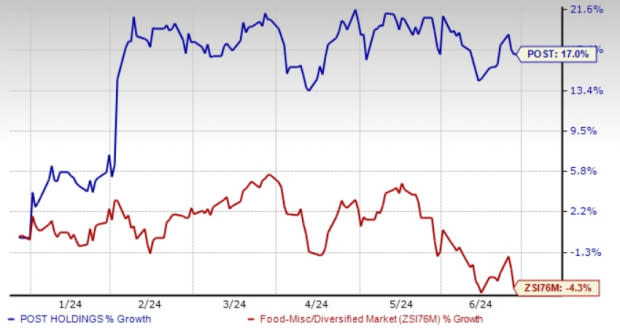

Post Holdings (POST) Marches Ahead of the Industry in 6 Months

Post Holdings, Inc. POST has experienced a 17% increase in its share value over the past six months against the industry’s decline of 4.3%. Despite a challenging broader market environment, Post Holdings’ stock has shown resilience. Currently trading near its 52-week high of $108.17, the stock reflects the market’s confidence in the company’s strategic direction and growth potential.

Over the past 60 days, the Zacks Consensus Estimate for earnings for the current fiscal year has risen by 1.6% to $5.61. This suggests growth of 5.1% from the year-ago levels, highlighting the company’s potential and solid outlook. Additionally, consensus estimates for the next fiscal year indicate growth of 10.8% compared with the previous year. The Zacks Consensus Estimate for sales suggests an increase of 14.2% and 2% for the current and next fiscal year, respectively.

Post Holdings has made significant strides in the consumer packaged goods sector, yet it faces a mix of promising opportunities and notable challenges. Let’s analyze.

Image Source: Zacks Investment Research

Detailed Look at the Key Factors

Post Holdings has been benefiting from the expansion of its value offerings in the pet food and grocery divisions, supported by robust manufacturing capabilities and effective pricing strategies. This trend persisted into the second quarter of fiscal 2024, as evidenced by year-over-year increases in both top-line and bottom-line performance. The company’s performance in the Post Consumer Brands segment was particularly driven by higher average net selling prices.

Post Holdings' recent acquisition, such as Perfection Pet, is expected to contribute positively to its long-term growth path. In the second quarter of fiscal 2024, the company's net sales included $467.9 million attributable to acquisitions, underscoring the importance of these moves in expanding its market reach and enhancing overall growth prospects.

This Zacks Rank #3 (Hold) company has made significant strides in improving its supply chain and manufacturing operations. Its efforts in optimizing the warehouse and distribution network for both cereal and pet food segments are noteworthy. The planned closure of the Lancaster, OH, cereal plant in fiscal 2025 is expected to yield operational efficiencies. Additionally, the Refrigerated Retail segment is focusing on driving volumes through an improved supply chain, which is critical for maintaining competitive advantage and cost leadership.

Buoyed by strong performance in the first half of the fiscal year, Post Holdings has raised its guidance for fiscal 2024. Management revised its adjusted EBITDA outlook, projecting $1,335-$1,375 million compared with the previous range of $1,290-$1,340 million.

Despite the aforementioned tailwinds, Post Holdings faces a few challenges. In the food service segment, the company faced headwinds due to a slowdown in restaurant foot traffic during the second quarter. This decline led to lower overall egg volumes, highlighting potential vulnerabilities in the segment. Furthermore, inflation remains a persistent challenge, with costs rising in areas such as sugar and labor.

Wrapping Up

The successful integration of pet food brands into Post Consumer Brands and ongoing investments in premium pet products signal robust future growth. Furthermore, Post Holdings' strategic initiatives in optimizing its supply chain and warehouse distribution, coupled with well-timed debt refinancing that increased liquidity, position the company favorably.

3 Picks You Can’t Miss

Here, we have highlighted three better-ranked stocks, namely, Vital Farms VITL, Vita Coco Company COCO and Ollie's Bargain Outlet OLLI.

Vital Farms offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.6% and 59.3%, respectively, from the year-ago reported numbers.

Vita Coco, which develops, markets and distributes coconut water products, currently flaunts a Zacks Rank #1. COCO has a trailing four-quarter earnings surprise of 25.3%, on average.

The Zacks Consensus Estimate for Vita Coco’s current financial-year sales and earnings implies an improvement of 3.5% and 40.5%, respectively, from the prior-year actuals.

Ollie's Bargain, the extreme-value retailer of brand-name merchandise, currently carries a Zacks Rank #2 (Buy). OLLI has a trailing four-quarter earnings surprise of 10.4%, on average.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year sales and earnings indicates a rise of around 7.9% and 12.0%, respectively, from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance