Noel Building on Tai Seng sold for $81.18 million, 17% above the guide price

The eight-storey Noel Building at 50 Playfair Road (Photo: Edmund Tie & Co)

SINGAPORE (EDGEPROP) - Just over a month after it was put up for sale by tender, Noel Building at 50 Playfair Road was sold for $81.18 million. The sale price is a 17% premium above the guide price of $70 million indicated by marketing agency Edmund Tie & Co. when the eight-storey building was launched for sale last month.

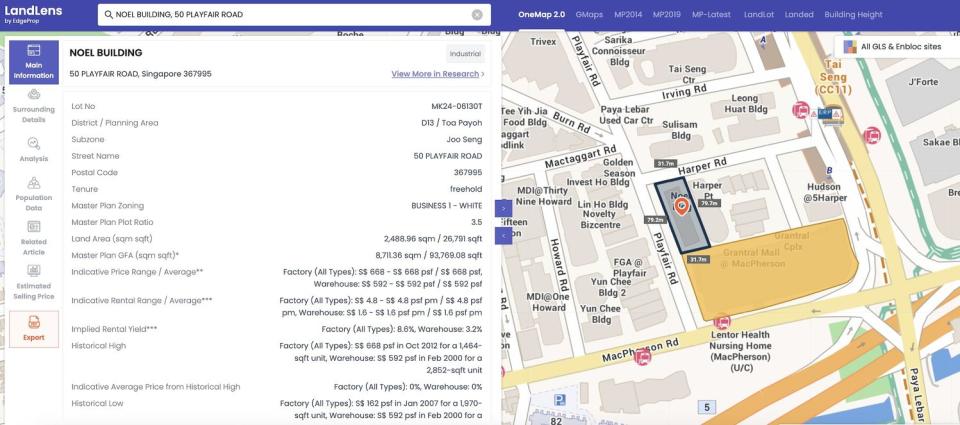

Located at the corner of Playfair Road and Harper Road, the 26,792 sq ft, freehold site is zoned for ‘Business 1 – White” use, which is “very rare”, according to Swee Shou Fern, head of investment advisory at Edmund Tie & Co., who brokered the sale. The site has a plot ratio of 3.5 and can be redeveloped into a new building with a maximum gross floor area of 93,771 sq ft. Hence, the purchase price of $81.18 million translates to $895 psf per plot ratio.

"The tender exercise for the site was hotly contested, attracting overwhelming interest from developers, end-users and investors, both local and foreign alike," says Swee. "Some of these parties were looking to redevelop the site for food-factory use or a mixed industrial complex with a commercial component, while owner-occupiers were looking to develop the site for their corporate headquarters."

Read also: Villa Des Flores up for collective sale at $180 mil

The freehold site is zoned for 'B1 industrial - white 'use, which is rare (Source: EdgeProp Landlens)

The building on Playfair Road is within the Tai Seng Business Hub, where prominent buildings include the BreadTalk IHQ, Grantral Mall @ MacPherson and 18 Tai Seng, with F&B, banking and lifestyle amenities as well as 400m from the Tai Seng MRT station.

The building's strata-titled owners at Playfair Road are expected to receive gross sale proceeds of between S$1.65 million and S$6.22 million per unit.

"The positive tender outcome is indicative evidence of investors' sustained strong confidence in the Singapore real estate market, particularly in properties with robust attributes," says Swee.

Rajah & Tann was the lawyer for the collective sale.

This latest transaction is the third collective sale brokered by Edmund Tie in 2023. In February, the firm sold Meyer Park for $392.18 million to a joint venture between UOL Group and Singapore Land Group, followed by the sale of GS Building on Lorong Ampas to boutique developer JVA Venture for $67 million.

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Lee Yeow Seng of Malaysia’s IOI Properties Group to buy Shenton House for $538 mil

Owners of High Street Centre make second collective sale attempt at $748 mil

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance