Reasons to Add Dominion Energy (D) to Your Portfolio Now

Dominion Energy Inc.’s D earnings estimates have been revised upward, reflecting analysts’ optimism surrounding the stock. The Zacks Consensus Estimate for 2024 and 2025 earnings reflects a year-over-year increase of 38.2% and 22.9%, respectively. The company reported a positive earnings surprise of 7.84% in the last quarter.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a good investment pick at the moment.

Strong Investment Plan

Dominion Energy has well-chalked plans to invest $43 billion in different projects in the 2025-2029 time frame. These investments will be directed toward modernizing and strengthening the company’s existing infrastructure, which should enable D to better serve its expanding customer base. Dominion Energy continues to fortify its infrastructure by burying overhead power lines to reduce the time for restoration of power in outage-prone areas in the hurricane season.

Dominion Energy’s long-term objective is to add 24 GW of battery storage, solar, hydro and wind (offshore as well as onshore) projects by 2036 and increase the renewable energy capacity by more than 15% per year, on average, over the next 15 years. Organic projects and acquired assets are expected to further expand the company’s clean energy portfolio.

Long-Term Growth and Dividend Yield

The company’s long-term (three- to five-year) earnings growth is 13.6%, courtesy of well chalked-out capital investment plans, natural gas pipeline projects and renewable generation assets.

Its current dividend yield is 5.42% compared with the Zacks S&P 500 composite’s average of 1.61%.

Demand From Data Centers

Dominion Energy unit has been successfully supplying 4GW of electricity to nearly 94 data centers since 2019. The company plans to supply another 15 data centers in Northern Virginia in 2024.

Larger data centers are being developed in Dominion Energy’s service territories with electricity demand of 300 MW to several GWs, which is much higher than the small conventional data center's demand in the range of 60-90 MW. The increasing demand from the data centers should create fresh demand for Dominion Energy’s services and boost its earnings.

Solvency & Liquidity Ratio

The times interest earned ratio of the company at the end of first-quarter 2024 was 2.4, which indicates that Dominion Energy has enough financial capability to meet its interest obligations on time.

Current ratio of the company at the end of the first quarter of 2024 was 1.05, indicating the company’s ability to meet its short-term obligations, which are due within a year.

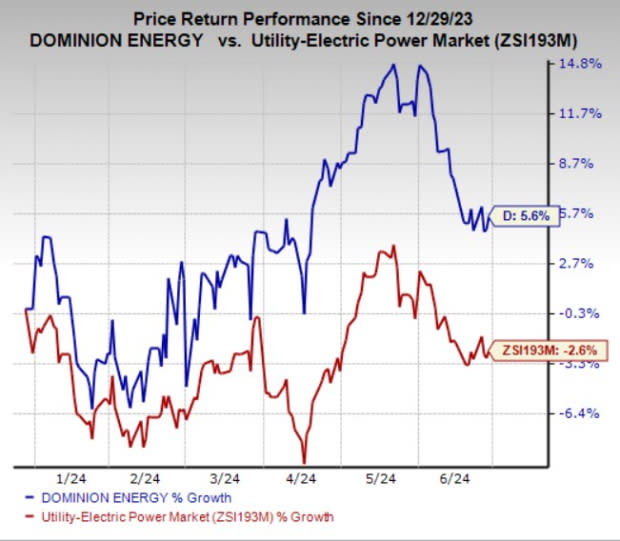

Price Movement

In the past six months, Dominion Energy’s shares have gained 5.6% against the industry’s decline of 2.6%.

Image Source: Zacks Investment Research

Other Key Picks

Some other top-ranked stocks from the same industry are PG&E Corporation PCG, Evergy EVRG and Consolidated Edison ED, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for PCG’s 2024 and 2025 earnings reflects a year-over-year improvement of 9.8% and 8.6%, respectively. The company reported a positive earnings surprise of 5.71% in the last quarter.

EVRG’s long-term earnings growth rate is 5%. The Zacks Consensus Estimate for Evergy’s 2024 and 2025 EPS implies a year-over-year improvement of 8.5% and 4.9%, respectively.

ED’s long-term earnings growth rate is 8.2%. The Zacks Consensus Estimate for Consolidated Edison’s 2024 and 2025 EPS implies a year-over-year increase of 5.1% and 5.2%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pacific Gas & Electric Co. (PCG): Free Stock Analysis Report

Consolidated Edison Inc (ED): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

Evergy Inc. (EVRG): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance