Pembina (PBA) Stock Rises 6.5% After Q3 Earnings Top Estimates

Pembina Pipeline Corporation's PBA stock has gone up 6.5% since the third-quarter 2022 earnings announcement on Nov 3. This rise could be attributed to Pembina Pipeline’s third-quarter earnings beating the consensus mark and a year-over-year improvement in quarterly sales.

Inside Pembina Pipeline's Earnings

Pembina Pipeline reported third-quarter 2022 earnings per share of $1.27, beating the Zacks Consensus Estimate of 48 cents and the year-earlier quarter's earnings of 80 cents. This outperformance was primarily due to the healthy performances in all three segments of the company.

The quarterly revenues of $2.13 billion improved about 27.8% year over year. This growth could be attributed to the better year-over-year performance of the various segments of the company.

Operating cash flow fell approximately 16% to C$767 million. Adjusted EBITDA of C$967 million was C$117 million higher than the figure registered in the third quarter of 2021.

In the third quarter of 2022, PBA saw volumes of 3,424 thousand barrels of oil equivalent per day (mboe/d), comparing favorably with the 3,411 mboe/d reported in the prior-year quarter.

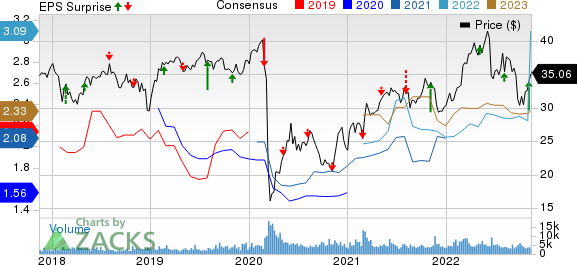

Pembina Pipeline Corp. Price, Consensus and EPS Surprise

Pembina Pipeline Corp. price-consensus-eps-surprise-chart | Pembina Pipeline Corp. Quote

Segmental Information

Pipelines: Adjusted EBITDA of C$535 million was up from the year-ago quarter’s level of C$503 million. This upside was due to higher volumes on the Peace Pipeline system and Cochin Pipeline and higher tolls due to inflation.

Moreover, the third quarter of 2022 included a higher contribution from Alliance due to higher revenues as a result of a wider AECO-Chicago natural gas price differential. However, the year-over-year volume marginally fell about 1.25% to 2,531 mboe/d.

Facilities: Adjusted EBITDA of C$291 million improved from the year-ago quarter’s C$273 million. The upside could be primarily attributed to the strong performance of PGI assets. Volumes of 893 mboe/d rose by about 5.3% year over year.

Marketing & New Ventures: Adjusted EBITDA of C$180 million compared favorably with C$108 million in the third quarter of 2021. This upside was due to higher margins on crude oil resulting from the increased crude oil market price environment, combined with contributions from natural gas marketing.

The Marketing & New Ventures segment recorded NGL volumes worth 184 mboe/d, up 4% compared to the same period in the prior year.

Capital Expenditure & Balance Sheet

Pembina Pipeline spent C$131 million as capital expenditure during the quarter under review compared with C$209 million a year ago. As of Sep 30, 2022, PBA had cash and cash equivalents worth C$294 million and C$9.57 billion in long-term debt. Debt-to-capitalization was around 37%.

Guidance

For full-year 2022, Pembina Pipeline raised its adjusted EBITDA guidance from the earlier C$3.575-C$3.675 billion range to the C$3.625-C$3.725 billion range.

The company stated that the revised outlook for 2022 primarily reflects stronger year-to-date results. However, PBA incorporated its expectation of a lower contribution from the marketing business in the fourth quarter relative to the third quarter, given the outlook for lower commodity prices and narrowing price differentials in the fourth quarter to date and implied by prevailing forward price curves.

Zacks Rank & Other Key Picks

Pembina Pipeline currently carries a Zacks Rank #2 (Buy). Investors interested in the energy space might also look at some other top-ranked stocks — Vista Oil & Gas VIST, NexTier Oilfield Solutions NEX and PBF Energy PBF — each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Vista’s 2022 earnings is pegged at $3.11 per share, which indicates an increase of 475.9% from the year-ago earnings of 54 cents.

The consensus mark for VIST’s 2022 earnings has been revised 29.6% upward over the past 60 days.

The Zacks Consensus Estimate for NexTier’s 2022 earnings stands at $1.41 per share, indicating an increase of about 427.9% from the year-ago loss of 43 cents.

NEX beat estimates for earnings in all the trailing four quarters, the average being around 271%.

The Zacks Consensus Estimate for PBF Energy’s 2022 earnings stands at $22.70 per share, indicating an increase of about 1,008% from the year-ago loss of $2.50.

PBF beat the consensus mark for earnings in all the trailing four quarters, the average being around 49%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report

Vista Oil & Gas, S.A.B. de C.V. Sponsored ADR (VIST) : Free Stock Analysis Report

NexTier Oilfield Solutions Inc. (NEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance