Private housing rents to increase 10% in 2023, contract 5% in 2024: Huttons

The combination of reduced demand and larger supply led to the slowest rate of rental increase in 3Q2023 at 0.8%: Huttons Data Analytics (Photo: Samuel Isaac Chua/EdgeProp Singapore).

SINGAPORE (EDGEPROP) - The global economic slowdown and geopolitical tensions are having a knock-on effect on the private housing rental market in 2H2023, says Lee Sze Teck, senior director of Huttons Data Analytics, in a report on Dec 8.

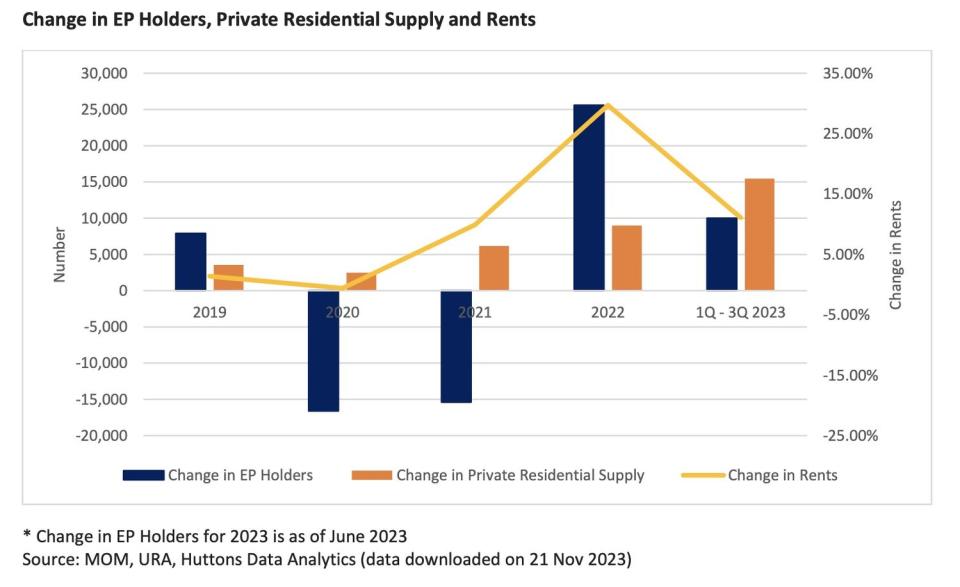

The number of new Employment Pass (EP) holders approved by the Ministry of Manpower (MOM) increased by 10,000 to 197,300 as of June 2023. It pales in comparison to the 25,600 increase in EP holders approved in 2022, bringing the total for the year to 187,300. Huttons' Lee believes it is "highly unlikely" that the full year increase in new EP holders for 2023 will come close to last year's figure.

The lower influx of new EP holders in Singapore translates to a slowdown in new tenant demand in 2H2023.

Read also: HDB rents to grow 12% in 2023, up to 8% in 2024: Huttons

Digital nomads relocating to JB, Bali, Batam

Another reason for a drop in tenant demand for private residential homes was the nearly 30% jump in rents in 2022, prompting some EP holders to opt for more affordable accommodation in co-living spaces and HDB flats. "Some EP holders who have the luxury of working anywhere have chosen to be digital nomads, moving to places such as Johor Bahru, Batam or even Bali," notes Lee.

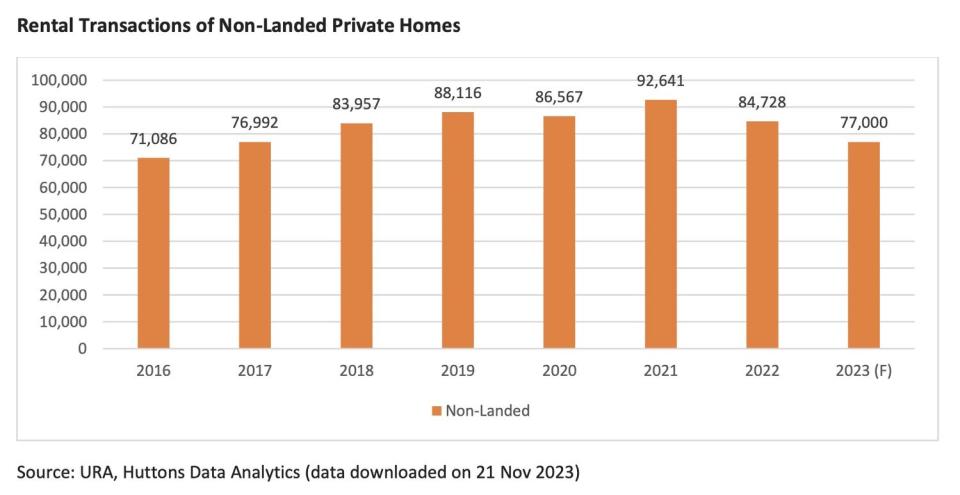

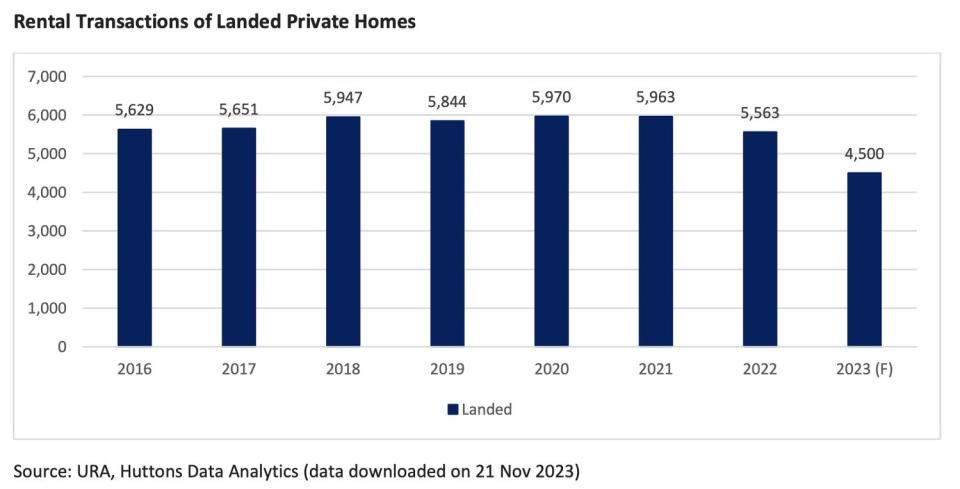

Huttons Data Analytics estimates the number of non-landed rental contracts in 2023 to be 77,000, 9.1% lower y-o-y. The estimated number of landed rental contracts in 2023 fell by 19.1% y-o-y to 4,500. Most contracts signed in 2023 are renewals with low incremental demand from new tenants.

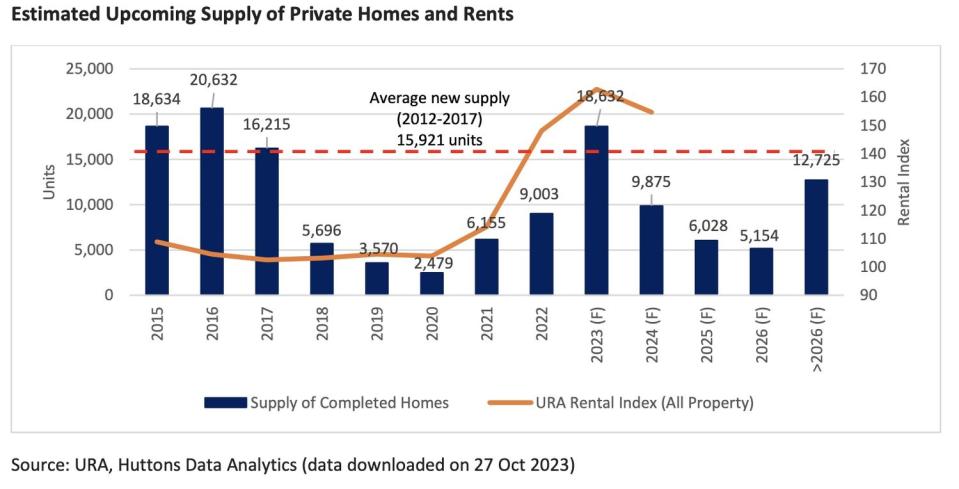

Adding to slower rental demand is a sharp increase in the number of private residential homes completed in 2023. According to Huttons, over 15,000 new private residences were completed in the first nine months of 2023, with another 3,167 slated for completion in 4Q2023. This year's total new supply will amount to more than 18,000 new private homes -- the highest since 2016.

Mega projects (those with at least 1,000 units) contributed to 9,100 new units, almost half of this year's new completions. They include the 1,052-unit Affinity at Serangoon, the 1,074-unit Avenue South Residence, the 1,862-unit Normanton Park, the 1,472-unit Riverfront Residences and the 2,203-unit Treasure at Tampines.

Competition for tenants heats up

With more new supply in the market, competition to attract and retain tenants has intensified in 2H2023. Landlords are taking longer to find a tenant, with many willing to hold their rents steady to retain their existing tenants. "Some landlords are feeling the heat from squeezed rents and high mortgage payments, a reversal of the 'take it or leave it' situation in 2022," says Lee.

The combination of reduced demand and larger supply led to the slowest rate of rental increase in 3Q2023 at 0.8% and the possibility of a rental contraction in 4Q2023. Huttons estimates rents to increase by up to 10% for 2023, compared to the 29.7% escalation last year.

Read also: Higher property taxes for residential investment property next year

Next year, the new supply of homes is almost half of 2023's. Singapore's economic outlook is also projected to be brighter in 2024 than this year; hence, there could be more new EP holders, says Huttons. The market could also be supported by foreigners renting while applying for their permanent residency before buying.

Landlords could find relief from high mortgage payments should interest rates ease next year.

However, it may take at least the first six months of 2024 for the market to digest the large number of completed private homes from 2023, putting downward pressure on rents in 1H2024.

The rental market is expected to find its footing in 2H2024, with rents to contract up to 5% in 2024.

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Higher property taxes for residential investment property next year

Private and public housing rentals slow down, expected to stabilise next year

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance