Pharmaniaga Berhad (KLSE:PHARMA) shareholders have endured a 41% loss from investing in the stock three years ago

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Pharmaniaga Berhad (KLSE:PHARMA) shareholders have had that experience, with the share price dropping 48% in three years, versus a market return of about 14%. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days.

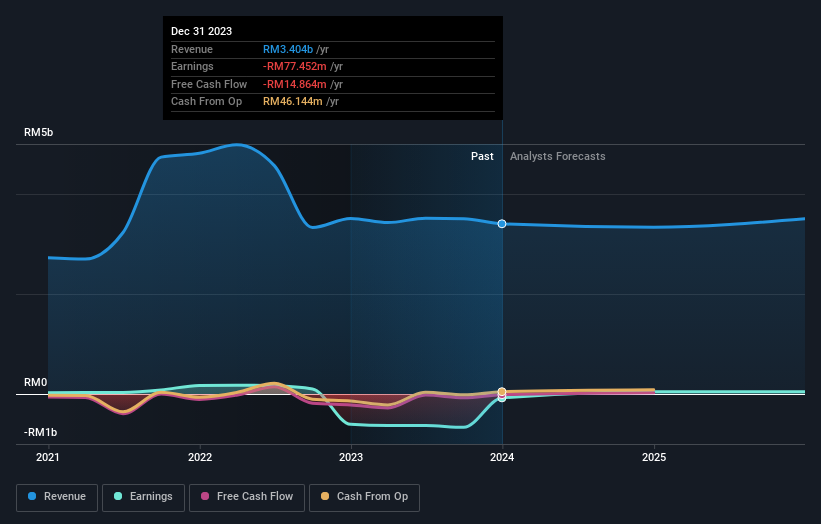

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Pharmaniaga Berhad

Pharmaniaga Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Pharmaniaga Berhad saw its revenue grow by 0.6% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 14% during that time. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Pharmaniaga Berhad stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Pharmaniaga Berhad's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Pharmaniaga Berhad's TSR of was a loss of 41% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 17% in the last year, Pharmaniaga Berhad shareholders lost 2.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Pharmaniaga Berhad is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

But note: Pharmaniaga Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance