Rakuten Group Leads Trio Of High Insider-Owned Growth Stocks On Japanese Exchange

As global markets navigate through a period of mixed signals and cautious optimism, Japan's stock market exhibits a nuanced landscape with the Nikkei 225 Index experiencing slight declines while the broader TOPIX Index sees gains. In this environment, understanding the potential resilience and growth prospects of companies like Rakuten Group, which boast high insider ownership, becomes particularly pertinent. High insider ownership often aligns leadership interests with shareholder goals, potentially enhancing company performance during uncertain times.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27.2% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.5% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 59.1% |

freee K.K (TSE:4478) | 24% | 82.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

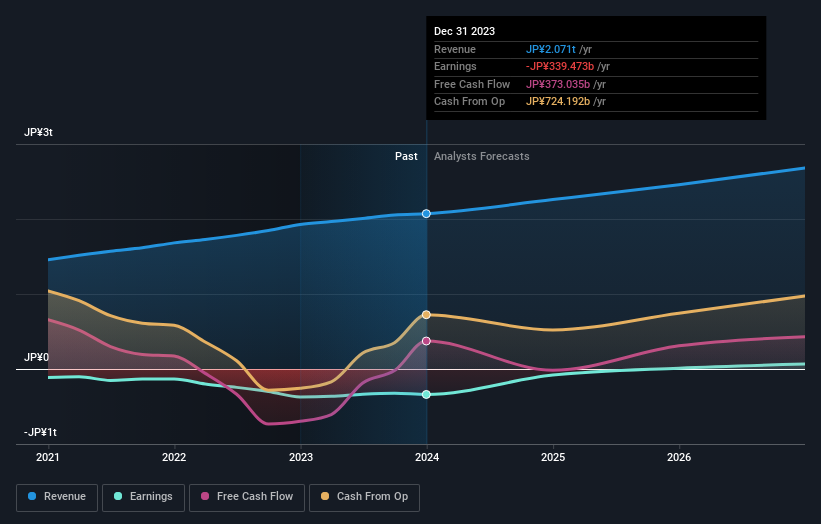

Overview: Rakuten Group, Inc., a diversified company, operates in e-commerce, fintech, digital content, and communications sectors globally with a market capitalization of approximately ¥1.75 trillion.

Operations: The company operates globally, generating revenues in sectors such as e-commerce, fintech, digital content, and communications.

Insider Ownership: 17.3%

Rakuten Group is poised for significant growth, with earnings expected to increase by 87.6% annually, outpacing broader market expectations. The company's revenue growth forecast at 7.4% annually also exceeds the Japanese market average of 3.9%. Despite trading at a substantial 78.5% below its estimated fair value, challenges remain as its Return on Equity is projected to be low at 8.8% in three years' time. Recent strategic moves include a $1.99 billion fixed-income offering and revising corporate guidance predicting double-digit operational growth excluding volatile securities business impacts for FY2024.

Furuya Metal

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Furuya Metal Co., Ltd. specializes in the manufacturing and sale of industrial-use precious metal products and temperature sensors in Japan, with a market capitalization of approximately ¥105.17 billion.

Operations: The company operates primarily in the production and distribution of precious metal products and temperature sensors for industrial applications in Japan.

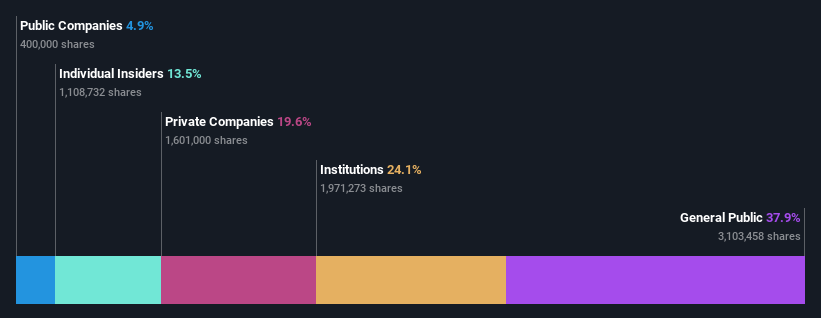

Insider Ownership: 13.5%

Furuya Metal, while trading at a competitive price-to-earnings ratio of 14.6x below the semiconductor industry average, faces challenges with a low forecasted return on equity at 14.1%. However, the company is set to outperform the Japanese market with its revenue and earnings growth forecasts of 10.7% and 21.1% per year respectively, significantly above market averages. Despite this promising growth trajectory, shareholder dilution over the past year and undercovered dividends raise concerns about future value sustainability.

Capcom

Simply Wall St Growth Rating: ★★★★☆☆

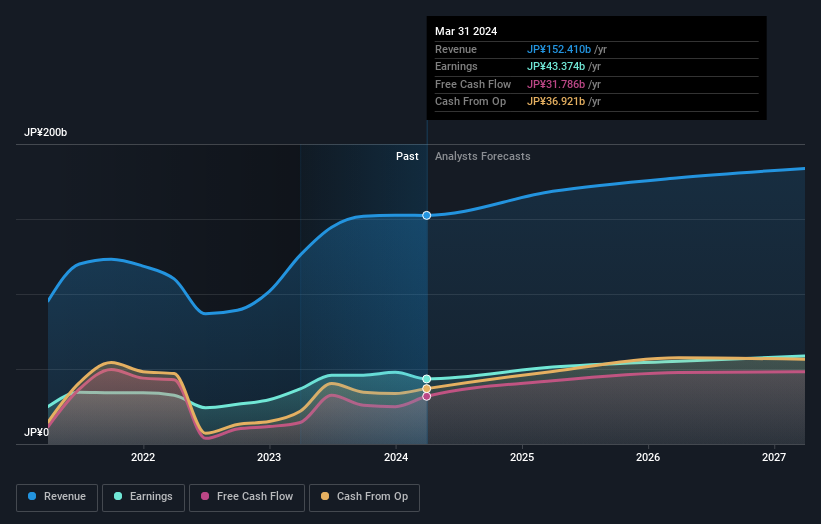

Overview: Capcom Co., Ltd. is a global company based in Japan that specializes in the planning, development, manufacturing, sale, and distribution of home video games, online games, mobile games, and arcade games with a market cap of approximately ¥1.21 trillion.

Operations: The company generates its revenue from the sale and distribution of various gaming products including home video games, online games, mobile games, and arcade games across both domestic and international markets.

Insider Ownership: 11.5%

Capcom, with its recent 2:1 stock split, underscores a strategic move to enhance shareholder value. The company's earnings have grown by 18.1% over the past year, and it is poised for further growth with earnings forecasted to increase by 8.82% annually and revenue expected to rise by 5.7% each year—both metrics outpacing the Japanese market averages of 8.5% and 3.9%, respectively. However, despite high insider ownership, there has been no substantial insider trading reported in the last three months, signaling a potential area for investor caution.

Seize The Opportunity

Get an in-depth perspective on all 109 Fast Growing Japanese Companies With High Insider Ownership by using our screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4755 TSE:7826 and TSE:9697.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance