Reasons to Add CenterPoint (CNP) to Your Portfolio Right Now

CenterPoint Energy, Inc. CNP, with its rising earnings estimates and strong ROE, makes a good pick in the utility space. It is registering growth in customer volumes and investing substantially to expand operations to meet increasing demand.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for 2024 and 2025 earnings per share is pegged at $1.62 and $1.75, indicating growth of 8% and 7.6%, respectively, from the year-ago levels.

The Zacks Consensus Estimate for 2024 and 2025 revenues is pegged at $8.78 billion and $9.11 billion, indicating a rise o of 1% and 3.7%, respectively, from the year-earlier actuals.

Regular Investments

CNP makes consistent investments to upgrade and maintain the existing infrastructure as well as expand operations. The company plans to invest $3.7 billion in 2024 and its five-year and 10-year capital expenditure targets are $21.3 billion and $44.5 billion, respectively. A major portion of the planned investment will be utilized to strengthen its electric operation.

Dividend & Long-Term Earnings Growth

CenterPoint has a dividend yield of 2.63%, higher than the Zacks S&P 500 composite’s average of 1.58%. It targets a long-term annual dividend growth in the range of 6-8%, subject to approval of its board of directors.

The company’s long-term (three-to-five years) earnings growth rate is currently pegged at 7%.

Return on Equity (ROE)

ROE is the measure of a company’s efficiency in utilizing shareholders’ funds. CNP has a trailing 12-month ROE of 10.57%, better than the industry average of 9.91%.

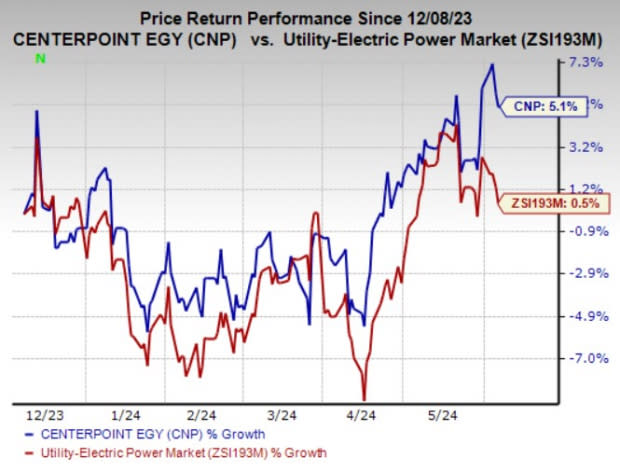

Price Performance

In the past six months, the stock has gained 5.1% compared with the industry’s growth of 0.5%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the same sector are DTE Energy DTE, Public Service Enterprise Group PEG and PPL Corporation PPL, each currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DTE Energy, Public Service Enterprise Group and PPL pay regular dividends, thereby ensuring steady income for investors. The current dividend yield of DTE, PEG and PPL is 3.6%, 3.2% and 3.6%, respectively.

The Zacks Consensus Estimate for 2024 earnings for DTE Energy, Public Service Enterprise Group and PPL implies growth 16.9%, 5.5% and 6.9%, respectively, from the prior-year figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance