Reasons to Add Portland General (POR) to Your Portfolio Now

Portland General Electric Company’s POR continuous capital investments to maintain and increase resiliency help enhance the company's performance. The modernization of the grid will help withstand severe weather conditions and ensure a continuous supply of electricity even during challenging conditions.

Currently, the company carries a Zacks Rank #2 (Buy). Let’s look at the factors that are driving the stock.

Growth Projections

The Zacks Consensus Estimate for POR’s 2024 and 2025 earnings per share increased 0.65% and 1.24%, respectively, in the last 90 days.

The consensus estimate for 2024 and 2025 sales indicates year-on-year growth of 10.2% and 3.7%, respectively.

Dividend

Portland General has been rewarding its shareholders with dividend payments at regular intervals. It has consistently paid shareholders a cash dividend on its common stock since 2006. The current dividend yield of the company is 4.65%, which is better than its industry’s yield of 3.74%.

Return on Asset

Portland General’s current return on assets (ROA) is pinned at 2.6%, which is more than the industry average of 2.5%. ROA, a profitable measure, reflects how effectively a company is utilizing its assets in its operations to generate income.

Liquidity

POR’s current ratio is 1.22, better than the industry average of 0.78. The current ratio, being greater than one, indicates that the company has enough short-term assets to meet its short-term obligations.

Investments & Customer Additions

The company plans to invest $1.3 billion during 2024 and more than $6 billion till 2028 to upgrade its distribution and transmission. These investments will mainly help deliver reliability and resiliency, improve customers’ experience, and provide environmental and cost-efficiency benefits to customers. The company aims to completely shift to clean energy by the year 2040.

Portland General’s regulated electric operations in Oregon generate a relatively stable and growing income. The company expects strong customer growth due to the robust growth in semiconductor and data center demand in its service area. The long-term load growth expectation is around 2% per annum till 2027.

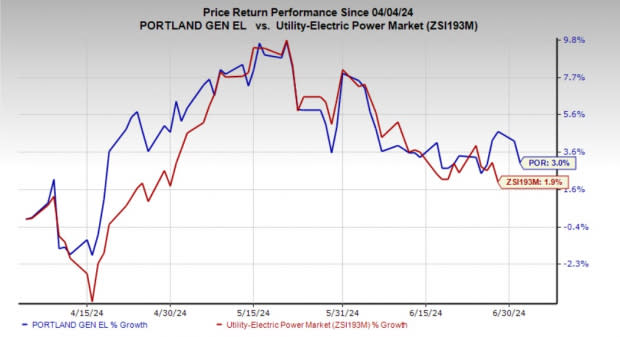

Price Performance

Shares of Portland General have gained 3% in the past three months against the industry’s 1.9% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the industry are Pampa Energia PAM, Consolidated Edison, Inc. ED and Fortis Inc. FTS. Pampa Energia currently sports a Zacks Rank #1 (Strong Buy), while Consolidated Edison and Fortis carry a Zacks Rank of 2 each. You can see the complete list of Zacks Rank #1 stocks here.

Pampa Energy has delivered an average earnings surprise of 81.14% in the last four quarters. The Zacks Consensus Estimate for earnings has gone up 14.14% in the last 60 days to $7.91 per share.

Consolidated Edison has delivered an average earnings surprise of 5.9% in the last four quarters. The Zacks Consensus Estimate for earnings for 2024 and 2025 indicates year-on-year growth of 5.13% and 5.15% respectively.

Fortis has delivered an average earnings surprise of 4.17% in the last four quarters. The Zacks Consensus Estimate for earnings for 2024 and 2025 indicates year-on-year growth of 2.19% and 2.66% respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Pampa Energia S.A. (PAM) : Free Stock Analysis Report

Portland General Electric Company (POR) : Free Stock Analysis Report

Fortis (FTS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance