NuScale Power Corp (SMR) Reports Increased Revenue and Widened Net Loss in 2023

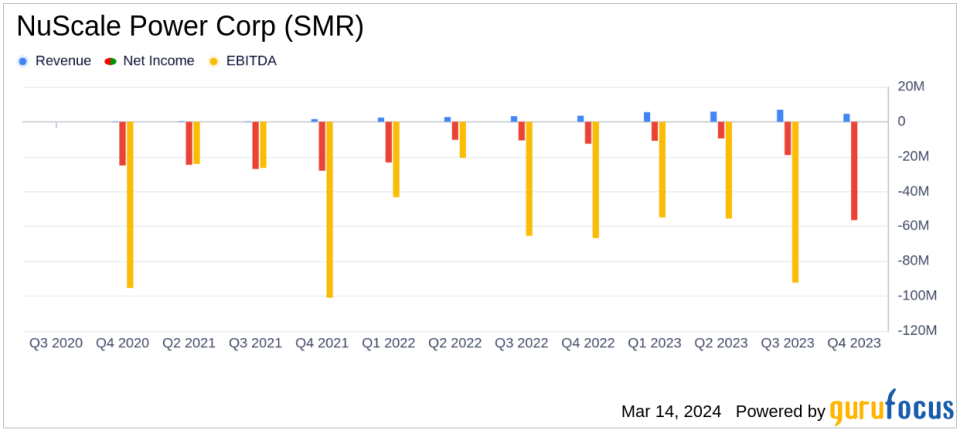

Revenue Growth: NuScale Power Corp (NYSE:SMR) reported a revenue increase to $22.8 million for the full year 2023, up from $11.8 million in 2022.

Net Loss: The company experienced a net loss of $180.1 million for the year, compared to a net loss of $141.6 million in the previous year.

Cost Efficiency Measures: NuScale announced initiatives expected to save $50-60 million annually, aiming to streamline operations and focus on commercial opportunities.

Cash Position: The balance sheet shows cash and equivalents of $125.4 million, with no debt.

Commercialization Progress: NuScale continues to make strides in commercializing its SMR technology, with the NRC reviewing its Standard Design Approval application.

On March 14, 2024, NuScale Power Corp (NYSE:SMR), a pioneer in the development of modular light water reactor nuclear power plants, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, which focuses on providing energy solutions for electrical generation and other applications, reported a year of significant advancements in its small modular reactor (NYSE:SMR) technology, despite facing a widened net loss.

Financial Performance and Strategic Developments

NuScale Power Corp (NYSE:SMR) reported a revenue of $4.6 million for the fourth quarter of 2023, an increase from $3.4 million in the same period of 2022. For the full year, revenue nearly doubled to $22.8 million from $11.8 million in the previous year. However, the net loss also increased, reaching $56.4 million for the quarter and $180.1 million for the year, compared to $47.2 million and $141.6 million, respectively, in 2022.

The company's balance sheet remains robust with $125.4 million in cash and equivalents, of which $5.1 million is restricted, and no debt. In January 2024, NuScale announced a resource optimization plan projected to yield $50-60 million in annualized savings. This strategic move is designed to reduce expenses and better position the company commercially and financially, focusing on immediate commercial opportunities and revenue-generating projects.

Operational Highlights and Industry Impact

NuScale Power Corp (NYSE:SMR) has made notable progress in its commercialization efforts, including the initiation of manufacturing for the NuScale Power Modules and the selection of its technology by Standard Power for two SMR-powered facilities in Ohio and Pennsylvania. These facilities are expected to produce nearly 2 GW of clean energy. The company's Standard Design Approval application for an uprated 77 MWe module design was accepted for review by the U.S. Nuclear Regulatory Commission (NRC) in July 2023, with a 24-month review process anticipated.

The company's advancements in SMR technology are critical for the Industrial Products industry, as they offer a path to reliable, carbon-free baseload energy. NuScale's progress positions it as a global leader in commercial SMR development, with potential applications in electrical generation, district heating, desalination, hydrogen production, and other process heat applications.

Looking Ahead

As NuScale Power Corp (NYSE:SMR) continues to navigate the complexities of the nuclear energy market, its focus on strategic cost optimization and commercialization of its SMR technology is expected to play a pivotal role in its long-term success. The company's efforts to secure new orders and advance revenue-generating projects will be crucial in the coming years, especially as it maintains its position as the first and only SMR to receive U.S. NRC design approval and certification.

Investors and industry observers will be closely monitoring NuScale's progress, particularly in light of the increasing demand for clean and reliable energy solutions. The company's ability to capitalize on its technological advancements and navigate the lengthy sales and development cycles will be key factors in its financial performance and industry impact.

For more detailed information on NuScale Power Corp (NYSE:SMR)'s financial results and operational updates, interested parties are encouraged to join the conference call or access the webcast as detailed in the company's earnings release.

Explore the complete 8-K earnings release (here) from NuScale Power Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance