Nike: The Contrarian Trade of 2024

Everyone around the world knows about Nike Inc. (NYSE:NKE). The American sportswear company has built a solid brand that is considered reliable and is regularly used by top athletes. Its presence is well implemented in many markets with a diversified partnership network.

And yet, the stock has underperformed the broader market in each of the last three years. Returns for Nike were 18% in 2021, -30% in 2022 and -12% in 2023. If we compare with the S&P 500, its returns were 27% in 2021, -19% in 2022 and 24% in 2023. Nike has clearly been underperforming its index.

Further, the stock dropped on the last trading day before Christmas by approximately 12% on the back of disappointing third-quarter earnings and a grim 2024 outlook, breaking a little bit more the already poor morale of long-term investors. Despite the negative news, UBS reiterated at the end of December its buy rating on Nike with a $138 target.

A closer look at earnings

Nike's earnings report disappointed investors for a third quarter in a row, with revenue coming in below expectations. Chief Financial Officer Matthew Friend explained on a call with analysts that the adverse headwinds the company is facing include currency risk due to a strong dollar, making exports from the U.S. less competitive, and consumer weakness, particularly in China, where it generates around 15% of its revenue.

While the Oregon-based company's earnings of $1.03 per share exceeded analysts' estimates of 85 cents, revenue of $13.39 billion was short of the projected $13.43 billion.

Additionally, Nike slashed its outlook for 2024 as China's economy struggles to reaccelerate and as the high federal funds rate is keeping the dollar strong, putting downward pressure on revenue. The revenue growth is expected to decline 1%, which is down from the previous guidance of around 5% growth.

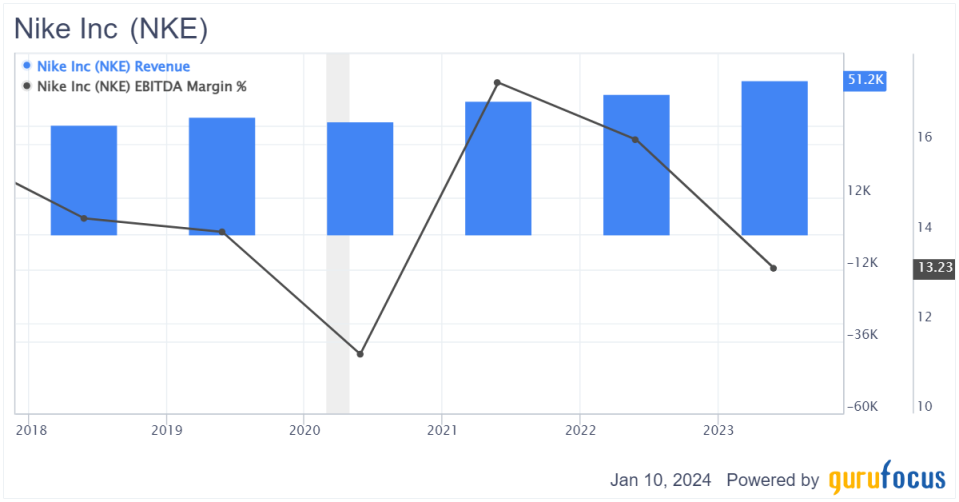

Looking at the financials, however, not everything is grim. Taking the last five years into consideration, Nike's revenue has climbed, on average, at a 7.1% growth rate. Ebitda margins, on the other hand, do not have a clear long-term trend and the restructuring plan announced during the earnings call will aim at rectifying that.

NKE Data by GuruFocus

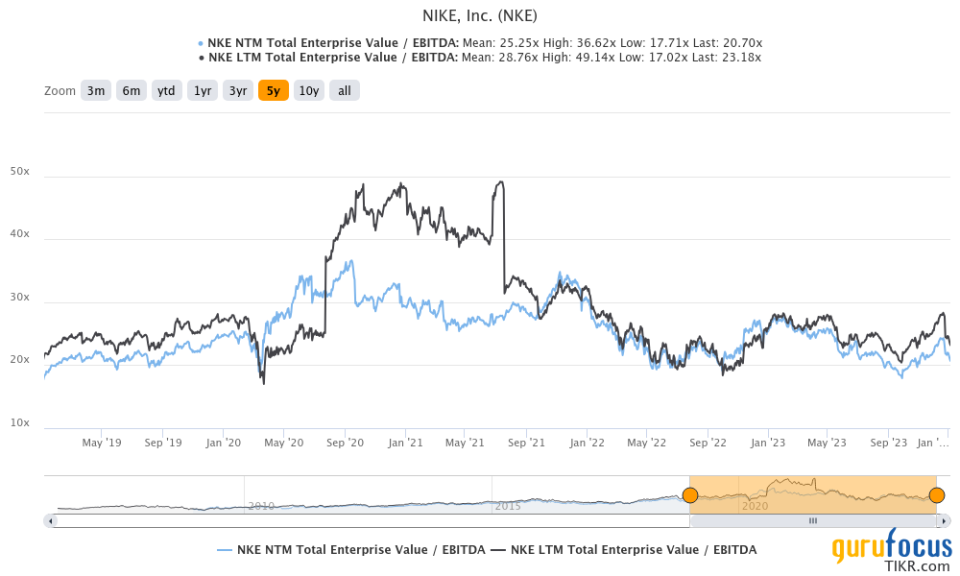

On the valuation side, we can clearly see the stock is on the cheaper end with enterprise value/Ebitda in the lower 20s.

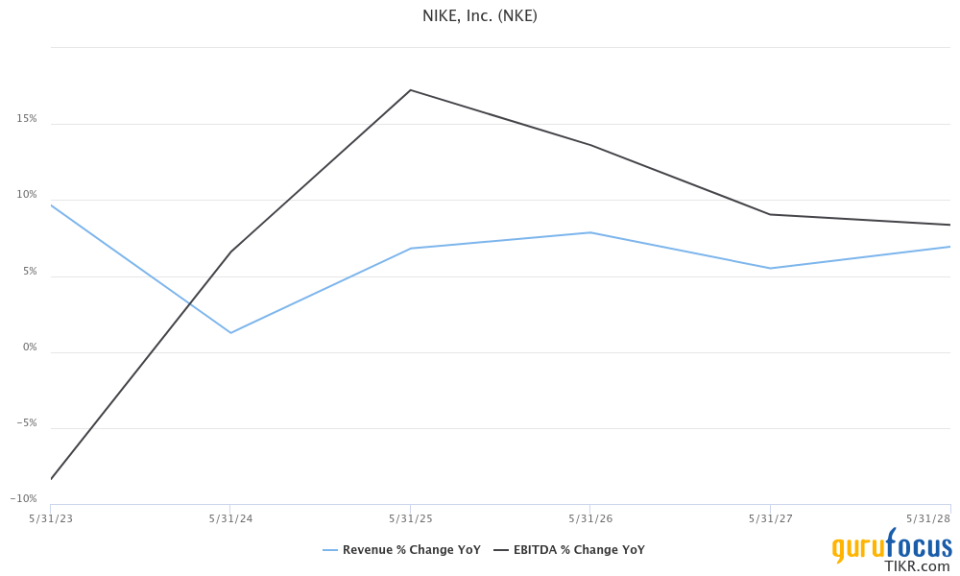

Last but not least, forward estimates indicate stable revenue growth and, more importantly, an increased efficiency at Nike with solid Ebitda growth after its restructuring.

Nike could outperform in the next three years

Purely from a corporate level, there is one big argument in favor of a turnaround: Nike's announced cost-cutting plan is a restructuring plan similar to the ones applied by some of the big tech companies such as Meta Platforms Inc. (NASDAQ:META) that has proven to be beneficial.

Essentially, Nike has announced plans to slash $2 billion of expenses in 2024. The initial reaction of investors was obivously the fear that this initiative will reduce investments in growth, new product lines, improving the supply chain or expanding into promising markets such as India and the Middle East.

However, looking into the different lines of the plan, it becomes clear that none of the latter is compromised. The plan will lead to a large restructuring that will initially cost around $400 millon to $450 million to implement and will actually simplify the corporate structure by significantly reducing the number of management layers and divisions, as well as increasing internal efficiency. To any investor, this plan is a welcome turnaround hope of a well-known brand that has the logistics, the network and the media attention to continue growing in existing markets and expand into new ones.

Additionally, there are several macro tailwinds awaiting the company. The obvious one is the likely Federal Reserve rate reduction (at least three rate cuts are expected this year per the fed dot plot), which could lead to a U.S. consumer demand uptick as interest rates drop. It would also make debt financing cheaper for Nike, though it has a net debt-to-EBITDA close to zero. On the other side of the Pacific, with China likely having to stimulate its economy aggressively, a quantitative easing program by the People's Bank of China could spark an intense buying spree among Chinese consumers.

Conclusion

Nike has had a couple of difficult years, with the most recent quarters being rather challenging, to say the least. And yet, given the solid brand name, the reliable supply chains and the established partnerships, the company has potential to return to a path of high growth. 2024 has several macro tailwinds in store for the athletic footwear and apparel sector, and if Nike successfully implements its ambitious restructuring plan, then it will likely remain one of the sector leaders and catch up on its performance.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance