Philip Morris (PM) Benefits From Focus on RRPs & Pricing Power

Philip Morris International Inc. PM has been benefiting from its focus on reduced-risk products (RRPs), given consumers’ increased inclination to this category. The company’s solid pricing efforts are working well. That said, escalated costs are putting pressure on its margin performance.

Let’s delve deeper.

Factors Favoring Philip Morris

Serious health hazards due to cigarette smoking have pushed consumers toward low-risk RRPs. The company is progressing with its business transformation, with smoke-free products generating more than 30% of its net revenues in the second quarter of 2022. Smoke-free net revenues formed nearly 30% of pro forma total while exceeding 30% of total PMI during the first half of 2022. IQOS,a heat-not-burn device, reflected almost 5% of the pro forma first-half RRP net revenues.

In second-quarter 2022, the company witnessed continued strength in IQOS performance with solid pro forma user growth of over 1.1 million, reflecting a sequential acceleration from the first quarter as device limitation and COVID restrictions are easing. IQOS ILUMA generated solid results across the first three markets: Japan, Switzerland and Spain. Management expects solid IQOS growth in the third quarter.

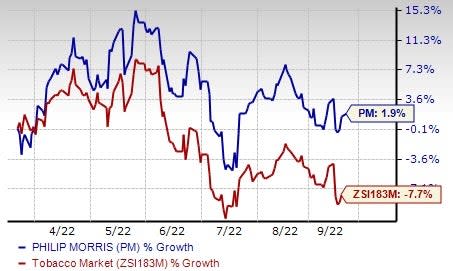

Image Source: Zacks Investment Research

The company is well placed to become a majority smoke-free company by 2025. Philip Morris recently proposed a combination with Swedish Match to its smoke-free portfolio is a major step in the transformation to becoming a smoke-free company. The transaction will likely conclude in the fourth quarter of 2022, subject to regulatory and other approvals.

In February 2021, the company revealed plans to generate at least $1 billion in annual net revenues from ‘Beyond Nicotine’ products by 2025. The initiative leverages its expertise in life sciences, inhalation technology and natural ingredients, among others. As part of the strategy, the company made three meaningful buyouts in the third quarter of 2021, including Vectura Group plc, Fertin Pharma A/S and OtiTopic.

Philip Morris has long been benefiting from its strong pricing power. Though higher pricing might lead to a possible decline in cigarette consumption, it is seen that smokers tend to absorb price increases due to the addictive quality of cigarettes. Higher pricing variance was an upside to the company’s performance across most regions during the second quarter of 2022. Proforma pricing for combustible products rose 3.5% and nearly 5%, excluding Indonesia.

Hurdles on Way

In second-quarter 2022, Philip Morris’ proforma adjusted operating income margin fell 1.9 points on an organic basis. The decline can be attributed to tough comparisons with the last year’s productivity savings, the increased initial cost of IQOS ILUMA devices and heated tobacco units, investments to expand the smoke-free portfolio, supply-chain hurdles (especially due to the Ukraine war) and overall cost hikes for certain direct materials, energy, wage and transportation induced by the pandemic recovery and worsened by the Ukraine war.

For 2022, the gross margin is expected to be lower due to a considerable rise in IQOS device volumes (with supply restrictions easing), the increased initial cost of IQOS ILUMA, elevated logistic costs, growth-oriented investments in the smoke-free space, raw material and energy cost inflation and incremental supply-chain costs. In addition, management expects a lower gross margin in the third quarter of 2022.

That being said, the aforementioned upsides will likely help Philip Morris continue with its growth story. Shares of the Zacks Rank #3 (Hold) company have risen 1.9% in the past six months against the industry’s 7.7% decline.

Solid Staple Bets

Some better-ranked stocks are Inter Parfums IPAR, The Chef's Warehouse CHEF and e.l.f. Beauty ELF.

Inter Parfums is engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products. IPAR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial year sales and earnings per share (EPS) suggests growth of 15% and 18.6%, respectively, from the year-ago period’s reported figures. IPAR has a trailing four-quarter earnings surprise of 31.1%, on average.

Chef’s Warehouse, a distributor of specialty food products in the United States, currently flaunts a Zacks Rank #1. CHEF has a trailing four-quarter earnings surprise of 355.9%, on average.

The Zacks Consensus Estimate for Chef Warehouse’s current financial year sales suggests growth of 40.7% from the year-ago reported numbers.

e.l.f. Beauty, a cosmetic company, currently has a Zacks Rank #2 (Buy). ELF has a trailing four-quarter earnings surprise of almost 77%, on average.

The Zacks Consensus Estimate for e.l.f. Beauty’s current financial-year sales and EPS suggests growth of 16.8% and almost 6%, respectively, from the year-ago period’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance