Reasons to Hold RBC Bearings (RBC) in Your Portfolio Now

RBC Bearings Incorporated RBC has been witnessing solid momentum in its Aerospace & Defense segment. Revenues from the segment increased 16.8% year over year in the fourth quarter of fiscal 2024 (ended March 2024). Strength in the commercial aerospace market, driven by the recovery in build rates from large OEMs (original equipment manufacturers), and stability in the aftermarket are driving the segment’s performance.

Strong U.S. & international defense budgets and robust demand for commercial air travel will augur well for the Aerospace & Defense segment in the quarters ahead. For the first quarter of fiscal 2025 (ended June 2024, results awaited), RBC anticipates overall net sales in the band of $415-$420 million, suggesting year-over-year growth of 7.2-8.5%.

The company believes in adding complementary businesses to its portfolio via acquisitions. For instance, in August 2023, it acquired Carson City, NV-based precision bearings manufacturer Specline. The unique bearing and manufacturing processes of Specline expanded RBC’s aerospace product offerings and boosted the company’s production capacity.

RBC Bearings focuses on rewarding its shareholders handsomely through dividend payouts and share buybacks. In fiscal 2024, it paid dividends worth $22.9 million, flat compared with the previous fiscal year. Also, it repurchased shares for $11 million, reflecting an increase of 41.4% year over year.

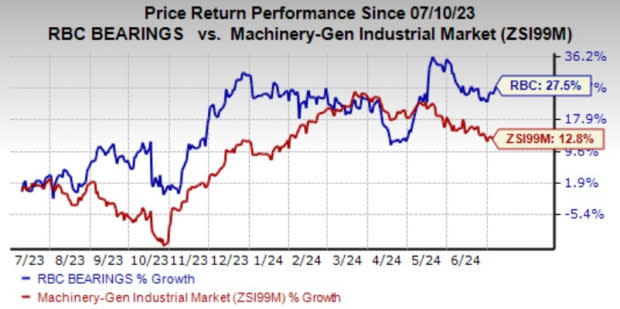

Image Source: Zacks Investment Research

In the past year, shares of this Zacks Rank #3 (Hold) company have risen 27.5% compared with the industry’s 12.8% growth.

However, RBC Bearings has been dealing with the rising cost of sales for some time now. In the fourth quarter of fiscal 2024, the company’s cost of sales rose 3.2% year over year due to an increase in raw material costs. Also, selling, general and administrative expenses escalated 8.1% year over year in the same period due to higher personnel, freight and IT-related costs and other professional fees.

Stocks to Consider

Some better-ranked companies from the same space are discussed below:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 8.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings has improved 0.9% in the past 60 days. The stock has risen 28.9% in the past year.

Flowserve Corporation FLS presently sports a Zacks Rank #1 and has a trailing four-quarter earnings surprise of 21.7%, on average.

The consensus estimate for FLS’ 2024 earnings has increased 0.8% in the past 60 days. Shares of Flowserve have rallied 23.7% in the past year.

Ingersoll Rand Inc. IR presently carries a Zacks Rank of 2 (Buy). IR delivered a trailing four-quarter earnings surprise of 12.9%, on average.

The Zacks Consensus Estimate for Ingersoll Rand’s 2024 earnings has increased 2.2% in the past 60 days. Its shares have risen 39.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RBC Bearings Incorporated (RBC) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance