Multi-Chem And Two Other Leading Dividend Stocks On SGX

As digital solutions like Visa's new emergency card service reshape financial interactions globally, the Singapore market is also experiencing shifts that reflect broader technological advancements and consumer behavior changes. In this dynamic environment, dividend stocks such as Multi-Chem offer investors potential stability and regular income, qualities that are increasingly valuable in rapidly evolving markets.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.58% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.03% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.57% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.14% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.27% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.84% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.65% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.05% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of SGD 238.75 million.

Operations: Multi-Chem Limited generates revenue primarily through its IT business in Singapore (SGD 372.78 million), followed by other international markets (SGD 153.93 million), Australia (SGD 54.60 million), India (SGD 40.56 million), and Greater China (SGD 34.96 million), with a smaller contribution from its PCB business in Singapore (SGD 1.79 million).

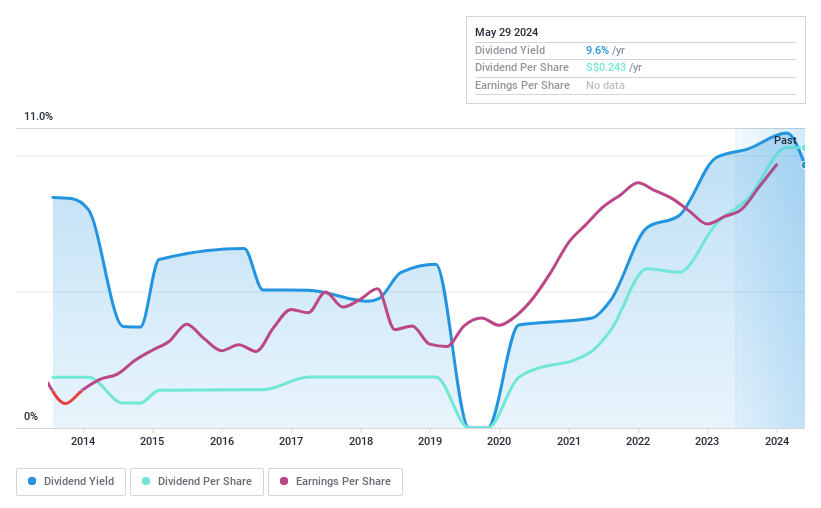

Dividend Yield: 9.1%

Multi-Chem’s dividend yield of 9.14% ranks in the top 25% in Singapore, supported by a payout ratio of 80.7%, indicating earnings sufficiently cover dividend payments, despite a volatile track record over the past decade. The firm trades at a 45% discount to estimated fair value and has seen earnings growth of 35.6% last year, enhancing its appeal but raising sustainability concerns given past fluctuations and significant insider selling recently. Recent board changes might impact governance dynamics and oversight going forward.

Take a closer look at Multi-Chem's potential here in our dividend report.

Our valuation report here indicates Multi-Chem may be undervalued.

Oversea-Chinese Banking

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited operates a financial services business spanning Singapore, Malaysia, Indonesia, Greater China, and other Asia Pacific regions, with a market capitalization of SGD 64.76 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates its revenue from financial services across Singapore, Malaysia, Indonesia, Greater China, and various other Asia Pacific regions.

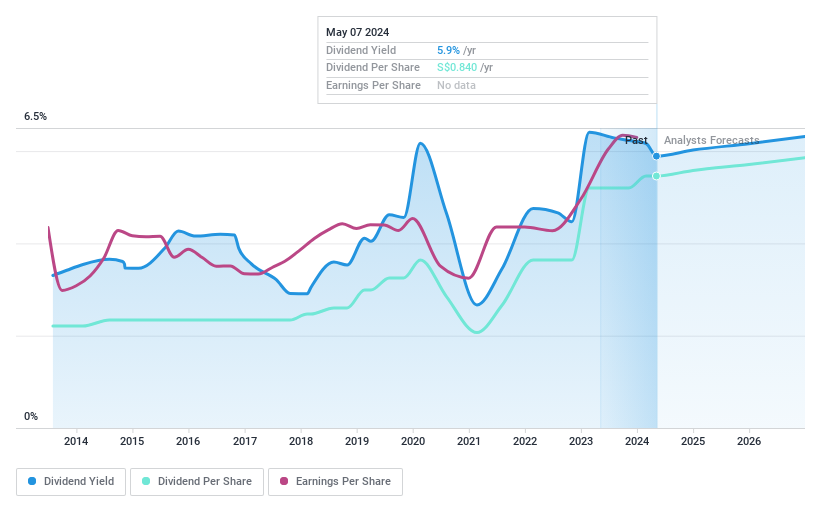

Dividend Yield: 5.8%

Oversea-Chinese Banking Corporation, while trading at a 48.6% discount to its estimated fair value, exhibits a mixed dividend profile. Its dividend yield of 5.83% is below the top quartile in Singapore's market, and its payout ratio stands at 52.9%, suggesting dividends are currently covered by earnings but have shown volatility over the past decade. Recent corporate activities include multiple fixed-income offerings and establishing a subsidiary in China, indicating strategic expansion but no immediate impact on dividends or earnings for 2024.

Singapore Exchange

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates as an integrated securities and derivatives exchange with related clearing houses in Singapore, boasting a market capitalization of SGD 10.14 billion.

Operations: Singapore Exchange Limited generates revenue primarily from two segments: Segment Adjustment at SGD 843.68 million and Fixed Income, Currencies, and Commodities at SGD 371.53 million.

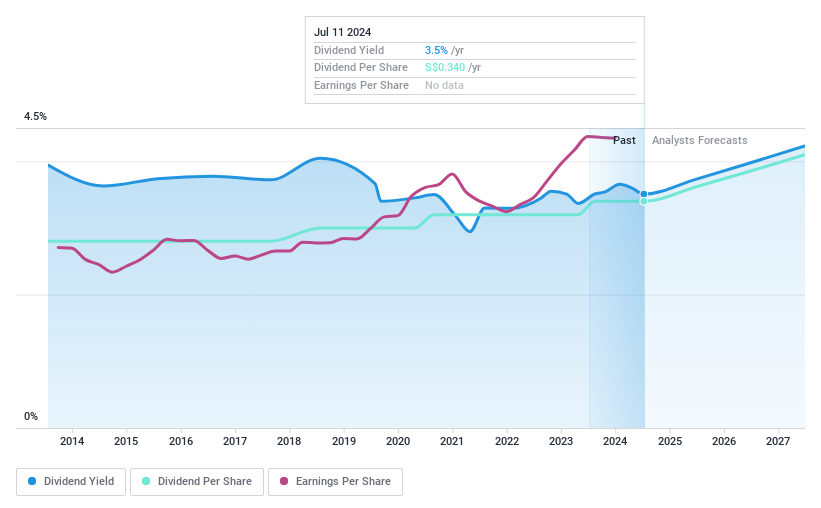

Dividend Yield: 3.6%

Singapore Exchange Limited has seen a 10-year growth in its dividend payments, supported by a stable payout ratio of 63% and cash payout ratio of 79.1%, ensuring dividends are well-covered by both earnings and cash flows. However, its current yield of 3.57% trails behind the top quartile in Singapore's market at 6.25%. Recent activities include participation in industry conferences and an upcoming dividend payment scheduled for May 3, 2024, reflecting ongoing operational engagement and shareholder commitment despite a lower yield comparative to peers.

Next Steps

Unlock more gems! Our Top SGX Dividend Stocks screener has unearthed 17 more companies for you to explore.Click here to unveil our expertly curated list of 20 Top SGX Dividend Stocks.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZ and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance