Nelson Peltz is still trying to get seats on Disney’s board–but Bob Iger is no easy target for the activist investor’s 25th attempt to take control of the company

Immediately after the Disney board returned Bob Iger as its savior in November 2022, before the freshly returned CEO even had time to lead an employee town hall, one of the first things Iger did as CEO was to answer a call from Nelson Peltz, who was complaining that Iger was already doing a lousy job.

What could have irked Peltz so quickly? The answer soon became clear. Recent SEC proxy filings make clear that within three days of Iger taking the job, Peltz was already demanding a board seat and threatening to run a proxy contest. Like a villain in a classic Disney film, Peltz’s motives seemed to be motivated by vanity rather than strategy.

Diplomatically, Iger asked Peltz if he might be willing to agree to a mutually acceptable independent director to add to the board, similar to how Disney added Carolyn Everson, the highly regarded former Instacart president, to the board that summer at the recommendation of another prominent activist, Dan Loeb at Third Point.

Peltz swatted away that suggestion, as well as other potential compromises he claims Disney floated such as giving him board observer status or an advisory agreement, responding that he refused to accept anything other than a board seat for himself, without providing any other actionable ideas besides his own board candidacy.

This conversation, dated Nov. 23, 2022, was merely one of a whopping 24 instances when Peltz demanded a board seat for himself from Disney for three years running now. But this long-running saga (now bordering on a tragicomedy) is finally winding towards the grand finale, as the Disney Annual Meeting approaches in early April. Shareholders will cast their votes for either the nominees endorsed by Disney, or for Peltz and his sidekick, former Disney CFO Jay Rasulo, who left Disney a decade ago as the apparent loser of a bitter power struggle, openly complaining about a “broken heart” when he was passed over. There is another activist slate of nominees put forward as well, though that activist holds only a trivial $5 million stake in Disney and their slate is not expected to receive much support.

This week is a particularly pivotal moment: Not only does Disney report earnings Wednesday after market close, but it is also the cut-off for voting eligibility, known colloquially as the date of record, so all Disney shareholders who hold stock today will be eligible to vote for the board, with ballots to be sent out within days.

It is distinctly possible that Disney may report disappointing earnings tomorrow, as some analysts expect, given the overhang from the writers' and actors' strike, as well as the overhang of Chapek-era films turning into box office busts. For example, Bank of America’s Jessica Reif Ehrlich predicts, “Q1 earnings lowered to reflect disappointing film performance." Regardless of whether the market overreacts to short-term disappointing news from Disney tomorrow–or whether Disney stock shoots upwards if earnings are great–Peltz’s board bid should be considered on its own merits and not merely in relation to transitory volatility in Disney’s stock price.

As Disney shareholders ourselves, some aspects don’t smell right about Peltz’s claims that he is looking out for shareholder value. Over the course of a five-decade corporate governance career, the first author has seen and informally advised hundreds if not thousands of proxy contests. There are occasional instances when activists can add genuine value and call out genuine misconduct–and then there are instances when activists are motivated by all the wrong reasons.

This Peltz proxy contest is perhaps one of the clearest and most blatantly transparent examples of the latter category that I’ve ever seen. Here are some of the most glaring problems with Peltz’s proxy challenge compared to other proxy contests. As I discussed recently with my friend CNBC Contributor Josh Brown of Ritholtz Wealth Management, these problems do not bode well for Peltz’s chances of success as shareholders cast their ballots.

A consumer and industrial goods and finance maven miscasting himself as Disney’s savior

Usually, when an activist seeks to make changes at a company, they have extensive expertise in that industry. Peltz, by his own admission, has no media experience. He has spent his entire career as a consumer goods operator, turning from frozen food enterprises to Snapple to restaurants and CPG brands.

As we’ve carefully documented before, since establishing Trian Partners as his investment vehicle in 2005, Peltz has dramatically underperformed the S&P 500 by an average of 6% across a majority of the boards he sits on during the entirety of his board tenure–including Wendy's, Unilever, MSG Sports, Mondelez, Sysco, Janus Henderson, Legg Mason, There are no less than 11 examples of significant underperformance if we count companies with a non-Peltz Trian representative on the board, including companies as varied as GE, BNY Mellon, and Family Dollar. Even in companies where Peltz reaped profits, such as Pepsi and P&G, we hear that the CEOs of those companies largely did the opposite of what Peltz advocated, ignoring far-fetched ideas such as moving headquarters to shake things up or decentralizing mergers and acquisitions to individual business units. No wonder Peltz is ironically facing activist challenges of his own at some of his companies. I have been sparring with Peltz for decades across several contests, but the overall track record of his investment returns–or lack thereof–speaks for itself. And he didn’t have much to say in his own defense when we confronted him with these findings.

Clearly, having Peltz on a board seems to be more value-destructive than value-additive. Meanwhile, perhaps thanks to his underwhelming track record, Peltz is shuttering some of his investment funds under pressure from investors, after having enlisted few new major investors and little fresh fundraising the last few years, with even his own son-in-law and second-in-command leaving Trian after decades together.

This track record makes Peltz an unlikely savior for Disney, but what is even more glaring is his lack of fresh ideas for the company, which hints at ulterior motives.

A personal vendetta

That Peltz has asked Disney 24 times for a board seat for himself or that he expressed his dissatisfaction with Iger just three days into his return, may be understandable if Peltz presented compelling ideas on how to face Disney’s many challenges. But is painfully clear from his own brief shareholder letters (speaking of which, where are Peltz’s long-promised Disney white paper and slide deck anyway?) that Peltz has no fresh ideas for how to fix Disney beyond adding himself to the board.

Peltz’s diagnoses of Disney’s key challenges are rather unoriginal. In fact, they are the same exact challenges Iger has identified as his top priorities. Just about everyone agrees that (1) Disney’s creative engine has lost its way with poor-quality movies, (2) Disney+ is losing more money than it should, (3) ESPN/linear TV is challenged by the digital transition to streaming, and (4) prices have gone up in parks. Although Iger has laid out a compelling plan to tackle each of these challenges, Peltz presents no solutions other than vague suggestions to make Disney more like Netflix without explaining how a legacy media business can take that leap. Huh?

The proxy filings fill in the blanks by suggesting what Peltz may really be after: a personal vendetta against Iger.

Peltz’s initial attraction to Disney arose from the efforts of his Palm Beach neighbor, Marvel boss Ike Perlmutter, who feared Iger’s return, to protect then-CEO Bob Chapek during the summer of 2022 despite Chapek’s poor performance and waning board support. Peltz thus pitched himself persistently for a board seat even though he did not own any Disney shares at the time. Peltz’s ally, Perlmutter, had held a grudge against Iger ever since Iger intervened a decade ago to keep Perlmutter from firing his subordinate, Kevin Feige, the creative mastermind behind the Marvel movies.

Peltz and Perlmutter were unsuccessful in persuading Disney’s board to either add Peltz or keep Chapek. In November 2022, Iger returned as CEO and Peltz immediately threatened a proxy contest after finally buying some shares. When Disney reported superb earnings in February 2023, Peltz immediately dropped his challenge and cashed out half his Disney stake.

Later in 2023, apparently left out to dry by allies, Perlmutter’s employment at Disney ended, part of Iger’s $7.5 billion in cost cuts which Peltz had advocated for. After several public laments and broadsides against Iger in the media, in a highly unusual move, Perlmutter then signed over voting control of his own ~25 million shares to Peltz as ammunition for a renewed drive towards getting Peltz on the board, with Perlmutter’s stake now comprising three-fourths of Peltz’s total ~33 million Disney stake (equivalent to ~2% of Disney), Peltz possessing only a small ~8 million share stake himself.

As Bill Cohan has astutely pointed out in Puck, this sordid history of bad blood makes it unlikely that Peltz can influence the direction of the board since even if he wins, he would control only 2 of 12 seats. Combined with the bizarre way Peltz is running this proxy contest, it seems reasonable to surmise that influence over Disney’s future or claims he is looking out for Disney shareholders may be secondary to settling old scores.

Misrepresenting Bob Iger's track record

In his proxy filing, Peltz claims that Iger underperformed the S&P 500–though he blatantly miscalculates Iger’s track record by explicitly including by his own admission, rather than excluding, the years during which Chapek held the CEO seat, from February 2020 through November 2022.

Obviously, Iger was not in control when major strategic missteps were made during that period, including most notably, going too far on streaming by cannibalizing the rest of the company to fill Disney+ with more content than subscribers wanted. If Iger’s returns are correctly calculated through the time he stepped down from his first stint as CEO, he delivered 554% total shareholder returns and created over $200 billion in shareholder value.

Similarly, Peltz claims in his proxy that since Iger returned as CEO in November 2022, Disney has underperformed a basket of "media" peers led by Amazon, Alphabet, Apple, and Meta. This comparison is blatantly ludicrous. Disney is not a Big Tech company, and Big Tech has outperformed virtually every industry amidst a record tech rally. Even the comparison to Netflix that Peltz loves to wield is misleading, given Disney’s significant exposure to legacy businesses in linear TV and theme parks, which Netflix does not have.

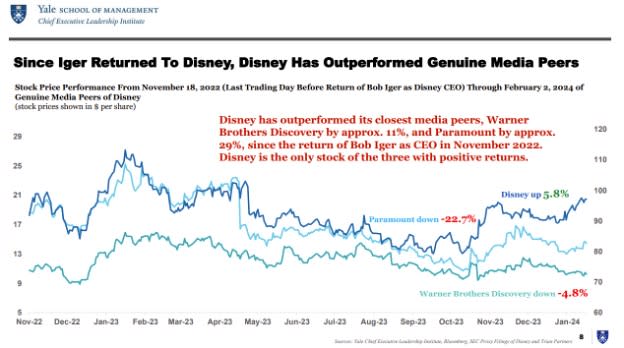

When benchmarked against Disney’s closest peer rivals from the last trading day before Iger returned (Nov. 18, 2022) through Feb. 2, 2024, Disney stock has outperformed all of them healthily as the only stock with positive returns with Disney up ~6%, while Warner Brothers Discovery stock is down ~5% and Paramount stock is down ~23%. Regardless of any short-term volatility in the stock from Disney’s earnings report tomorrow, and although there is still much to do, Iger’s turnaround of Disney is well underway amidst stark industry-wide headwinds.

Peltz also claims that Iger overpaid for the transformative acquisition of 21st Century Fox from Rupert Murdoch in 2019. (An ironic critique, considering the rumors we’ve heard that certain activists were complaining about Disney’s under-leveraged balance sheet at the time.)

That critique does not stack up to basic math. The purchase price of $71 billion was actually considerably less, since Disney immediately sold the regional sports networks to Sinclair for $11 billion (and sold high–Diamond Sports Group, recently declared bankruptcy) and Sky to Comcast for $15 billion (also at peak valuation), bringing the deal price down closer to $45 billion. The 30% stake in Hulu Disney acquired is now worth ~$12 billion, bringing the deal price down closer to $33 billion. The content Disney acquired was well worth the price, with the second Avatar movie alone pulling in over $2 billion at the box office (the third highest-grossing film of all time), while adding priceless franchises such as the Simpsons and National Geographic to Disney’s content library, as well as exposure to India. That’s on top of Disney actualizing $3 billion in cost cuts and synergies. If one puts a highly conservative 6x or 7x valuation multiple on those immediate earnings and cost savings, the deal has already paid for itself several times over.

In a CNBC interview, Peltz also blamed Iger for the fact that Disney has lost money on its last five movies–ignoring the fact those projects were either greenlit or largely produced during the anything-flies Chapek era. Peltz’s solution, transferring oversight of the creative process from Iger to a Peltz-led board, is hard to justify. Much like Chapek when he took the job, Peltz has never made a film in his life. During Chapek’s entire time as CEO, not a single Disney movie released under his watch crossed $1 billion in gross box office revenues. High-budget, highly hyped busts include Black Widow in 2021, as well as Encanto, Thor Love and Thunder, Pinocchio, and Black Panther: Wakanda Forever in 2022. Meanwhile, in 2019 alone, his last full year as CEO, Iger oversaw seven films cross the $1 billion box office threshold, with Disney producing 11 of the 12 biggest box office openings of all time during his tenure. No wonder Iger has swiftly moved to cancel or postpone at least a dozen projects greenlit by Chapek. Bob Iger’s track record suggests he knows how to make good movies and that he’s the right leader to fix the studio’s problems.

These glaring concerns reflect poorly on Peltz’s board bid–and Bob Iger is anything but an easy activist target. As I wrote about in my book The Hero’s Farewell, much like the callbacks to duty of the great allied generals of World War II, such as Generals MacArthur, Patton, Montgomery, and De Gaulle, the soaring vision of Iger and fellow returning corporate chieftains often need time to fully actualize. Returning CEOs have restored their companies to greatness over the span of years, not months, and certainly not over three days. Starbucks stock was down 49% one year after Howard Shultz returned to Starbucks in 2008, but after three years shares had bounced back 63%. Similarly, Apple stock was largely flat immediately after Steve Jobs returned to Apple but within three years, it shot upward 403%. And in this case, Iger is supported by a terrific cast of potential successors ranging from CFO Hugh Johnston, freshly lured over from Pepsi, Dana Walden and Alan Bergman from Disney Entertainment, Josh D’Amaro from Disney Parks, and Jimmy Pitaro of ESPN, in addition to Kevin Mayer and Tom Staggs.

Not only does Iger have the credibility to deliver, but his plan for turning around Disney is already well underway, with free cash flow expected to double this year regardless of any short-term volatility around earnings tomorrow. Perhaps that is why even other activist funds, most notably the savvy, constructive Mason Morfit of ValueAct, have chosen to side with Iger instead of Peltz, with only a single small institutional investor expressing support for Peltz’s bid so far. When even top-tier activist funds are lining up against Peltz amidst so many glaring red flags and problems with his candidacy, it's clear he has no pathway to victory as shareholders start receiving their ballots in the days and weeks ahead.

The long-term merits, or lack thereof, of Peltz’s bid, transcend any single short-term earnings report from Disney. Personal grudges do not mix well with proxy contests. Like an aging WWE wrestler shouting insults while losing on the mats, Peltz has picked the wrong sport–and the wrong opponent.

Jeffrey Sonnenfeld is the Lester Crown Professor in Management Practice and Senior Associate Dean at Yale School of Management. In 2023, he was named “Management Professor of the Year” by Poets & Quants magazine.

Steven Tian is the director of research at the Yale Chief Executive Leadership Institute and a former quantitative investment analyst with the Rockefeller Family Office.

More must-read commentary published by Fortune:

The markets are starting to realize just how hawkish the Fed is–and reckoning with higher-for-longer interest rates

The Biden administration’s freeze on LNG projects is a gift to Putin

WEF president: ‘It’s time to revitalize trade—and reverse the trend of Slowbalization’

The anti-DEI movement has gone from fringe to mainstream. Here’s what that means for corporate America

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance