OCBC announces key leadership changes for Greater China business

The new appointments will take effect from Nov 1.

OCBC, on Oct 18, announced several key leadership changes. The changes, which see seasoned OCBC bankers taking on expanded roles, are said to continue enhancing the bank’s Greater China coverage.

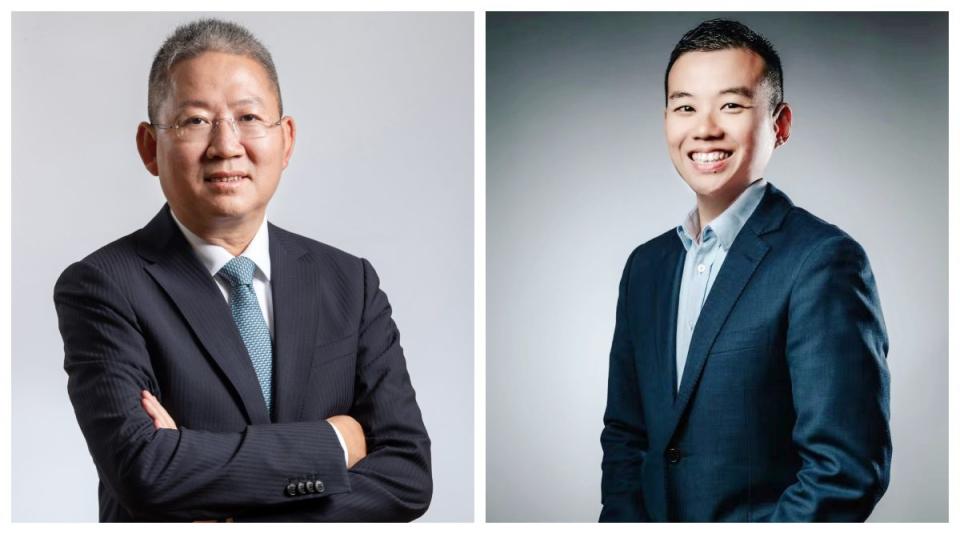

Wang Ke, who is currently the CEO of OCBC Wing Hang China, will become the bank’s head of Greater China. He succeeds Tan Wing Ming to the role. Tan will return to Singapore as an adviser to the group CEO, Helen Wong.

Ang Eng Siong, who is currently the deputy president and head of corporate banking at OCBC Wing Hang China, will become OCBC Wing Hang China’s acting CEO. His appointment will be formalised once regulatory approval is obtained.

Both Wang and Ang’s appointments will take effect on Nov 1.

Wang joined the OCBC group in 2012 as the head of IT in China. He then expanded his responsibilities to include operations in 2014. He was appointed the head of Pearl River Delta region in 2017, then assumed the position of CEO of OCBC Wing Hang China in 2019. Under his tenure, Wang oversaw the building up of critical technology infrastructure and capabilities and led OCBC Wing Hang China to see its profit more than double since 2019.

Ang has also been with OCBC for a long time, beginning in 2009. He spent six years in Singapore before moving to China in 2015 as part of the bank’s talent development programme. Ang was appointed China’s chief risk officer in 2018 and head of corporate banking in 2022. During his time there, he was said to have built a resilient risk management architecture to support the growing franchise.

Tan has been with OCBC for 18 years with his first role being the country head of OCBC’s China branch. He was later appointed as the regional general manager of North East Asia in 2009, and was later tasked to set up and lead the Greater China division in 2021. Since then, Tan has enlarged OCBC’s share of the Asean-Greater China trade and investment flows by building up its transaction banking capabilities and developing new collaboration channels.

“I am pleased that our deep internal talent pool has provided the best candidates for these senior Greater China appointments. It affirms our commitment to nurturing homegrown talent and providing avenues for career progression and mobility. Wang Ke and Eng Siong are valuable contributors to the OCBC franchise. I am confident that, in their expanded roles, they will further advance OCBC’s strategic priorities in Greater China,” says group CEO Wong.

“Wing has created synergistic values by harnessing the OCBC One Group strengths and capabilities. He has built an effective Greater China platform that will propel OCBC to the next phase of growth. I am glad that Wing is staying on as an adviser,” she adds.

As at 9.56am, shares in OCBC are trading 6 cents lower or 0.46% down at $13.01.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

OCBC private bank to sustain hiring push despite China slowdown

Brokers' Digest: OCBC, Delfi, CDL, Raffles Medical Group, UOL, Singtel, ESR-LOGOS REIT

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance