Polygon-Based DeFi Platform QuickSwap Closes Lending Service After Exploit

QuickSwap, a decentralized-finance (DeFi) platform that's based on the Polygon blockchain, closed its lending services for users following a flash-loan exploit for over $220,000 worth of tokens on Monday.

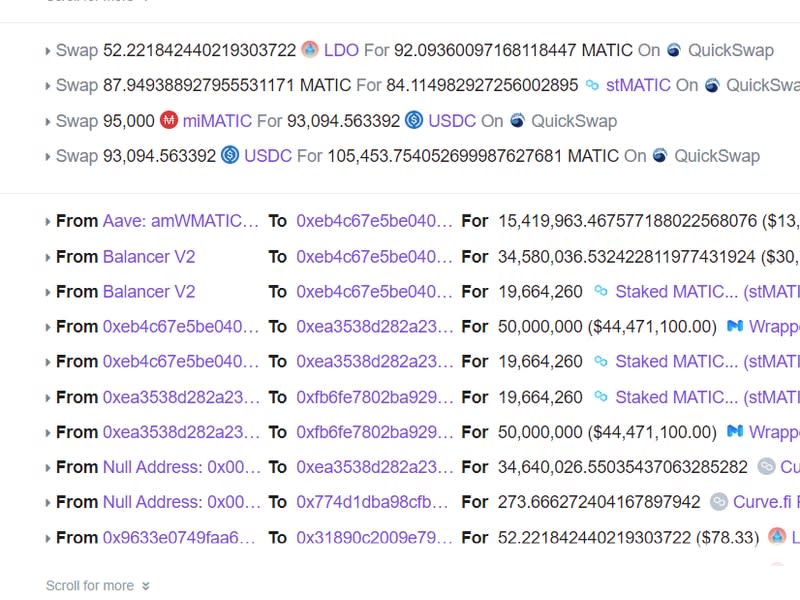

Blockchain data shows the attackers manipulated token prices by borrowing funds using a flash loan – a form of unsecured lending – and then used the inflated values as collateral to drain all liquidity from the affected QuickSwap pool. Stolen tokens including MATIC, Lido’s LDO and staked MATIC were exchanged for other tokens on privacy mixer Tornado Cash on Monday afternoon, data shows.

"QuickSwap Lend is closing," the company said in a tweet. "$220k was exploited in a flash loans attack due to a vulnerability with the Curve Oracle, which @marketxyz was using."

Flash loans are provided by some DeFi networks and don't require a borrower to post collateral as long as the loan is paid back in the same transaction.

QuickSwap initially pinned the exploit on a vulnerability with the Market XYZ platform, which it said used faulty oracles from DeFi protocol Curve and stablecoin issuer QiDao. Oracles are services that fetch data from external sources to feed into any blockchain network. QiDao said the exploit was unrelated to its smart contracts.

QuickSwap said it would publish an update on the exploit on Monday, but no further information had been released as of press time Tuesday.

The attack is the latest in a growing list of exploits this month, which is already the worst month ever for crypto attacks.

Yahoo Finance

Yahoo Finance