Quick Intelligent EquipmentLtd And Two More High Insider Ownership Growth Companies On The Chinese Exchange

Amidst a backdrop of fluctuating global markets, China's stock indices have shown mixed responses, with sectors like real estate beginning to show signs of recovery. This shifting landscape underscores the importance of strategic investments in growth companies, particularly those with high insider ownership which often signals strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's dive into some prime choices out of from the screener.

Quick Intelligent EquipmentLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quick Intelligent Equipment Co., Ltd. specializes in the research, development, and manufacturing of precision assembly technology for electronics, operating both in China and internationally, with a market capitalization of CN¥5.43 billion.

Operations: The company generates revenue primarily from the special equipment manufacturing industry, totaling CN¥801.42 million.

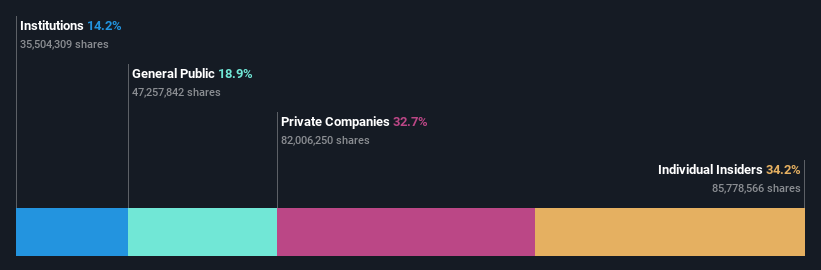

Insider Ownership: 34.2%

Revenue Growth Forecast: 28.8% p.a.

Quick Intelligent Equipment Co., Ltd. has a Price-To-Earnings ratio of 28.6x, slightly below the Chinese market average, indicating potential value. The company's earnings are expected to grow by 40.11% annually, outpacing the broader market forecast of 22.7%. Additionally, revenue growth is also robust at an annual rate of 28.8%, surpassing the market expectation of 13.8%. However, recent financials show a dip in year-over-year earnings and revenue for the full year ended December 31, 2023, with net income falling from CNY 273.38 million to CNY 191 million despite a share buyback program completing in March 2024.

Shenzhen Newway Photomask Making

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company based in China, specializing in the design, development, and production of mask products, with a market capitalization of approximately CN¥5.22 billion.

Operations: The company generates revenue primarily from its electronic components and parts segment, totaling CN¥713.30 million.

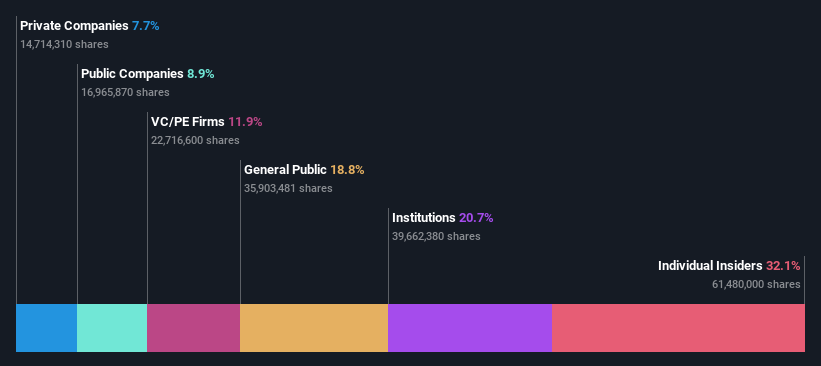

Insider Ownership: 32.1%

Revenue Growth Forecast: 26.9% p.a.

Shenzhen Newway Photomask Making Co., Ltd has demonstrated robust financial performance with a recent quarterly net income increase to CNY 41.07 million from CYN 28.41 million year-over-year. The company's revenue and earnings growth are outpacing the broader Chinese market, with forecasts indicating a significant annual growth of 26.9%. Despite this, its dividend sustainability is questionable as it's poorly covered by cash flows, and the price-to-earnings ratio stands at 32.9x, below the industry average of 39.3x, suggesting potential value relative to peers.

Estun Automation

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estun Automation Co., Ltd. specializes in the research, development, production, and sale of intelligent equipment and its control components in China, with a market capitalization of approximately CN¥12.72 billion.

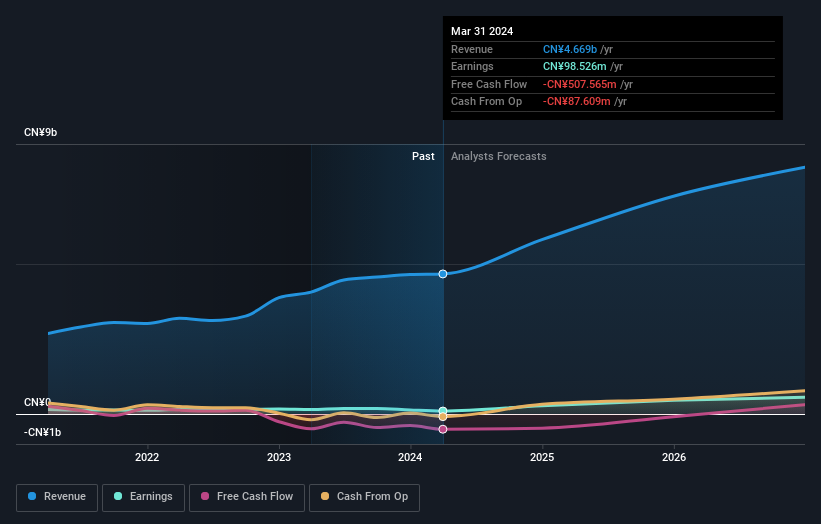

Operations: The company generates CN¥4.67 billion from its instrument and meter manufacturing segment.

Insider Ownership: 12.7%

Revenue Growth Forecast: 15.9% p.a.

Estun Automation, a growth-oriented company with high insider ownership in China, is experiencing mixed financial dynamics. While its earnings are projected to grow by 33.5% annually, surpassing the Chinese market average of 22.7%, its revenue growth at 15.9% annually is modest compared to sector benchmarks. The company's profit margins have declined from last year, and interest payments are not well covered by earnings, indicating potential financial strain despite recent dividend increases and robust annual meetings agendas focused on profit distribution and strategic credit applications.

Dive into the specifics of Estun Automation here with our thorough growth forecast report.

Our expertly prepared valuation report Estun Automation implies its share price may be too high.

Turning Ideas Into Actions

Gain an insight into the universe of 389 Fast Growing Chinese Companies With High Insider Ownership by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603203 SHSE:688401 and SZSE:002747.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance