Ningbo Solartron TechnologyLtd Leads Three Growth Companies With High Insider Ownership On Chinese Exchange

Amidst a backdrop of fluctuating global markets, China's equities have experienced notable pressures, with deflationary trends and consumer caution weighing heavily on the economic landscape. In such an environment, growth companies with high insider ownership, like Ningbo Solartron TechnologyLtd, may offer a unique investment perspective as these insiders often have a vested interest in the company’s long-term success.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningbo Solartron TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Solartron Technology Co., Ltd. specializes in researching, developing, producing, and selling functional films both domestically and internationally, with a market capitalization of approximately CN¥3.74 billion.

Operations: The company generates revenue primarily through its special functional film segment, amounting to CN¥1.32 billion.

Insider Ownership: 16.4%

Earnings Growth Forecast: 40.2% p.a.

Ningbo Solartron Technology Co., Ltd. has shown strong growth prospects with earnings forecasted to increase by 40.2% annually, outpacing the Chinese market's average. However, recent financial results indicate a decline in net income and profit margins, with Q1 net income dropping to CNY 8.23 million from CNY 24.93 million year-over-year, despite a rise in revenue to CNY 313.74 million from CNY 250.82 million. The company is also engaging in strategic financial activities like a significant private placement and share buybacks totaling CNY 49.99 million, reflecting confidence from management but also signaling potential dilution or shifts in shareholder structure which could impact insider ownership dynamics.

SDIC Intelligence Xiamen Information

Simply Wall St Growth Rating: ★★★★★☆

Overview: SDIC Intelligence Xiamen Information Co., Ltd. operates in the technology sector, focusing on software and information services, with a market capitalization of approximately CN¥10.58 billion.

Operations: The company generates its revenue primarily from software and information services.

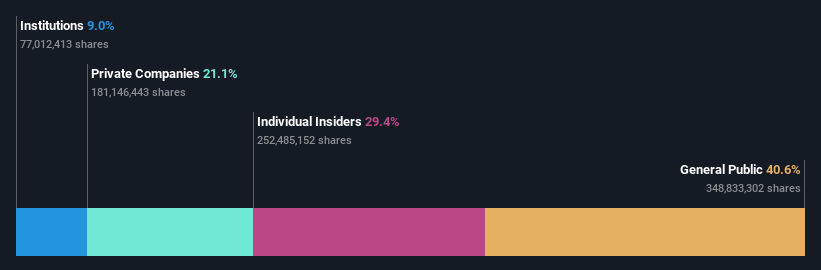

Insider Ownership: 29.4%

Earnings Growth Forecast: 65% p.a.

SDIC Intelligence Xiamen Information has faced challenges with a significant net loss reduction from CNY 167.37 million to CNY 34.12 million year-over-year, showing some recovery despite a decrease in annual revenue from CNY 2.28 billion to CNY 1.98 billion. The company is expected to become profitable within three years, with projected revenue growth at 29.1% annually, outpacing the Chinese market's average of 13.9%. However, its forecasted return on equity remains low at around 5.8%, suggesting potential concerns about future profitability and efficiency.

POCO Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in developing, producing, and selling alloy soft magnetic powders and cores, along with related inductance components for electronic equipment users, with a market capitalization of CN¥12.20 billion.

Operations: The company generates revenue primarily from its electronic components segment, amounting to CN¥1.20 billion.

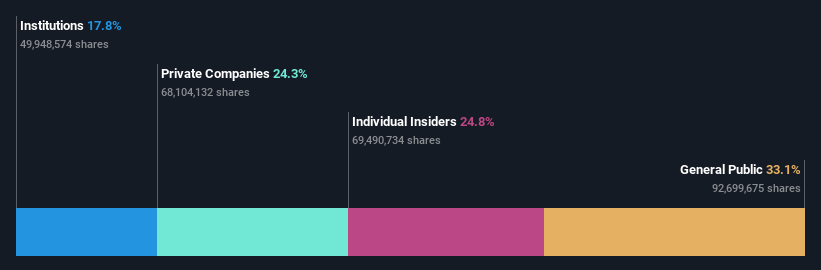

Insider Ownership: 24.8%

Earnings Growth Forecast: 28.0% p.a.

POCO Holding, a Chinese firm with significant insider ownership, reported a robust year with sales reaching CNY 1.16 billion and net income of CNY 255.6 million. Its quarterly performance also showed strong growth with revenue up to CNY 335.06 million from CNY 290.65 million last year. The company's earnings are expected to grow by approximately 28% annually, outpacing the Chinese market prediction of 22.7%. Despite these positives, its forecasted Return on Equity in three years is relatively low at about 18%, signaling potential efficiency issues ahead.

Summing It All Up

Click through to start exploring the rest of the 359 Fast Growing Chinese Companies With High Insider Ownership now.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688299 SZSE:300188 and SZSE:300811.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance