Northwest Pipe's (NASDAQ:NWPX) investors will be pleased with their 30% return over the last five years

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market. But Northwest Pipe Company (NASDAQ:NWPX) has fallen short of that second goal, with a share price rise of 30% over five years, which is below the market return. Over the last twelve months the stock price has risen a very respectable 13%.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Northwest Pipe

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Northwest Pipe actually saw its EPS drop 0.8% per year.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 15% per year is probably viewed as evidence that Northwest Pipe is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

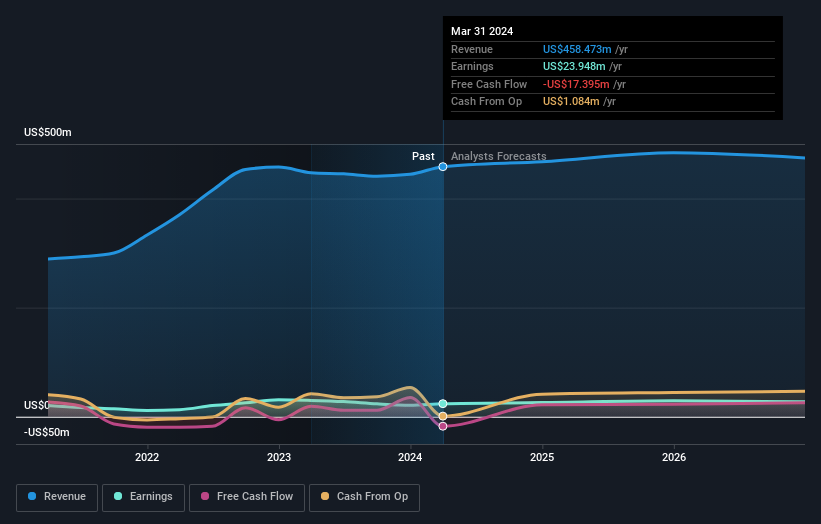

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Northwest Pipe's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Northwest Pipe shareholders gained a total return of 13% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 5% per year over five year. This suggests the company might be improving over time. Before deciding if you like the current share price, check how Northwest Pipe scores on these 3 valuation metrics.

Of course Northwest Pipe may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance