Reasons to Retain Revvity (RVTY) Stock in Your Portfolio Now

Revvity, Inc. RVTY is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism, led by its first-quarter 2024 performance and focus on artificial intelligence (AI), also looks promising. Headwinds resulting from foreign exchange volatility and integration risks are major downsides.

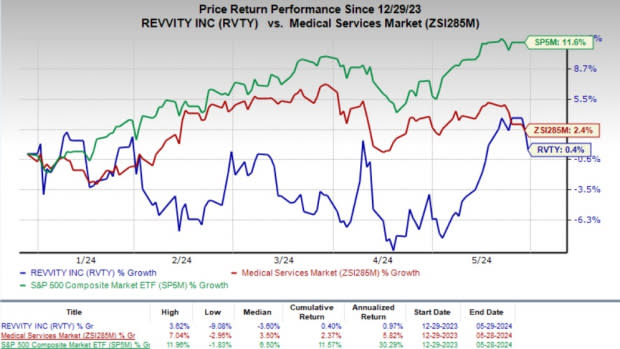

This Zacks Rank #3 (Hold) company’s shares have risen 0.4% year to date compared with 2.4% growth of the industry.The S&P 500 has increased 11.6% during the same time frame.

The renowned provider of health science solutions has a market capitalization of $13.8 billion. It projects 8.3% growth for the next five years and expects to witness continued improvements in its business going further. Revvity’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average surprise of 3.67%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Focus on AI: We are upbeat about the use of AI by healthcare companies, which has been the latest trend. Management at Revvity introduced PKeye Workflow Monitor — a cloud-based platform that allows laboratory personnel to manage and monitor their Revvity instruments and workflows in real time, remotely.

Revvity also introduced its Signals Research Suite, a complete cloud-based solution, used by Amazon Web Services.

Product Portfolio: We are optimistic about Revvity’s portfolio, which delivers a comprehensive suite of scientific informatics and software solutions to aggregate data into actionable insights in an automated and scalable way. During the first quarter, the company’s software and informatics division, Revvity Signals Software, demonstrated strong growth, a trend that is likely to continue in the rest of 2024 on the back of new offerings. RVTY introduced three new SaaS-based offerings during the quarter. These include Signals Clinical and Signals Synergy that will help the company to expand into new markets.

Revvity also announced the launch of its next-generation sequencing solution for Newborn Screening during the first quarter. This launch is likely to help the company maintain its market leadership position in Newborn Screening. Moreover, the expansion of GMP reagent capacity is helping the company launch several new GMP recombinant proteins, creating potential for additional revenues.

Q1 Results: RVTY’s diagnostic businesses have continued to remain strong during the quarter. The immunodiagnostics franchise, which is by far the largest category of the Diagnostics segment, grew in the low double-digits. Moreover, a rise in pharma and biotech spending is in the cards, which may boost sales in the second half of 2024. Meanwhile, ongoing cost containment efforts are likely to improve margins going forward.

Downsides

Foreign Exchange Volatility: Increasing exposure to international markets enhances the risk of foreign exchange volatility. The fluctuations in currency exchange rates can adversely impact the company’s international sales. Due to the sluggish European economy, future revenues and earnings are likely to be affected if the company does not hedge from exposure to such fluctuations.

Integration Risks: Revvity continues to acquire a large number of companies. While this improves revenue opportunities, it also adds to integration risks. The frequent acquisitions can also negatively impact its balance sheet in the form of a high level of goodwill and intangible assets. Frequent acquisitions are also a distraction for management and impact organic growth.

Estimate Trend

Revvity has been witnessing a positive estimate revision trend for 2024. Over the past 30 days, the Zacks Consensus Estimate for earnings per share (EPS) has moved north 0.2% to $4.66.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $695.7 million, indicating a 1.9% decline from the year-ago reported number. The Zacks Consensus Estimate for EPS is pinned at $1.14, implying a year-over-year decline of 5.8%.

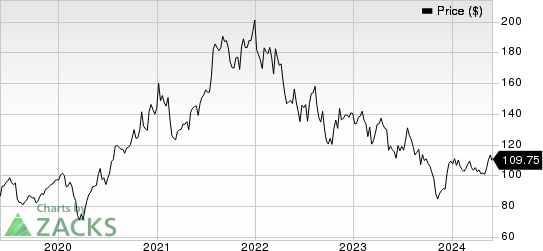

Revvity Inc. Price

Revvity Inc. price | Revvity Inc. Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Align Technology ALGN and Encompass Health EHC.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 29.35%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have risen 32.2% year to date compared with the industry’s 0.3% growth.

Align Technology, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 5.92%.

Align Technology’s shares have lost 6.7% year to date compared with the industry’s 3.2% decline.

Encompass Health, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.6%. EHC’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 18.74%.

Encompass Health’s shares have risen 26.6% year to date compared with the industry’s 8.7% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Revvity Inc. (RVTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance