OCBC sees stronger recovery in 2H2022 happening for hospitality sector; China’s reopening a 'key catalyst'

ART remains OCBC's top pick; the brokerage has kept its "buy" call with a fair value estimate of $1.29.

The research team at OCBC Investment Research has seen a strong rebound in demand for the hospitality sector, with leisure travel remaining the major driver of room demand in the 7M2022.

In its report dated Sept 9, the team points out that Singapore saw total visitor arrivals of 2.2 million for the 7M2022, coming to around 20% of its pre-Covid-19 levels.

According to the Singapore Tourism Board (STB), visitor arrivals are expected to reach four million to six million in 2022.

During the same period, Singapore hotels’ average occupancy rate was 69.5%, up 18.9 percentage points y-o-y. However, the rate still stood 17.0 percentage points below the average occupancy rate of 86.4% in the same period in 2019.

Meanwhile, the average room rate (ADR) in the 7M2022 stood at $220.9, surpassing its pre-Covid-19 levels by 2.7%. This was boosted by strong travel demand, inflation, along with a tighter labour market, says the OCBC team.

Along with a y-o-y growth in occupancy rate and ADR, revenue per available room (RevPAR) increased by 102% y-o-y to $153 in 7M2022, compared to $186 in 7M2019.

However, the team is optimistic that the 2H2022 will see further room for recovery in occupancy and continued support for ADR in 2H2022 due to the corporate travellers. This is given the return of the meetings, incentives, conferences and exhibitions (MICE) events, as well as the Formula 1 event.

While the team has not seen signs of deteriorating travel demand based on forward bookings trend, it is less buoyant on the recovery trajectory in 2023 on the back of a weakening macro-outlook, inflationary pressure and dissipation of pent-up demand could limit demand growth.

However, it adds that the potential boost from the reopening in China will be a key catalyst to the Singapore hospitality sector.

“China was Singapore’s largest inbound market from 2017 to 2019. We are hopeful that the substantial pent-up demand from China could replace some of the loss of travel demand from markets which could see some decline in travel as the pent-up demand subsides gradually,” the team writes.

“Based on STB’s latest estimates, Singapore RevPAR is projected to grow beyond 2019 levels in 2023,” it adds.

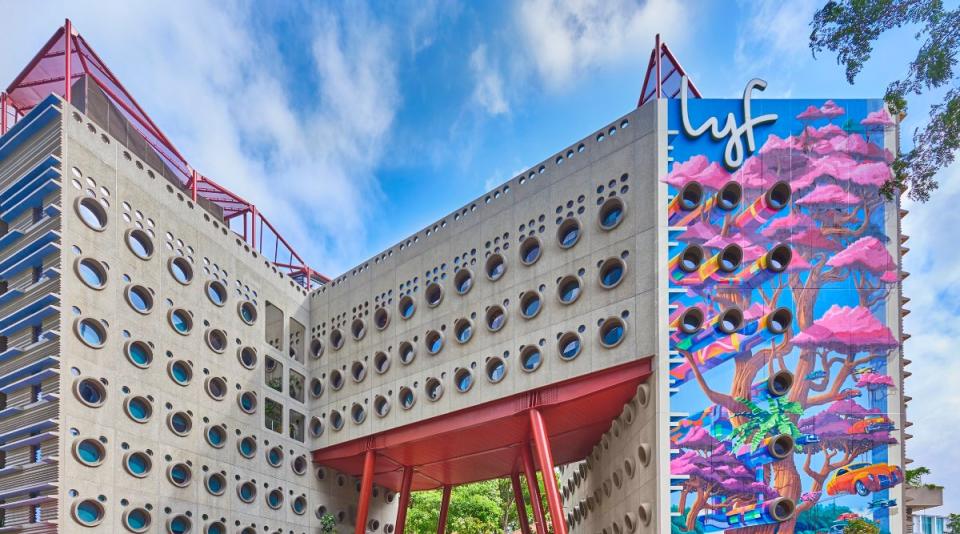

Among the Singapore hospitality REITs under its coverage, Ascott Residence Trust (ART) remains the team’s top pick within the sub-sector.

“With a geographically diversified portfolio and range of lodging assets, ART could continue to benefit from a recovery in the hospitality sector while its stable income sources (from master leases, management contracts with minimum guaranteed income or MCMGI, rental housing and student accommodation properties) could provide income stability against any downside risks,” the team writes.

ART’s stable income sources made up around 68% of its gross profit in the 1HFY2022 ended June.

“While ART has [around] 18% of assets in Europe which could face higher recession risks, its properties in Europe operate under either master lease arrangements with fixed rents or MCMGI, providing some forms of income protection,” the team adds.

The OCBC team has given ART a “buy” call with a fair value estimate of $1.29.

Units in ART closed flat at $1.08 on Sept 20.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Did bullish outlook derail privatisation of Frasers Hospitality Trust?

Some office and retail S-REITs could rebound, but expect a 'fear of recession' ahead: DBS

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance