PeptiDream Leads Three High Growth Japanese Stocks With Significant Insider Ownership

Japan's stock markets have shown resilience, with the Nikkei 225 Index gaining significantly over the week. This robust performance, driven by historic weakness in the yen benefiting export-heavy industries, sets a favorable backdrop for exploring growth companies with high insider ownership. In such market conditions, stocks with substantial insider ownership can be particularly compelling. High insider ownership often aligns management’s interests with shareholders', potentially leading to prudent long-term decision-making that capitalizes on current economic dynamics.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.4% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 72.9% |

We're going to check out a few of the best picks from our screener tool.

PeptiDream

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥322.85 billion.

Operations: The company's revenue is generated primarily from the discovery and development of various therapeutic molecules.

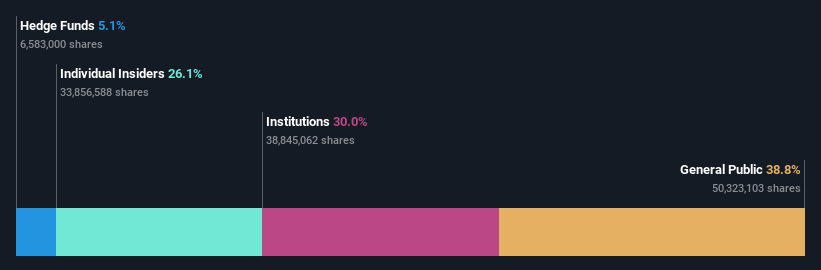

Insider Ownership: 26.1%

PeptiDream, a Japanese biotech firm, recently revised its fiscal year 2024 revenue and profit forecasts significantly upwards, reflecting strong business growth. The company's strategic expansion with Novartis and a promising clinical study targeting renal cell carcinoma underscore its innovative edge. Despite high share price volatility and lower current profit margins compared to last year, PeptiDream's robust insider ownership aligns interests with long-term investors, supporting its position in the competitive landscape of growth companies in Japan.

Click to explore a detailed breakdown of our findings in PeptiDream's earnings growth report.

Upon reviewing our latest valuation report, PeptiDream's share price might be too optimistic.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc., a diversified company based in Japan, operates in sectors including e-commerce, fintech, digital content, and communications with a market capitalization of approximately ¥1.78 trillion.

Operations: The company operates across several sectors, generating revenues from e-commerce, fintech, digital content, and communications.

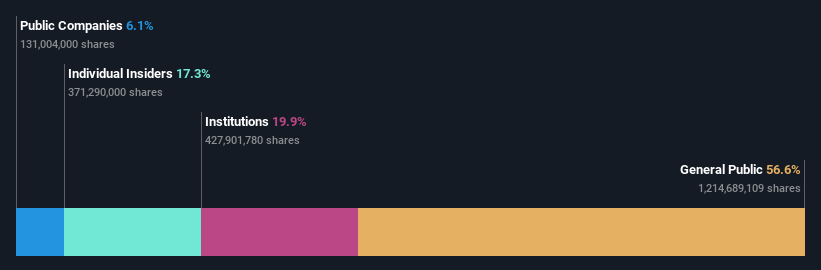

Insider Ownership: 17.3%

Rakuten Group, currently trading at a significant discount to its estimated fair value, is poised for substantial growth with earnings expected to increase by 83.88% annually. Despite slower revenue growth forecasts of 7.4% per year compared to the broader market expectation of 20%, Rakuten's revenue is still outpacing the Japanese market average of 4.1%. Recent corporate activities include a successful $1.99 billion fixed-income offering and optimistic guidance predicting double-digit growth in operating results for FY2024, excluding its securities business impacted by market volatility.

Lasertec

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and globally, with a market capitalization of approximately ¥3.25 trillion.

Operations: The company generates its revenue from the design, manufacture, and sale of inspection and measurement equipment across domestic and international markets.

Insider Ownership: 12.1%

Lasertec Corporation, a key entity in Japan's tech sector, is experiencing robust growth with earnings projected to rise by 20.23% annually, outpacing the Japanese market's average. Revenue growth at 16.4% annually also exceeds the local market norm of 4.1%. Recent executive shifts aim to bolster this trajectory, notably with Tetsuya Sendoda ascending as CEO, which could enhance strategic initiatives and maintain their competitive edge in semiconductor technology amidst high volatility in share prices.

Key Takeaways

Explore the 99 names from our Fast Growing Japanese Companies With High Insider Ownership screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4587 TSE:4755 and TSE:6920.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance