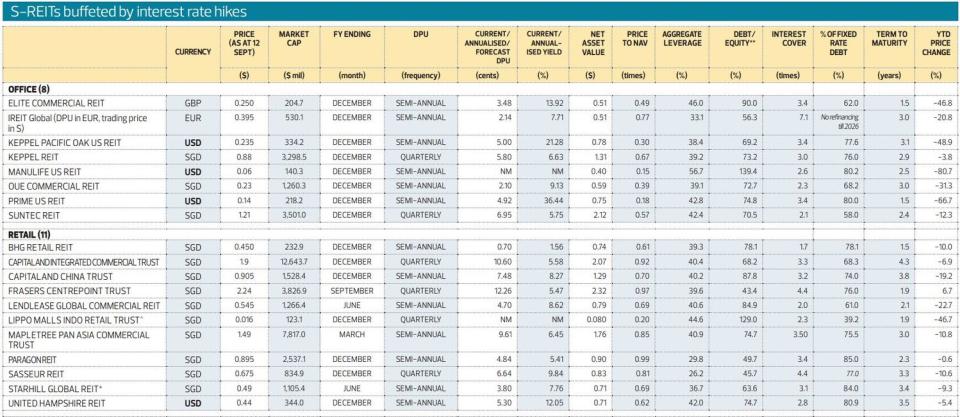

So far this year, two S-REITs have halted distributions for one reason or another. A third S-REIT is suspended. And to date, internalisation hasn’t been the panacea it is made out to be.

Rising risk-free rates, which materialised against a backdrop of rising policy rates — in particular the Federal Funds Rate which rose from near-zero to 5.5% in around 18 months — have harmed the cost of capital.

Rising interest rates led to higher finance costs, moderating distribution per unit levels. They also caused discount rates to rise. If higher discount rates are not offset by higher rents and lower costs which would result in higher cash flows from REIT assets, valuations would fall.

The most notable declines among the S-REITs are those with office space in London, the US, and to a much smaller extent Australia. On the other hand, rents in Australian industrial assets are firm, mitigating the impact of higher discount and capitalisation rates.

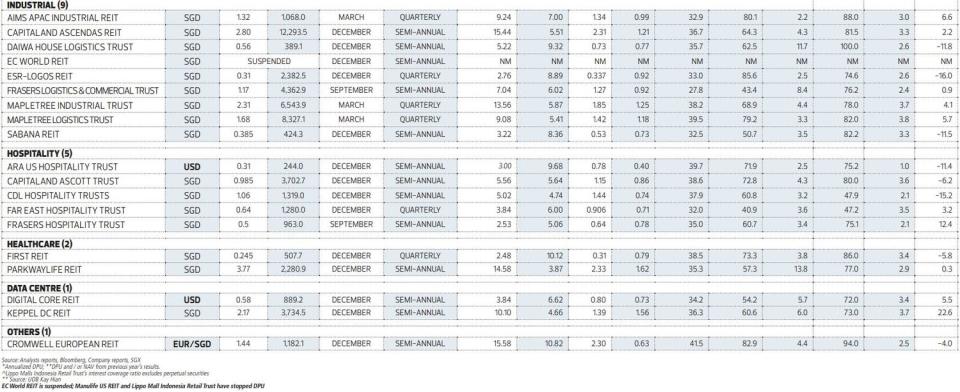

Mainly, higher interest rates and risk-free rates raise the cost of capital, causing unit prices of S-REITs to fall. As evidenced in The Edge Singapore’s “big” REIT table, most of the S-REITs unit prices are down year to date.

The standout outperformer is Keppel DC REIT, followed by ARA US Hospitality Trust, Frasers Centrepoint Trust (FCT), Mapletree Logistics Trust and Mapletree Industrial Trust in that order.

The worst performers were the three US office S-REITs: Manulife US REIT (MUST), Prime US REIT and Keppel Pacific Oak US REIT. Of the three, MUST has halted its distributions.

Despite a recovery in Class A office rents in cities such as New York, Boston and Chicago, none of the US office S-REITs have assets in those cities. The closest is The Exchange owned by MUST, which is located opposite Hudson Yards/ West New York where rents are above pre-Covid levels.

As market watchers have observed, Singapore’s position as a global REIT hub is likely to be increasingly challenging given the problems faced by S-REITs with foreign assets.

On Sept 4, EC World REIT (ECW) announced that $3.4 million of its offshore interest reserve was released and used to fully repay the ECW’s interest expenses due on Aug 31. The offshore interest reserve had to be topped up within five business days of its release.

“The manager wishes to update unitholders of EC World REIT that this deadline has not been met. The breach of this requirement would, if not remedied within the agreed cure period result in an event of default under the offshore facilities and also trigger a cross-default under the ECW’s existing onshore facilities,” said ECW’s manager in an announcement on Sept 12.

ECW has a cure period of 10 business days to remedy its breach and top up the offshore interest reserve.

Among the property trusts, Dasin Retail Trust is facing refinancing challenges and some issues concerning the board of its trustee-manager. On the other hand, CapitaLand India Trust, the most liquid proxy for India on the SGX, continues to perform. Investors clearly like REITs which are able to divest properties. FCT’s unit price firmed after it announced the divestment of Changi City Point.

Internalisation was promoted as a panacea by an activist hedge fund which requisitioned an EGM, held on Aug 7, with the resolution to remove Sabana Industrial REIT’s manager. Sabana REIT has underperformed since the ordinary resolution was passed. Year to date, Sabana REIT is down 11% with most of the losses coming from the days leading up to the EGM and thereafter. If Sabana REIT continues to underperform, that could be a test case for the internal-external manager debate in Singapore.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance