NICE (NICE) Hits a Count of One Million Agents on CXone

NICE NICE is riding on a strong product portfolio that includes CCaaS, conversational AI, automation, workforce engagement and CXone.

CXone adoption has been strong in recent times. The company recently announced that CXone now has more than one million agents and supervisors using the full breadth of its functionality.

CXone is a CX native cloud platform that enables leading organizations to offer a seamless CXi experience to customers by utilizing digitalization, AI and automation.

Integrating Nice’s CXone with Open-AI’s generative modeling creates the industry’s first Chat-GPT-enabled conversational CX. This enables consumers to resolve issues with human-friendly automated customer service.

Earlier this month, CXone was adopted by New Zealand Telehealth Services, allowing them to achieve greater insight into its services and deliver frictionless customer experience to support the health of the New Zealand public.

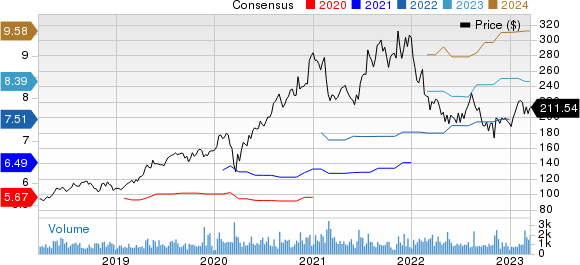

Nice Price and Consensus

Nice price-consensus-chart | Nice Quote

LanguageLoop, Australia’s leading language translators and interpreters, have also adopted Nice’s CXone to seamlessly automate their call interactions and connect customers with available interpreters.

CXone was adopted by Penrith City Council, a telephony contact center allowing it to focus on the types of calls and interactions it receives. CXone enables the council’s contact center team to easily identify areas for improvement, thereby allowing coaches and team leaders to manage the workforce.

Expanding Partnership’s to Aid NICE’s Prospects

Nice is riding on an expanding partner base and frequent customer wins. Its partnership with Alphabet GOOGL, Microsoft MSFT and Cognizant CTSH has been aiding in the growing adoption of CXone.

Nice’s partnership with Cognizant leverages latter’s domain expertise. The combination of Cognizant and Nice’s CXone native cloud platform improves customer experience by bringing hyper-personalized ways for enterprises to engage with their users.

Nice’s partnership with Google and Microsoft has played an important role in defining the former’s growth trajectory.

Integration of CXone with Google cloud CCAI empowered businesses to offer more sophisticated ways to help customers with smarter service and AI-enhanced assistance.

Moreover, the collaboration with Microsoft to deliver the power of CXone on Azure created frictionless and cohesive customer service interaction.

The expanding availability of Nice’s products on different platforms is helping it win customers frequently, driving the company’s long-term growth.

What awaits NICE’s Shares in 2023?

Nice’s shares have lost 1.2% in the past year, primarily due to challenging macroeconomic conditions and raging inflation. Reversal of pandemic trends has also hurt NICE’s prospects.

However, NICE has outperformed the Zacks Computer and Technology sector that has declined 13.6% over the same time frame.

The outperformance can be attributed to the strong demand for NICE’s cloud-based solutions, expanding partner base and innovative product pipeline.

These factors helped NICE report a 10% year-over-year revenue increase in fourth-quarter 2022.

Nice’s cloud revenues increased 26% year over year to $358.9 million.

Moreover, this Zacks Rank #3 (Hold) company’s earnings of $2.04 per share increased 18% year over year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For the first quarter of 2023, NICE expects revenues between $559 million and $569 million. Earnings are pegged in the range of $1.92-$2.02 per share.

Nice raised its guidance for 2023. It expects total revenues between $2.345 billion and $2.365 billion, representing 8% growth over 2022. Earnings are pegged in the $8.28-$8.48 per share range, representing 10% growth at the midpoint over 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis Report

Nice (NICE) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance