Netflix (NFLX) Boosts Content Portfolio With New Episodes

Netflix NFLX releases new episodes of its first Brazilian children’s entertainment series, The Nutty Boy, on Apr 6.

The Nutty Boy is an animated comedy series that showcases the life of an out-of-the-box kid with big ideas and a positive mindset who loves involving everyone in his adventures.

The first season, which premiered on October 2022, had an ambivalent ending. The series is an adaptation of a Brazilian classic children’s book with the same title written by Ziraldo. It’s produced by Chatrone for Netflix and directed by Beto Gomez and Michele Massagli. Gustavo Suzuki is the lead writer for the show.

Apart from The Nutty Boy, Netflix offers a slate of animated shows designed for kids, like The Cuphead Show!, Sharkdog, He-man and the Masters of the Universe and Jurassic World: Camp Cretaceous.

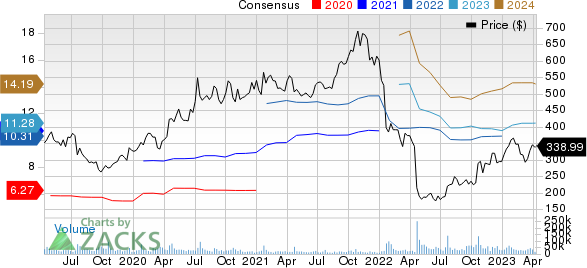

Netflix, Inc. Price and Consensus

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

Strong Content Portfolio to Aid Netflix’s Prospects

Netflix Animation, a subsidiary of Netflix, offers a wide range of animated programs and feature films for children, diversifying its content portfolio and expanding its viewer base.

Netflix has made progress in adding a huge range of styles, genres and themes and is now pivoting toward multilinguistic content streaming in over 190 countries, supporting 20 languages.

It continues to serve a wider demography by producing original content with regional creators, writers, cast and production teams, reflecting its values toward diverse cultures.

Netflix is expected to continue dominating the streaming space with its diversified content portfolio and its customer-centric focus. It also started diversifying its portfolio with its mobile games range, with a stack of more than 50 games spanning across genres.

Its global paid subscriber base in fourth-quarter 2022 increased by 4% year over year to 230.75 million.

Netflix’s revenues increased 1.9% year over year in fourth-quarter 2022, thanks to strong diversification in its content.

Netflix Suffering from Stiff Competition

Netflix shares have grown 15% year-to-date, outperforming the Zacks Consumer & Discretionary sector, which gained 8.6% over the same time frame.

This outperformance can be explained by its diversified content portfolio and expanding game portfolio, which is attributable to heavy investments in the production and distribution of multilinguistic content.

However, Netflix has been suffering from stiff competition from the likes of Disney DIS, Warner Bros. Discovery WBD and Paramount Global PARA. These companies have followed the footsteps of Netflix to compete on a large scale.

NFLX shares have underperformed Disney, Warner Bros. and Paramount shares, which have risen 16.1%, 62.5% and 32.1% year to date, respectively.

The underperformance is largely due to a saturated market with service offerings from major media conglomerates, challenging macroeconomic conditions, service disruptions and production risks.

Netflix launched its low cost ad-supported video-on-demand model in the United States on Nov 3 but failed to gain user Interest.

In fourth-quarter 2022 the global subscriber base net additions for Netflix have been 7.66 million, whereas Disney+ Core, Warner Bros., and Paramount added 1.4 million, 1.1 million and 9.9 million subscribers, respectively.

Netflix expects to see accelerating revenue growth in 2023 through rolling out paid sharing model and improvements in its newly launched ad delivery service. Its strong content and games portfolio shall help it win new subscribers.

This Zacks Rank #3 (Hold) company expects first-quarter 2023 earnings of around $2.82 per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

For the first quarter of 2023, Netflix expects revenues to increase 3.9% year-over-year to around $8.17 billion.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $8.18 billion, indicating 3.92% growth from the year-ago quarter’s reported figure.

The consensus mark for first-quarter 2023 earnings remained unchanged at $2.81 per share in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance