Ramaco Resources And 2 Undervalued Small Caps With Insider Action In The United States

Amidst a buoyant U.S. stock market, with the S&P 500 reaching an unprecedented high and dovish remarks from the Federal Reserve Chairman boosting investor sentiment, small-cap stocks are drawing attention for their potential value. In this environment, identifying undervalued small-cap companies with insider buying can signal opportunities for informed investors looking to diversify their portfolios.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Hanover Bancorp | 8.3x | 1.9x | 49.03% | ★★★★★☆ |

Columbus McKinnon | 20.8x | 1.0x | 46.43% | ★★★★★☆ |

PCB Bancorp | 8.8x | 2.4x | 45.05% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 30.13% | ★★★★★☆ |

Ramaco Resources | 13.7x | 1.1x | 12.39% | ★★★★☆☆ |

Chatham Lodging Trust | NA | 1.3x | 18.78% | ★★★★☆☆ |

Papa John's International | 19.8x | 0.7x | 36.84% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -151.23% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -149.47% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Ramaco Resources

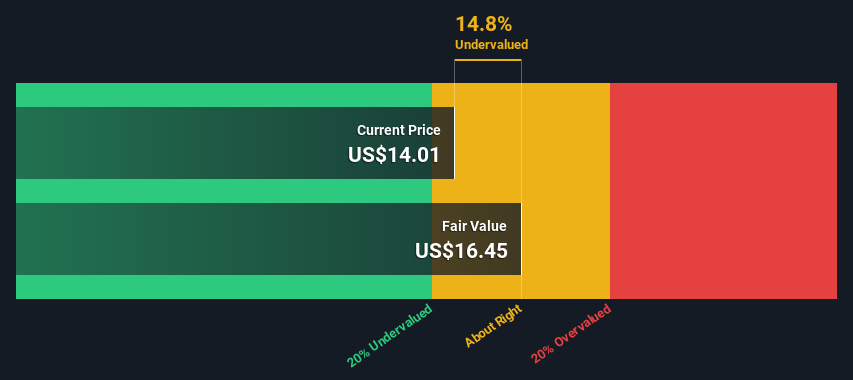

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ramaco Resources is a company focused on the metals and mining sector, specifically in coal, with a market capitalization of approximately $699.84 million.

Operations: In the most recent fiscal period, the company reported revenue of $699.84 million and a net income of $56.32 million, with a gross profit margin of 25.27%. The cost of goods sold was $522.96 million, contributing significantly to operational costs alongside depreciation and amortization expenses totaling $57.62 million.

PE: 13.7x

Amid a flurry of index reclassifications, Ramaco Resources has recently been added to several growth-oriented indices, signaling potential underestimation by the market. This shift comes alongside insider confidence, demonstrated by recent purchases from insiders who likely see intrinsic value not yet recognized publicly. Despite a recent drop in profit margins from 17.3% to 8%, and reliance on higher-risk external borrowing for funding, the company's strategic shifts in executive roles and expansion into critical mineral projects suggest a proactive stance towards future growth opportunities.

Get an in-depth perspective on Ramaco Resources' performance by reading our valuation report here.

Evaluate Ramaco Resources' historical performance by accessing our past performance report.

Clear Channel Outdoor Holdings

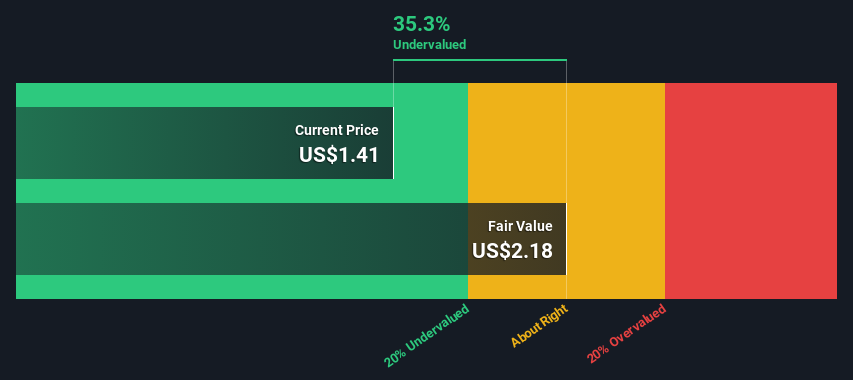

Simply Wall St Value Rating: ★★★★★☆

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations spanning airport, European, and American markets, and a market capitalization of approximately $0.65 billion.

Operations: The company generates revenue primarily from its operations in America (excluding airports), Europe-north, and airports, contributing $1.11 billion, $630.45 million, and $334.74 million respectively. Its gross profit margin has seen fluctuations over the periods but generally trends around 46% to 48%.

PE: -4.9x

Recently, Clear Channel Outdoor Holdings demonstrated insider confidence with significant share purchases, underscoring a strong belief in the company's future. Despite its current unprofitability and reliance on higher-risk external borrowing, the firm's inclusion in multiple Russell indexes suggests growing recognition within the investment community. With projected annual revenues reaching up to $2.26 billion, their strategic positioning might soon reflect these optimistic revenue forecasts, hinting at potential underappreciated value amidst small-cap peers.

Leggett & Platt

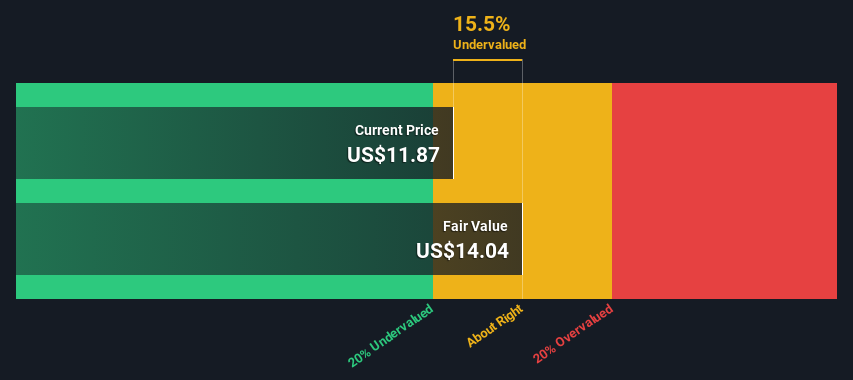

Simply Wall St Value Rating: ★★★★★☆

Overview: Leggett & Platt is a diversified manufacturer specializing in engineered components and products for bedding, furniture, and various industrial markets, with a market capitalization of approximately $4.65 billion.

Operations: The company generated a gross profit margin of 0.18% to 0.24% over multiple quarters, reflecting varying costs of goods sold and revenue figures ranging from $3.47 billion to $5.31 billion in different periods. Notably, the net income has shown fluctuations, with margins ranging from -0.03% to approximately 0.10%, indicating diverse operational and non-operational expense impacts across fiscal periods.

PE: -9.4x

Leggett & Platt's recent filing for a Shelf Registration and its addition to the S&P 600 underscore its strategic flexibility and market recognition. Despite a drop in quarterly earnings, the company's leadership reaffirms full-year sales projections between US$4.35 billion and US$4.65 billion, reflecting cautious optimism. Insider confidence is evident as they recently purchased shares, signaling belief in the company’s potential despite current financial headwinds. With earnings expected to grow significantly, Leggett & Platt remains an intriguing prospect within the undervalued sector, poised for recovery and growth.

Click to explore a detailed breakdown of our findings in Leggett & Platt's valuation report.

Assess Leggett & Platt's past performance with our detailed historical performance reports.

Seize The Opportunity

Investigate our full lineup of 59 Undervalued Small Caps With Insider Buying right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:METC NYSE:CCO and NYSE:LEG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance