Raytheon (RTX) Wins Contract to Support Next Generation Jammer

Raytheon Technologies Corp. RTX secured a modification contract to support Next Generation Jammer (NGJ) Mid-Band (MB). The award has been offered by the Naval Air Systems Command, Patuxent River, MD.

Details of the Deal

Valued at $26.6 million, the contract is projected to be completed by December 2023. Per the terms of the deal, Raytheon will provide engineering and manufacturing development support for NGJ-MB.

The latest modification also entails provision for software support, which includes management, design, development, test and delivery of NGJ-MB software systems. The contract will serve the U.S. Navy and the Australian government.

Majority of the work related to this deal will be executed in El Segundo, CA.

Importance of NGJ-MB

Raytheon’s NGJ-MB is a jamming technology that provides enhanced airborne electronic attack capabilities to EA-18G Growler fighter aircraft. The NGJ-MB is the U.S. Navy’s advanced electronic attack system to disrupt enemy technology, including air-defense systems and communication tools. The NGJ-MB uses digital, software-based and Active Electronically Scanned Array technologies that allow operators to non-kinetically attack more targets at greater distances.

Growth Prospects

Per a report by Research and Markets firm, the global signal jammer market is expected to witness an incremental growth of $983.92 million, at a CAGR of 5.4%, during 2023-2027. Increasing defense spending on surveillance and communication jamming is anticipated to support the aforementioned market’s growth during the same period.

Such projections bode well for Raytheon as well as other manufacturers of electronic jamming technologies such as L3Harris Technologies LHX, Northrop Grumman NOC and Lockheed Martin LMT .

L3Harris manufactures a handful of electronic warfare (EW) systems like AN/ALQ-214 (IDECM) F/A-18 Countermeasure System, Viper Shield AN/ALQ-254(V)1 All-digital Electronic Warfare Suite, AN/ALQ-161A B1-B Countermeasure System, AN/ALQ-172 B-52, and C-130 Self Protection System and CREW Vehicle Receiver/Jammer.

The company’s long-term earnings growth rate is 2.6%. The Zacks Consensus Estimate for its 2023 sales indicates an improvement of 4.4% from the 2022 reported figure.

Northrop Grumman has been providing Naval Airborne Electronic Warfare solutions for more than 55 years. It is the Airborne Electronic Attack System Integrator for the U.S. Navy warfighter. Some of its EW systems include the ALQ-251 radio frequency countermeasures system and the AN/APR-39 Radar Warning Receiver/Electronic Warfare Management System.

NOC boasts a solid long-term earnings growth rate of 3.8%. The Zacks Consensus Estimate for its 2023 sales indicates year-over-year growth of 4.7%.

Lockheed Martin provides global ground EW solutions to U.S. forces, as well as partner nations, through a unique next-generation open architecture product platform and open business model. Its Advanced Off-Board Electronic Warfare program delivers persistent electronic surveillance and attack capability against naval threats like anti-ship missiles.

The company boasts a solid long-term earnings growth rate of 6.2%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.46%.

Price Movement and Zacks Rank

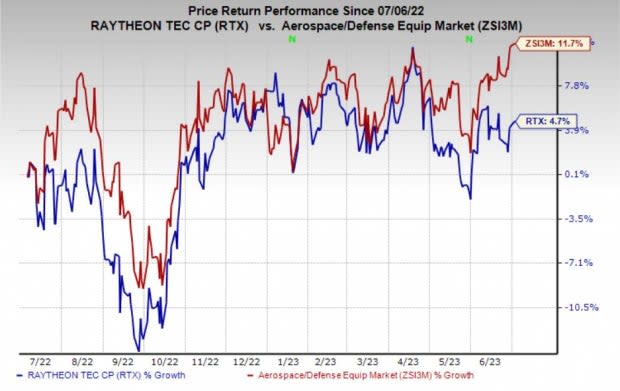

Shares of Raytheon have risen 4.7% in the past year compared with the industry's growth of 11.7%.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance