Options Alert: Highly Asymmetric Trade Setup in OLLI

If you have followed my research for any amount of time, you know I am very favorable toward stocks with strong momentum. It is an extremely well-researched market anomaly that can provide superior returns in a strong stock market like the one we are in today.

Combine that with the Zacks Rank and you really have something special.

One stock that recently jumped onto my radar due to powerful one-month momentum measures is Ollie's Bargain Outlet (OLLI).

The stock has numerous growth catalysts, a fantastic business model with die-hard customers, and most importantly, relatively cheap options offering big profit potential.

Strong Earnings and Loyal Customer Base Drive Ollie's Army

Ollie's Bargain Outlet recently impressed investors with a strong quarterly earnings report. The company surpassed both sales and earnings expectations, with earnings per share coming in 12.3% higher than analyst estimates.

This positive performance isn't a one-off event. Ollie's Army, the company's loyalty program, continues to be a significant sales driver. Membership keeps increasing, with 14 million active members at the end of Q4 2023, accounting for over 80% of total sales. This loyal customer base provides a strong foundation for future growth.

With such a loyal customer base along with bargain deals, I liken Ollie’s to a mix between Costco and Dollar General.

Bullish Catalysts in OLLI Shares

The stock chart for OLLI is particularly exciting. After a long period of consolidation, the stock is trading well below its 2021 highs. I like that the stock is coming off its lows compared to the broader market, it makes me think fewer investors are looking at the company.

The recent price action suggests a potential breakout is on the horizon. Notably, OLLI has experienced impressive 1-month momentum, boasting one of the top performances in the market over that time with a gain of around 25%.

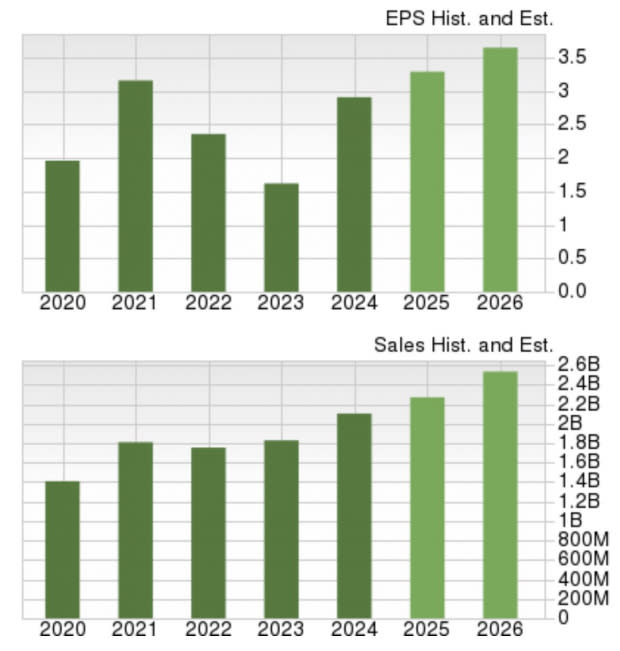

This momentum is backed by strong fundamentals. Analysts forecast steady sales and earnings growth for Ollie's, with estimates of 8% and 12% growth this year for sales and earnings, respectively. The trend is expected to continue next year with projected growth of 12% for both sales and earnings.

Furthermore, OLLI carries a Zacks Rank #2 (Buy) rating, reflecting the upward trajectory of earnings revisions.

Image Source: Zacks Investment Research

OLLI Technical Analysis: Bull Flag Poised for Breakout

The technical chart for OLLI showcases a compelling bull flag pattern. This formation often indicates a continuation of the uptrend after a period of consolidation. In OLLI's case, the consolidation has occurred following the recent earnings beat.

The earnings beat and gap up, followed by a tight bull flag is a very high probability setup as it demonstrates significant positioning by institutional investors.

A breakout above the key resistance level of $99.50 could trigger a significant move higher. My primary target over the next couple of weeks is $106.

Image Source: TradingView

Implied Volatility in Options Trading

Probably the most important consideration when trading options is the implied volatility. The process for determining when the market favors buying versus selling an option is pretty straightforward.

Traders should buy an option when implied volatility (IV) is relatively low and look to sell options when the implied volatility is relatively high, when it fits with a trading thesis.

If you are looking to buy an option, but the IV is already relatively high, you are severely limiting the upside potential, and buying the underlying stock is likely to be the better expression of the trade.

Whereas if you are an option seller, you want to see high IV priced into the options, because it gives you a juicier premium to collect if you sell the option.

In the case of Ollie’s Bargain Outlet stock, implied volatility is currently relatively low. The quarterly earnings report has been released, a big move has happened, and the price has consolidated in recent weeks, lowering the recent range and IV.

Of course, determining whether implied volatility is high or low is a nuanced activity, but as of this writing, IV on OLLI stock is 30%. Additionally, the IV Percentile is 27%, meaning the stocks implied volatility is higher than it has been only 27% of the time in the last year.

Based on these metrics, I would say that call options are relatively cheap in OLLI stock, and favor buying, although they are not a bargain. However, based on the momentum trade setup, there is still considerable asymmetry in the trade.

Strike Selection: Targeting Asymmetric Potential

After trading options for the last ten years, I have found an extremely simple and effective method for structuring these trades.

While many traders like using spreads and advanced multi-leg strategies, I am a fan of simply buying 30 delta calls (puts). This way investors can risk the trade to $0, and the only trade management necessary is selling the option to take profit. If your trade is wrong, you can just let the option expire worthless.

I prefer risking the full premium in the option because it gives me very explicit risk management.

Additionally, the 30-delta option gives a perfect mix of lower priced options, medium distance to being in-the-money, and high asymmetry. Lower delta and the strikes are too far from the current price, and higher delta lowers the asymmetry.

For this trade, the strike we have selected offers a Delta of 22, which is the best we could find for OLLI stock and close enough to the ideal level of 30.

Image Source: Barchart

OLLI July 19 Long Call

Buy $105 Call @ $0.95

Upfront trade cost: $95 per contract

Maximum risk: $95.00

Maximum return: infinite (on upside)

P.S. remember that each contract is quoted at the per-share rate but represents 100 shares of the underlying security.

I'm considering the OLLI July 19th $105 calls, currently trading around $0.95 per contract. My bullish thesis suggests the stock could reach a target price of $106 by next Friday.

If this price target is achieved, it would translate to a potential return of approximately 228% or $217 per contract. This represents a significant potential gain for a relatively short holding period.

Of course, the stock may move differently, getting to the target sooner, later or not at all, with returns ranging from +300% returns, to -100%. But most importantly, we know the maximum amount of risk built into the trade, allowing us to properly fit it into a portfolio.

Image Source: Options Profit Calculator

Key Takeaways

Ollie's Bargain Outlet is a company demonstrating solid growth and boasting a loyal customer base. The recent earnings beat, combined with the bullish technical setup, suggests a potential breakout is on the horizon. Options offer a way to participate in this potential upside while managing risk.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance