Pharma Stock Roundup: MRK to Buy Harpoon, JNJ to Acquire Ambrx Biopharma & More

This week, both Merck MRK and J&J JNJ announced plans to acquire cancer biotechs making oncology therapies with novel mechanisms of action. AbbVie ABBV announced positive data from a mid-stage study on a skin disease candidate. Pfizer PFE provided some regulatory updates.

Recap of the Week’s Most Important Stories

J&J to Acquire Ambrx Biopharma: J&J announced a definitive agreement to acquire Ambrx Biopharma for a total equity value of approximately $2.0 billion. The acquisition will strengthen J&J’s oncology pipeline by adding the latter’s lead pipeline candidate, ARX517, a prostate-specific membrane antigen targeting antibody drug conjugate (ADC), being developed for metastatic castration-resistant prostate cancer (mCRPC). Ambrx is developing next-generation ADCs, leveraging its proprietary synthetic biology technology that effectively kills cancer cells and limits toxicities associated with chemotherapy treatment.

Merck to Buy Harpoon Therapeutics: Merk announced plans to acquire Harpoon Therapeutics for $23.00 in cash, which amounts to an approximate total equity value of $680 million. The acquisition will strengthen Merck’s oncology pipeline by adding Harpoon’s lead pipeline candidate, HPN328, a T cell engager. HPN328 is currently being evaluated in a phase I/II study in certain patients with small cell lung cancer (SCLC) and other neuroendocrine tumor types. In October, Harpoon Therapeutics presented positive interim data from the phase I/II study.

FDA Grants Priority Review Status to Pfizer’s Tivdak sBLA: Pfizer announced that the FDA has accepted and granted priority review status to a supplemental biologics license application (sBLA), seeking to convert the accelerated approval of Tivdak (tisotumab vedotin-tftv) to a full approval. The sBLA is based on positive data from the global phase III innovaTV 301 study, which demonstrated the overall survival benefit of Tivdak over chemotherapy. Tivdak was granted accelerated approval by the FDA for previously treated recurrent or metastatic cervical cancer in September 2021. Tivdak was added to Pfizer’s portfolio following the acquisition of Seagen, which was closed in December 2023.

Pfizer also announced that the European Commission has granted approval to a combination of its cancer drugs, Talzenna plus Xtandi (standard of care), for treating mCRPC. With the approval, Talzenna became the first and only PARP inhibitor approved in combination with Xtandi, which is the standard of care for mCRPC, in the European Union. The approval was based on data from the phase III TALAPRO-2 study. Talzenna plus Xtandi was approved in the United States for HRR gene-mutated mCRPC based on data from the TALAPRO-2 study in June 2023.

AbbVie’s Hidradenitis Suppurativa Candidate Meets Goal in Phase II: AbbVie announced positive data from a phase II study evaluating its pipeline candidate, lutikizumab (ABT-981) in adults with hidradenitis suppurativa (HS) who had previously failed anti-TNF therapy. HS is a chronic inflammatory skin disease characterized by scarring, lesions and sinus tracts.

The data showed that patients treated with lutikizumab (ABT-981) 300 mg weekly or 300 mg every other week achieved higher response rates in the primary endpoint of achieving HS Clinical Response (HiSCR 50) at week 16. The study also showed that patients in the lutikizumab arm achieved higher rates of improved skin pain than placebo. AbbVie plans to advance the candidate to phase III based on data from the phase II study.

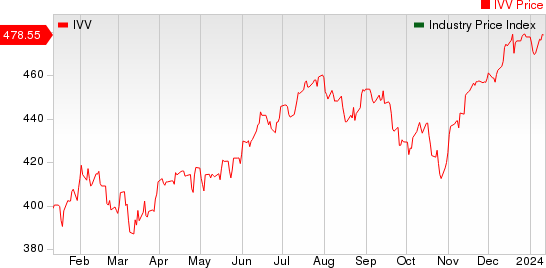

The NYSE ARCA Pharmaceutical Index rose 1.1% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

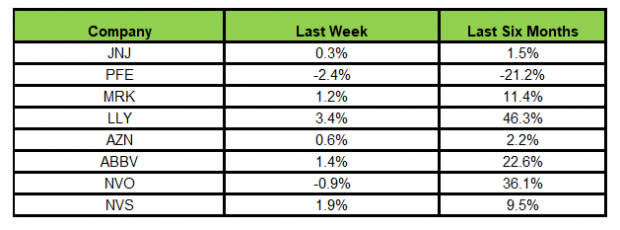

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, Lilly rose the most (3.4%), while Pfizer declined the most (2.4%).

In the past six months, Lilly has risen the most (46.3%), while Pfizer has declined the most (21.2%).

(See the last pharma stock roundup here: LLY’s New Digital Pharmacy, NVO & ABBV’s Fresh R&D Deals)

What's Next in the Pharma World?

Watch for pipeline and regulatory updates next week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance