PPG Achieves 40% Reduction in Overspray Using SIGMAGLIDE 2390

PPG Industries Inc. PPG recently announced that the EDR Antwerp shipyard achieved a 40% reduction in overspray through the electrostatic application of PPG Sigmaglide 2390 fouling release coating. The project was carried out on the underwater hull of the RoRo passenger vessel Stena Transporter from Stena Line and is EDR's second successful electrostatic application project.

Electrostatic application improves transfer efficiency compared with airless spraying, thereby resulting in less overspray and waste, and when paired with the low VOC emissions of PPG Sigmaglide coating, provides cleaner operation and a better work environment for applicators. PPG Sigmaglide fouling release coating and PPG NEXEON 810 antifouling coating, due to their chemical composition, can be applied using the electrostatic process.

Electrostatic application enhances the weather window for painting activities while drastically minimizing overspray. Ship owners and shipyards seek new solutions to comply with increasing environmental laws and achieve their sustainability objectives.

The company has seen an increase in demand not only for biocide-free and copper-free hull coatings to reduce vessel emissions but also for more environmentally friendly application techniques by yards. PPG strongly believes in the long-term viability of electrostatic application and is promoting it in shipyards around Europe, Singapore and China.

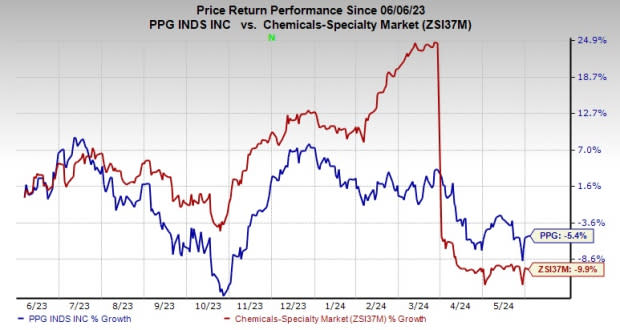

Shares of PPG have lost 5.4% over the past year compared with its industry’s 9.9% decline.

Image Source: Zacks Investment Research

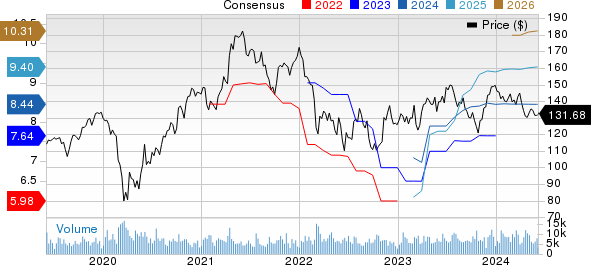

For the second quarter, the company projects adjusted earnings per share (EPS) to be in the band of $2.42-$2.52. For the full-year 2024, it expects adjusted EPS to be in the range of $8.34-$8.59.

PPG envisions strong organic growth in demand for its products in China. Demand is projected to stabilize in Europe as the company progresses through 2024. While economic conditions remain subdued in several end-use markets in the United States, PPG expects overall improvement as the year progresses.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Zacks Rank & Key Picks

PPG currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space are ATI Inc. ATI, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

ATI currently carries a Zacks Rank #2 (Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have soared 77% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Carpenter Technology currently sports a Zacks Rank of 1. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company’s shares have soared 143.2% in the past year.

The Zacks Consensus Estimate for Ecolab's current year earnings is pegged at $6.56 per share, indicating a year-over-year rise of 25.9%. The consensus estimate for ECL’s current-year earnings has gone up in the past 30 days. ECL, which currently carries a Zacks Rank of 2, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company’s shares have rallied roughly 38.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance