Public Sector Demand Aids Vulcan (VMC) Amid Price Fluctuations

The U.S. construction sector has been witnessing an increase in public construction demand over the past few quarters. President Joe Biden’s endeavor to pump money for rebuilding the nation's roads, bridges and other infrastructure has been encouraging Vulcan Materials Company VMC and other Zacks Building Products - Concrete and Aggregates industry players as well.

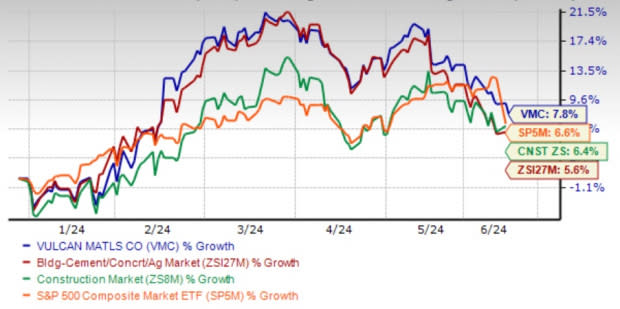

This construction-aggregates producer’s shares gained 7.8% year to date, outperforming the industry and the broader sector. The industry collectively gained 5.6% so far this year compared with the Zacks Construction sector’s 6.4% growth and the S&P 500 index’s 6.6% rally.

Earnings estimates for 2024 have increased to $8.54 per share from $8.51 in the past 30 days, which indicates 22% year-over-year growth. This can further be substantiated by its VGM Score of B. These positive trends indicate bullish analysts’ sentiments, robust fundamentals and the continuation of outperformance in the near term.

Image Source: Zacks Investment Research

Let’s check out the factors that are substantiating this Zacks Rank #3 (Hold) company amid price fluctuation and labor constraints. Moreover, seasonal influences on construction activity and dependency on government projects remain concerns for VMC.

Growth Driving Factors

Rising Public Sector Construction: Increasing public construction demand has been benefiting Vulcan. President Biden signed a historic, bi-partisan infrastructure bill in November 2021. The Infrastructure Investment and Jobs Act (IIJA) provided the largest increase in federal highway, road and bridge funding in more than six decades with a five-year reauthorization of Federal-Aid Highway Program funding. In December 2022, Biden signed the Fiscal Funding Year (FFY) 2023 omnibus spending package, which fully funds the IIJA highway investment levels for FFY 2023. These works are likely to aid Vulcan as it holds a strong position in some of these states.

Vulcan has been witnessing strong pricing, underpinned by growing public demand (mainly transport) and operational discipline. Publicly-funded construction accounted for approximately 40% of its total 2023 Aggregates shipments and nearly 20% of the aggregates sales by volume, which were used in highway construction projects.

The company expects healthy growth in highway and infrastructure demand this year, with trailing 12-month highway starts surpassing $100 billion and record-level 2024 state budgets. Strong upcoming opportunities are anticipated in various Vulcan states, fueling growth projections for highways and infrastructure activities over the next few years. This growth outlook aligns with anticipated unit profitability growth, with the company projecting a fourth consecutive year of double-digit growth in adjusted EBITDA at the midpoint of 2024 guidance.

Long-Term Strategic Moves: The company remains focused on creating long-term value by compounding unit margins through two strategic disciplines: the Vulcan Way of Selling (VWS) (Commercial Excellence & Logistics Innovation) and the Vulcan Way of Operating (VWO) (Operational Excellence & Strategic Sourcing).

VWS uses technology, innovation and analytics to win work and capture value. VWO is the combination of tools, processes and approaches used by Vulcan’s teams to drive value in everyday operations. As a result of these strategic disciplines, aggregates gross profit per ton surged 27% to $7.40, and aggregates cash gross profit per ton rose to $9.46 from $7.43 from 2021 to 2023. For the last four quarters, the company has consistently expanded its trailing 12-month unit profitability across the segments. Cash unit profitability increased by nearly $1.50 per ton in Aggregates, almost $6 per ton in Asphalt and nearly $5 per cubic yard in Concrete.

Acquisitions Synergies: Vulcan has followed a systematic inorganic strategy for expansion since 1956 and has wrapped up various bolt-on acquisitions that have contributed significantly to its growth. The company unveiled its strategy of reinvesting in the business, pursuing growth through M&A and Greenfields, and returning cash through sustainable dividends.

In the first quarter, the company acquired aggregates operations in North Carolina. Also, in April, it acquired aggregates and asphalt operations in Alabama. VMC continues to expect to spend $625-$675 million on capital expenditures for 2024.

Major Risks

Industry Woes Ail: The company uses large amounts of electricity, diesel fuel, liquid asphalt and other petroleum-based resources, subject to potential supply constraints and significant price fluctuation, which could affect operating results and profitability. Variability in the supply and prices of these resources could affect the company’s operating costs, and the rising costs could erode profitability. It may also experience energy and labor woes.

Weather Woes & Seasonality: Vulcan is susceptible to bad weather conditions and seasonality, as most of its products are used outdoors in the public or private construction industry. Also, the company’s production and distribution facilities are located outdoors. Inclement weather negatively impacts the company’s ability to produce and distribute products and affects demand, as construction work can be hampered by weather.

During the first quarter of 2024, the company noted that a 7% decline in aggregates shipments was mainly due to unfavorable weather conditions throughout most of the quarter. Also, the Asphalt mix was partially impacted by lower shipments in Texas due to weather impacts. Normally, the company generates the lowest sales and earnings in the first quarter of each year.

Government Projects/Construction Market Uncertainty: Vulcan’s products are used in a variety of public infrastructure projects that are funded and financed by federal, state and local governments. Dependency on the timing and amount of federal as well as local funding for infrastructure work for its business is a cause of concern. Approximately 40-55% of its total Aggregates shipments have historically been used in publicly-funded construction. Therefore, reductions in state and federal funding can curtail publicly-funded construction.

The company sells most of its aggregates and aggregates-intensive downstream products (such as asphalt mix and ready-mixed concrete) to the construction industry. Any untoward situation influencing the construction and housing sectors will impact the company's financials.

Key Picks

Some better-ranked stocks in the broader sector are:

Howmet Aerospace, Inc. HWM presently carries a Zacks Rank #1 (Strong Buy). HWM has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HWM’s 2024 sales and earnings per share (EPS) indicates a rise of 10.6% and 29.9%, respectively, from the prior-year levels.

Sterling Infrastructure, Inc. STRL presently carries a Zacks Rank #2 (Buy). Sterling Infrastructure has a trailing four-quarter earnings surprise of 22.3%, on average.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 11.7% and 14.8%, respectively, from the prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2. GTES has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance