Office rents to soften next year on the back of record building completions: Savills Singapore

Savills is projecting CBD Grade A rents to fall between 2% and 3% y-o-y in 2024 (Picture: Samuel Isaac Chua/The Edge Singapore)

SINGAPORE (EDGEPROP) - While a tight supply of Grade A office space has underpinned office rental rates this year, a downward adjustment in rents is likely on the horizon, according to an October report by Savills Singapore. Savills Research is forecasting office rents to soften in 2024 following “record levels of CBD and non-CBD building completions”.

Office rental growth has already shown signs of tempering, with the average monthly rents of the basket of CBD Grade A offices tracked by Savills edging up just 0.1% q-o-q in 3Q2023 to $9.64 psf. In comparison, the basket registered rental growth of 0.7% in 2Q2023.

“Rental numbers in 3Q2023 support the general feeling that the market has softened despite a lack of new supply throughout the year,” says Ashley Swan, executive director, commercial leasing at Savills Singapore. “The continued economic uncertainty, global tensions and high interest rate environment have led to a host of occupiers delaying expansion plans, sitting tight and adopting a 'wait and see' approach.”

Read also: Prime office rents holding up despite slowing economy: Knight Frank

Nonetheless, Savills is maintaining its projected growth of 2% y-o-y for CBD Grade A office rents in 2023, underpinned by the significant reduction in net supply registered in 2022 that has subsequently impacted the market in 2023. For the first three quarters of this year, rents have risen by 1.1%.

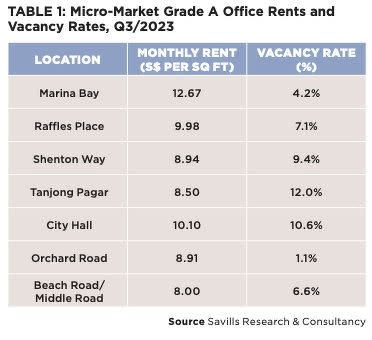

Rents of Grade A offices in Marina Bay, Tanjong Pagar, City Hall and Orchard Road remained unchanged in 3Q2023. Raffles Place and Shenton Way respectively saw a 0.1% q-o-q increase in Grade A offices, while the Beach Road-Middle Road area saw stronger quarterly growth of 1.1%, largely due to higher rents at Bugis Junction Towers.

Grade A offices in the CBD saw a higher vacancy rate of 7.1% as of 3Q2023, up 0.6 percentage points from the previous quarter, primarily driven by the addition of Guoco Midtown to office stock.

Savills’ Swan believes the lackluster sentiment in the office market will remain through 2024. This will contribute to a further slowdown in leasing activity which will, in turn, lead to a decline in CBD rents, he adds. Savills is projecting CBD Grade A rents to fall between 2% and 3% y-o-y in 2024.

This comes as islandwide office supply is expected to see an influx next year pursuant to the completion of projects such as IOI Central Boulevard Towers, Keppel South Central, Paya Lebar Green and Labrador Tower.

Alan Cheong, executive director, research and consultancy at Savills Singapore, cautions that while new supply will drop sharply in 2025 and 2026, the impact may not be strong enough to “convincingly turn rents around” in light of rising business and global political risks. “The recent attacks on Israel’s soil and the consequent retaliatory actions may ignite Middle East flashpoints, possibly spilling over to the economic realm,” he says.

Read also: Asia Pacific companies lead the return to office: CBRE

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Prime office rents holding up despite slowing economy: Knight Frank

Prime office rents see marginal growth in 2Q2023, but occupancy rates stay resilient

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance