Pound Sterling Is At A Historic Low: Should You Lock In Your GBPSGD Exchange Rate Now Or Right Before You Need It?

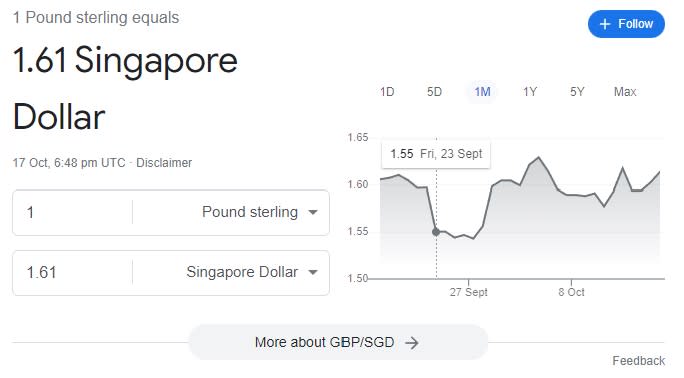

If you are travelling to Britain, forex trader or investor or just a frequent watcher of the exchange boards at the money changer, you may be aware that the Pound Sterling is at a historic low. While we aren’t at the lowest point of GBP/SGD rate of 1.49, the exchange rate for Pound Sterling is currently around 1.61 Singapore Dollar.

Given the current favourable exchange rates, it may be tempting to just make our currency exchange now, rather than later. Especially for the Pound Sterling which is trading at a historical low, Singaporeans who are planning to travel to the U.K. or are studying in the U.K. may be tempted to lock in the current rates. Yet is this a good idea?

Read Also: Best Countries For Singaporeans To Travel To In 2H2022 (Based On Exchange Rate)

What If The Singapore Dollar Continues To Strengthen Against The Pound?

Just as we had discussed in our article – Travelling To Japan: Should You Lock In The Rates For Your Japanese Yen Now?, the common question is whether the SGD will continue to strengthen against the Pound?

We may need a crystal ball (or George Soros) to find out.

For every currency exchange, we need to look at both countries. On one hand, we already know that the MAS is allowing the SGD to strengthen in order to alleviate imported inflation.

On the other hand, the pound had weakened significantly in response to the mini-budget announced by the previous British finance minister Kwasi Kwarteng on 23 September. It promised more tax cuts funded by the huge amount of borrowing during a time of rising inflation and increasing costs of borrowing. This caused the pound to drop against the major currencies (including SGD). After the new finance minister Jeremy Hunt reversed much of the 23 September mini-budget, the pound rallied and pared its losses.

Logically, if we had exchanged our money during the 23 September plunge at the lowest point of 1.49 on 26 September, we would have benefited from it. However, the odds are like catching the lowest point of a stock market crash: lucky for those who did, but unlikely for most of us.

Historic Lows May Go Lower

Just as stock prices reflect investors’ sentiment regarding the company, currency exchange rates are a reflection of the sentiment regarding the country. The highs and lows of the pound has been tied to the economic sentiments surrounding the U.K.

Those who had thought that the pound had reached its lowest point in 2013 at GBP/SGD = 1.85, would have been shocked by the Brexit referendum in 2016. This resulted in the historic low of GBP/SGD = 1.62. However, the recent plunge to GBP/SGD = 1.49 has superseded all of these past historic lows.

Changing currencies and locking in a favourable rate may be tempting and may benefit travellers who are already intending to travel to the U.K. in the near future. However, if you are planning to study in the U.K. or your travel plans are not so soon, there is a lot of room for volatile exchange rate changes.

Some may prefer the certainty of knowing their fixed cost of study and lock in the rates at an exchange rate acceptable to them, while others may prefer to accept the spot rate or exchange currency gradually (when tuition and other payments are due).

We Can Exchange Foreign Currencies Now And When Needed

The good thing is that with multi-currency wallets like YouTrip, we can easily make our currency exchanges quickly without the inconvenience of finding a money changer. This would allow us to take advantage of sudden currency movements and lock in rates at historic lows or allow us to pay the long game and slowly exchange our desired amounts.

As long as credit card payments are accepted, we can use multi-currency wallets like YouTrip to exchange the desired currencies that we want at a rate that is favorable to us and to pay using our personal YouTrip Mastercard in over 150 currencies.

Additionally, GBP is one of ten currencies that we can hold in our YouTrip multi-currency wallet. We can also use our YouTrip card to withdraw cash at all overseas Mastercard, Maestro or Cirrus ATMs outside of Singapore at wholesale exchange rates, though a withdrawal fee of $5 or foreign currency equivalent per transaction will apply.

Read Also: 8 Things You Need To Know Before Heading To The Money Changer

Enjoy Favorable Rates With YouTrip

While being able to lock in favorable rates in advance is good, we also want to ensure that we enjoy the best possible conversion rates without any markups.

The good news is that YouTrip doesn’t charge any currency conversion fees. This is unlike traditional moneychangers and financial institutions, where currency conversion fees and foreign exchange spread are how they make money. So, the rates that you enjoy from YouTrip will likely be quite similar to the spot rate.

DollarsAndSense Exclusive: Use the promo code “DNS5″ during your YouTrip registration to receive a welcome credit of $5 in your YouTrip account.

The post Pound Sterling Is At A Historic Low: Should You Lock In Your GBPSGD Exchange Rate Now Or Right Before You Need It? appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance