Nearly 99% of first-time resale EC units make average gross profit of $300,000: OrangeTee & Tie

Artist's impression of the 639-unit Copen Grand (Picture: CDL-MCL Land)

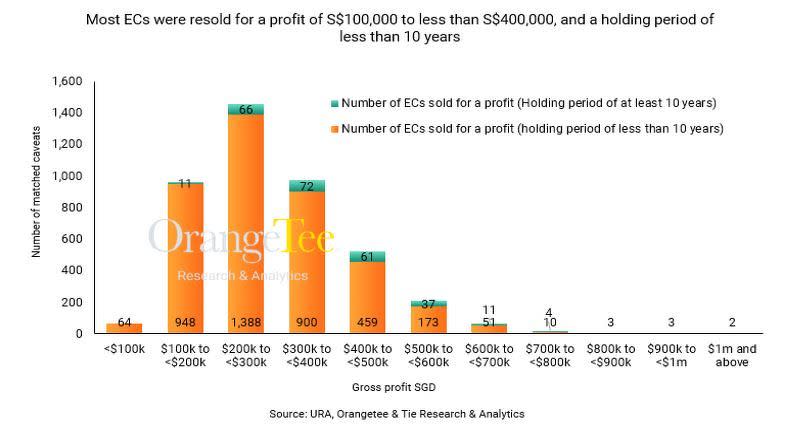

EDGEPROP (SINGAPORE) - According to a market report by real estate agency OrangeTee & Tie (OTT), nearly 99% of first-time resale executive condominium (EC) units raked in an average gross profit of about $300,000 when they first changed hands on the secondary market.

This analysis is based on a sampling of 4,266 EC units and was calculated by matching URA new sale caveats between January 2007 and August 2022 with the resale caveats of the matching units. About 4,000 of these sampled units were sold less than 10 years from the initial date of purchase.

Based on research by OTT, this means that about 4,263 first-time resale EC units earned their sellers profits of about $300,000. Of this number, 294 EC units yielded a gross profit of at least $500,000 each.

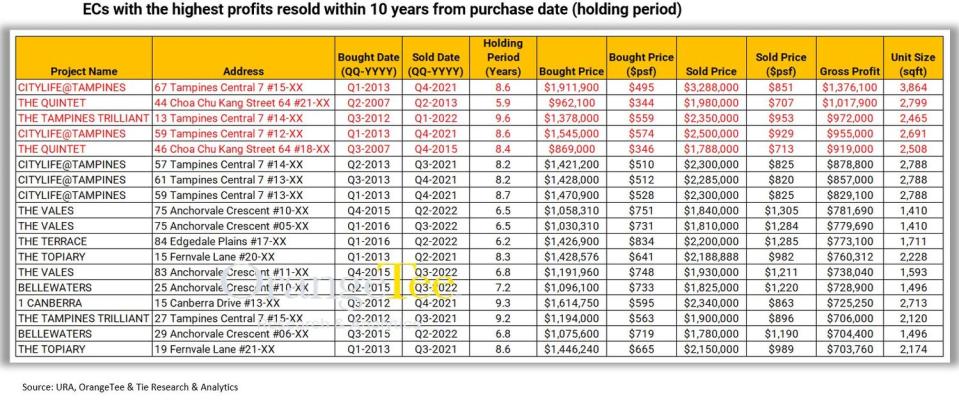

The EC unit that holds the record profit is a 3,864 sq ft unit on the 15th floor of Citylife @ Tampines. The unit had been bought for $1.91 million ($495 psf) in 2013 and fetched $3.29 million ($851 psf) when it first changed hands last year. This translates to a profit of $1.37 million.

This is followed by the sale of a 2,799 sq ft unit on the 21st floor of The Quintet in Yew Tee. This unit had been bought for $962,100 ($344 psf) in 2007, and eventually changed hands for $1.98 million ($707 psf) when it was sold in 2013. This translates to a profit of $1.02 million.

OTT also notes that larger-sized EC units tend to yield higher profits compared to smaller-sized EC units. The report states that 2,717 units that range from 800 to 1,200 sq ft yielded an average gross profit of $268,493. Meanwhile, EC units of 1,200 to 1,600 sq ft yielded an average gross profit of $362,997.

The very largest EC units of more than 1,600 sq ft raked in an average gross profit of $455,207 each.

OTT says that the median resale price of resale ECs is climbing faster than the sales price of new EC units. The median price of EC units on the secondary market grew 30.3% from $856 psf in 2019 to $1,115 psf over the first eight months of this year (8M2022).

A look at the resale price movements of ECs using EdgeProp's analytics tool.

In comparison, the median price of new EC units increased 15.9% from $1,101 psf to $1,276 psf over the same period. As a result, the price gap between new and resale ECs has narrowed from 28.6% in 2019 to 14.4% over 8M2022.

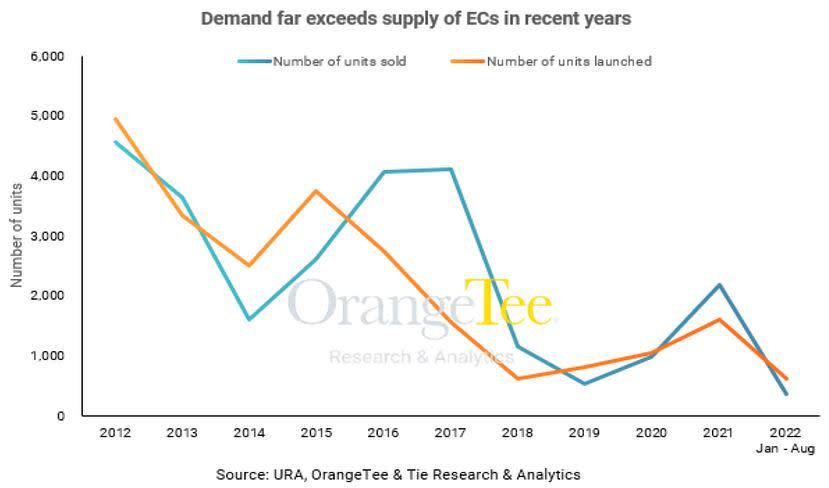

According to Christine Sun, senior vice-president, research & analytics at OTT, demand for EC units far exceeds the supply of new EC units in recent years. “Prices are holding steady possibly because of a lack of EC supply,” she says.

Two upcoming EC projects are due to be launched by the end of this year – Copen Grand at Tengah Garden Walk, and Tenet at Tampines Street 62.

See also: Copen Grand, Tenet test demand for ECs after cooling measures

“Copen Grand is the first EC to be launched in the new precinct of Tengah and buyers will have the first-mover advantage of owning their first private homes in Tengah. Tenet at Tampines Street 62 is located near the upcoming Tampines North MRT Station,” says Sun.

She adds that there have been no new EC launches in Tampines since the launch of Parc Central Residences in 2021. In addition, around 6,000 flats have reached their five-year minimum occupation period in Tampines and Pasir Ris from 2019 to 2022, and keen upgrader interest for Tenet should be expected, says Sun.

“Many buyers find ECs affordable especially since prices of new condos in the suburbs have risen substantially over the past year. Given their low entry prices, many ECs have yielded hefty profits in recent years,” she says.

Sun adds: “Moreover, the supply of new ECs is projected to be low over the next two years. Considering the limited supply and high profitability of ECs, demand may remain firm despite the new cooling measures.”

Check out the latest listings near Copen Grand, Tenet, Tampines North MRT Station

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Prices of new luxury condos in Singapore climb 5.2% y-o-y in 3Q2021: OrangeTee&Tie

Private home price growth moderates to 0.8% q-o-q in 2Q2021, driven by upgrader demand

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance