NUS real estate survey points to improving market sentiment among industry leaders

A survey respondent cited “healthy household balance sheets and the prevailing low unemployment level” as factors that would continue to support demand and prices in the housing market. (Picture: Samuel Isaac Chua/The Edge Singapore)

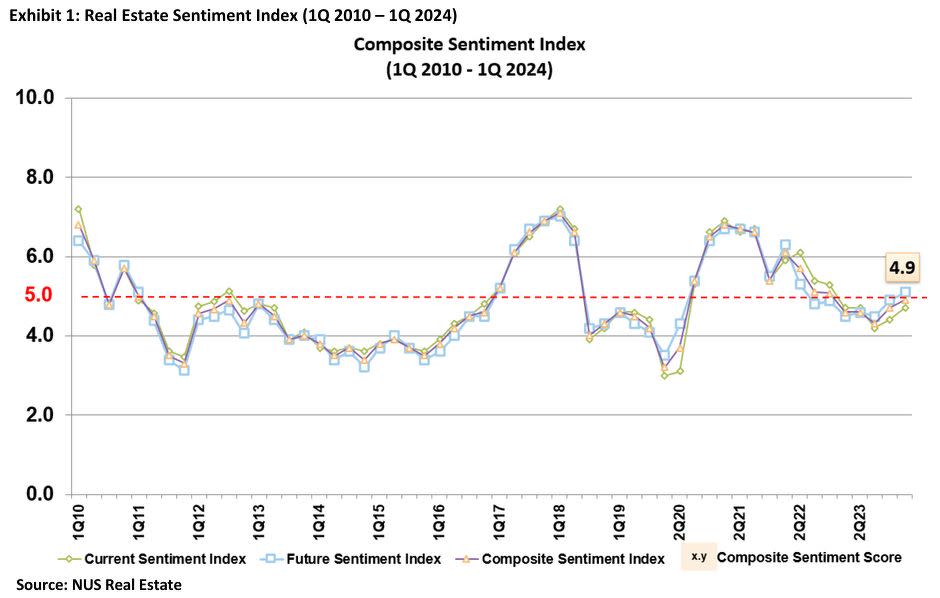

According to the latest Real Estate Sentiment Index (RESI) published by the National University of Singapore (NUS), the first three months of this year saw sentiment in the local real estate market improve after turning the corner in the last quarter of 2023.

The quarterly market survey is produced by the university’s Department of Real Estate and the Institute of Real Estate and Urban Studies. The survey is based on the sentiments of senior executives of real estate firms. RESI comprises a Current Sentiment Index and a Future Sentiment Index, tracking changes in market sentiments over the past and the next six months respectively.

In 1Q2024, the current sentiment index increased to 4.7, up from 4.4 in the preceding quarter. Meanwhile, the future sentiment index rose above the neutral score of 5.0, for the first time in five consecutive months, to reach 5.1.

“Overall, Singapore’s macroeconomic indicators are holding up well, which, barring unforeseen shocks, point to a healthy economy that could recover over the year ahead,” says Professor Qian Wenlan, director of the NUS Institute of Real Estate and Urban Studies.

She adds that a strong Singapore dollar has also helped to ease inflation. “In March, core inflation eased to 3.1% y-o-y, down from 3.6% in February, while headline inflation slowed to 2.7% y-o-y in March from the 3.4% recorded for February”.

A survey respondent cited “healthy household balance sheets and the prevailing low unemployment level” as factors that would continue to support demand and prices in the housing market.

NUS reported that in 2023, the net worth of households grew by 8.9% to reach $2.80 trillion, up from $2.57 trillion a year ago, while the unemployment rate stayed low at about 2% in tandem with the declining rate of retrenchments in 1Q2024.

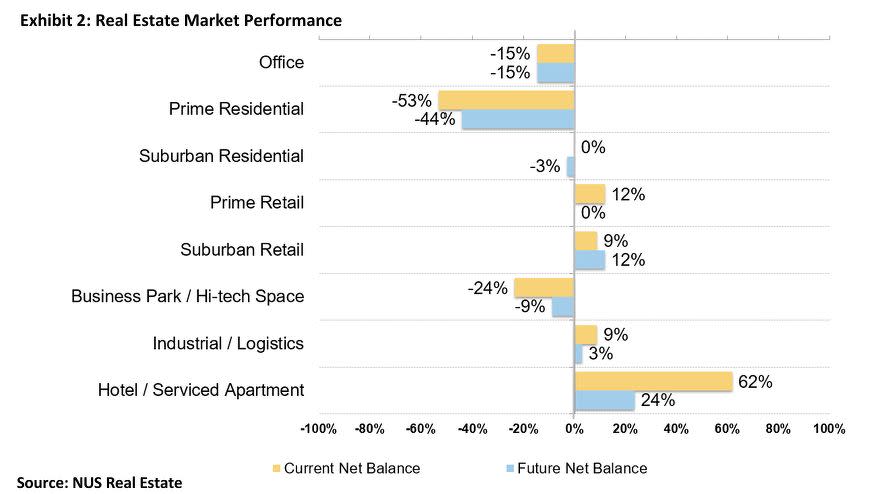

Real estate industry leaders continue to cast an overwhelmingly positive outlook towards the local hotel and serviced apartment segment, followed by a relatively milder outlook towards the suburban retail sector. On the other hand, survey respondents had a poor outlook on the general performance of the prime residential market.

In addition, 73.5% of the respondents in the 1Q2024 survey indicated that a slow-down or decline in the global economy was the top potential risk that may adversely impact sentiments over the next six months, a considerable decrease from 90% in the 3Q2023.

Read also: Prolonged Inflation and elevated interest rates continue to dampen sentiments, says NUS Real Estate

“Economic recovery is an important factor in the health of the property market. We are (also) concerned with potential oversupply of residential apartments as the Government ramps up Government Land Sale (GLS) supply over the last few quarters. Potential cooling measures is always a concern,” cited one survey respondent.

About 29.4% of the respondents raised concerns regarding increased development land supply, increasing from 23.7% in the last quarter.

Job losses and a decline in the domestic economy continued to rank as the second highest area of concern at 55.9%, which decreased slightly from 57.9% in the last quarter. Rising inflation and interest rates followed at 50.0%, increasing from 44.7% in 4Q2023.

Meanwhile, the risk of government intervention in the market and a real estate price bubble ranked the lowest at 11.8% and 2.9%, respectively.

Looking ahead, about 22.2% of the developers surveyed expected unit prices of new launches in the next six months to be moderately higher, falling from 42.9% in 4Q2023. On the other hand, 72.2% expected new launch prices to maintain at the same price level, a sizeable increase from 47.6% in the last quarter.

The remainder (5.6%) expect unit prices to be moderately lower.

“Home buyers have become more resistant to high price points and discerning amid ample new project options. While developers are expected to adopt sensitive pricing strategies, major price corrections are unlikely due to previously committed land and development costs,” says a survey respondent, adding that healthy household balance sheets and the prevailing low unemployment level are also expected to continue to support demand and prices.

Read also: NUS SRPI: Private non-landed private residential price Index up 0.3% m-o-m in November

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Prolonged Inflation and elevated interest rates continue to dampen sentiments, says NUS Real Estate

NUS SRPI: Private non-landed private residential price Index up 0.3% m-o-m in November

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance