PPG Adds Two Adhesives to its Aerospace Product Portfolio

PPG Industries, Inc. PPG has announced the addition of two adhesives to its aerospace portfolio, namely PPG PR-2940 epoxy syntactic paste adhesive (ESPA) for bonding aircraft's internal structures and PPG PR-2936, an adhesive with shim and sealant properties for attaching aircraft's outer skin to the internal structures. The products will give PPG’s aerospace customers considerable performance and sustainability benefits through light-weighting.

PPG PR-2940 ESPA adhesive is a lightweight potting compound that is used in secondary aircraft structures by both original equipment manufacturers (OEMs) and maintenance, repair, and overhaul. It fills and strengthens the honeycomb structures used to make an airplane's internal components, such as the inner wing structure, galley, lavatories, overhead bins and flooring.

OEMs utilize PPG PR-2936 adhesive to bind an aircraft's metallic or composite skin to its internal structures, including the fuselage, tail assembly, wings and stabilizers. This epoxy-based adhesive cures at ambient temperature and is intended to cover gaps or irregularities on the surfaces of the primary and secondary components. It combines exceptional mechanical strength, flexibility and micro-cracking resistance over a wide temperature range.

These new adhesives provide enhanced chemistries and low-density qualities while keeping a high strength-to-weight ratio, which contributes to increased aviation fuel efficiency.

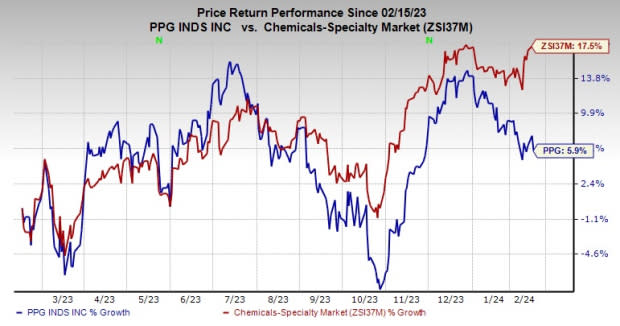

Shares of PPG have gained 5.9% over the past year compared with an 17.5% rise of its industry.

Image Source: Zacks Investment Research

For the first quarter of 2024, the company anticipates an adjusted EPS in the band of $1.80-$1.87. For full-year 2024, the company foresees its adjusted EPS to be in the range of $8.34-$8.59.

The effective tax rate for the first quarter is projected to be between 24% and 25%, implying an increase from the previous year’s figure. This uptick is attributed to various factors, including the impact of heightened regional tax rates and the anticipated distribution of country-specific earnings.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Zacks Rank & Key Picks

PPG currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include United States Steel Corporation X, Carpenter Technology Corporation CRS and Alpha Metallurgical Resources Inc. AMR.

United States Steel carrying a Zacks Rank #1 (Strong Buy). X beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 54.8%. The company’s shares have soared 56.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have soared 22.1% in the past year.

The Zacks Consensus Estimate for AMR’s current-year earnings has been revised upward by 69% in the past 60 days. It currently carries a Zacks Rank #1. AMR delivered a trailing four-quarter earnings surprise of roughly 9.6%, on average. AMR shares are up around 129.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance