Reasons to Add Vistra (VST) to Your Portfolio Right Away

Vistra Corp. VST, an electricity and power generation company, is poised to grow on the back of its long-term capital investment plans, stable dividend payments and strong financial position.

Let’s focus on the factors that make this Zacks Rank #1 (Strong Buy) company a strong investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for VST’s 2024 and 2025 earnings per share is pegged at $4.08 and $5.37, respectively, indicating a 13.1% and 31.8% improvement over the past 60 days.

The Zacks Consensus Estimate for 2024 and 2025 sales is pegged at $17.8 billion and $19.33 billion, respectively, suggesting an increase of 20.7% and 8.3%.

Return on Equity (ROE)

Return on Equity indicates how efficiently a company utilizes shareholders’ funds to generate returns. At present, Vistra’s ROE is 24.7%, higher than the industry's average of 9.6%. This indicates that company is utilizing its funds better than its peers in the industry.

Dividend & Share Repurchase

The company has been consistently paying dividends to its shareholders. It declared a quarterly dividend of 21.75 cents per share for second-quarter 2024, up 7% year over year. Currently, the annual payout is 87 cents per share. Vistra is targeting $300 million in dividends annually.

Management also increased shareholders’ value by making systematic buyback of shares. From November 2021 through May 2, 2024, Vistra bought back shares worth $3.9 billion of its outstanding shares since the buyback program was announced. It plans to buyback shares worth at least $2.25 billion over 2024 and 2025. The lower shares outstanding should have a positive impact on its bottom line.

Solvency & Liquidity Ratio

The times interest earned ratio of the company at the end of first-quarter 2024 was 2.6, which indicates Vistra has capacity to meet its near-term interest obligation easily.

VST has a current ratio of 1.08, better than the industry’s average of 0.91. This implies that the company has sufficient financial capability to meet its short-term debt obligations.

Investments & Energy Transition

Vistra has been making systematic capital expenditures to boost its portfolio. It plans to invest $1.94 billion in 2024 and $1.75 billion in 2025 to further strengthen its operations.

The company is aiming to achieve net-zero emissions by 2050. It is working to reduce emissions and its development activities are nearing completion. Construction has started on two large solar and energy storage projects in Illinois, part of the Illinois Coal to Solar Initiative.

The new and advanced solar energy projects should reduce emissions and generate more revenues for the company.

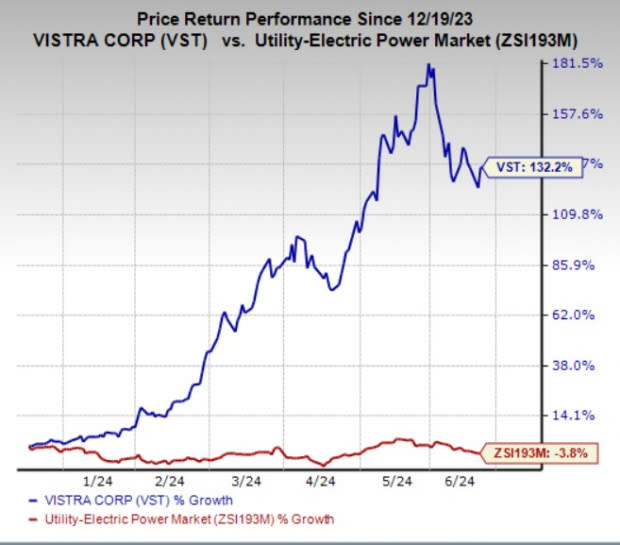

Price Performance

In the past six months, VST’s shares have risen 132.2% against the industry’s decline of 3.8%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the same industry are Consolidated Edison ED, CenterPoint Energy CNP and Eversource Energy ES, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Consolidated Edison, CenterPoint Energy and Eversource Energy’s long-term (three-to-five years) earnings growth rate is 7.4%, 7% and 5.4%, respectively.

The Zacks Consensus Estimate for ED, CNP and ES’ 2024 earnings suggests growth of 5.3%, 8% and 4.4%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance