Reasons Why You Should Hold on to Stericycle (SRCL) Now

Stericycle, Inc. SRCL shares have had an impressive run in the past three months. The stock has gained 11.3% compared with 13.6% growth of the industry it belongs to and the 10.4% rise of the Zacks S&P 500 composite.

The company has a long-term expected earnings per share growth rate of 8%.

Factors Boding Well

SRCL is likely to benefit from ongoing trends, such as increasing environmental concerns, rapid industrialization, an improvement in population and active government measures to reduce illegal dumping.

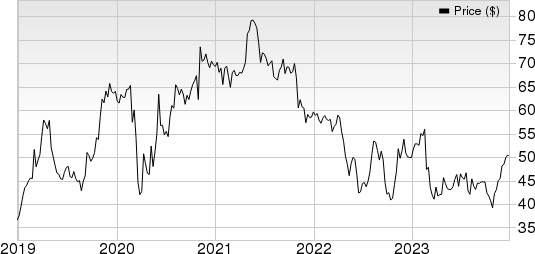

Stericycle, Inc. Price

Stericycle, Inc. price | Stericycle, Inc. Quote

Stericycle has expanded through acquisitions, both domestically and globally. The 2021 acquisition of a Midwest-regulated waste business enhanced the company’s North American customer base. While 2020 saw no acquisitions, the years 2019, 2018 and 2017 witnessed significant acquisitions contributing $9.5 million, $29.7 million and $32.2 million to revenues. Notably, the company completed one, 21 and 30 acquisitions in 2019, 2018 and 2017, indicating a consistent and robust acquisition strategy across diverse regions and business sectors.

Stericycle is gaining through its partnerships, as it extended its five-year partnership with the National Park Foundation, thus committing to wetland restoration at Yosemite and Cape Cod. Prior efforts supported oyster bed reconstruction, reducing erosion. The recent collaboration with Arbor Day Foundation continues, with the company aiming to plant 45,000 trees across the US and Canada, fostering habitat restoration and aiding wildfire and hurricane recovery. Stericycle's commitment reflects a positive impact on the environment and communities.

Stericycle is taking steps in its extensive, multiyear Business Transformation initiative, launched in 2017, to enhance long-term operational and financial performance. The program focuses on five key objectives: enhancing revenue quality, optimizing operations through work measurement, optimizing assets, technology and strategic sourcing, rationalizing portfolio through divestitures, reducing debt and leveraging improvement, and implementing Enterprise Resource Planning.

Factors Against

Stericycle’s current ratio (a measure of liquidity) was 0.90 at the end of third-quarter 2023, lower than the 1.02 recorded at the end of third-quarter 2022. The gradually decreasing current ratio indicates the company may face problems meeting its short-term obligations.

SRCL currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector:

Gartner IT: The Zacks Consensus Estimate of Gartner’s 2023 revenues indicates 7.9% growth from the year-ago reported figure, whereas earnings are expected to decline 1.9%. The company has beaten the consensus estimate in each of the four quarters, with an average surprise of 34.4%.

IT currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DocuSign DOCU: The Zacks Consensus Estimate of DocuSign’s 2023 revenues indicates 9.2% growth from the year-ago reported figure, whereas earnings are expected to grow 41.4%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

DOCU presently flaunts a Zacks Rank of 1.

Broadridge Financial Solutions BR: The Zacks Consensus Estimate of Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago reported figure, whereas earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR currently has a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Stericycle, Inc. (SRCL) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance