MLP And 2 Top German Dividend Stocks To Consider

Amid a backdrop of fluctuating global markets, Germany's DAX index has shown resilience with a modest increase, reflecting cautious optimism among investors. In these times, dividend stocks in Germany could offer potential stability and steady returns, making them an appealing consideration for those looking to diversify their investment portfolios.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.38% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 7.01% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.79% | ★★★★★★ |

Deutsche Telekom (XTRA:DTE) | 3.42% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 5.20% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.78% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 4.76% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.10% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.33% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

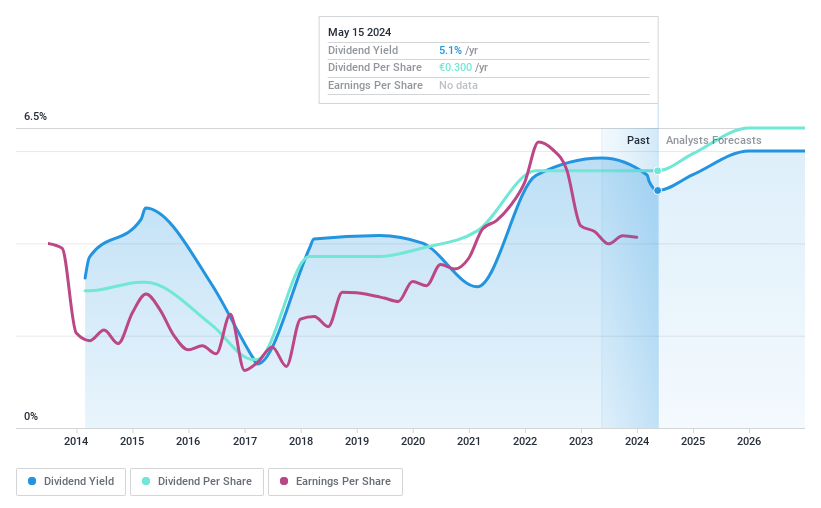

MLP

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE operates as a financial services provider catering to private, corporate, and institutional clients primarily in Germany, with a market capitalization of approximately €0.70 billion.

Operations: MLP SE generates revenue through various segments, with Financial Consulting contributing €0.43 billion, FERI at €0.22 billion, Banking operations at €0.20 billion, DOMCURA accounting for €0.13 billion, Germany Real Estate at €0.05 billion, and Industrial Broker adding another €0.04 billion.

Dividend Yield: 4.8%

MLP SE, trading 35.8% below its estimated fair value, offers a dividend yield of 4.78%, ranking in the top 25% in the German market. Despite a volatile dividend history over the past decade, recent earnings growth (9.5% annually over five years) and forecasts (8.85% per year) suggest improvement. Dividends are well-covered by earnings with a payout ratio of 62.3% and strongly supported by cash flows with a cash payout ratio of just 10.9%. Recent activities include consistent share buybacks and an inclusion in Germany's SDAX Index, enhancing its investment profile amidst fluctuating dividends.

Click to explore a detailed breakdown of our findings in MLP's dividend report.

Our valuation report unveils the possibility MLP's shares may be trading at a discount.

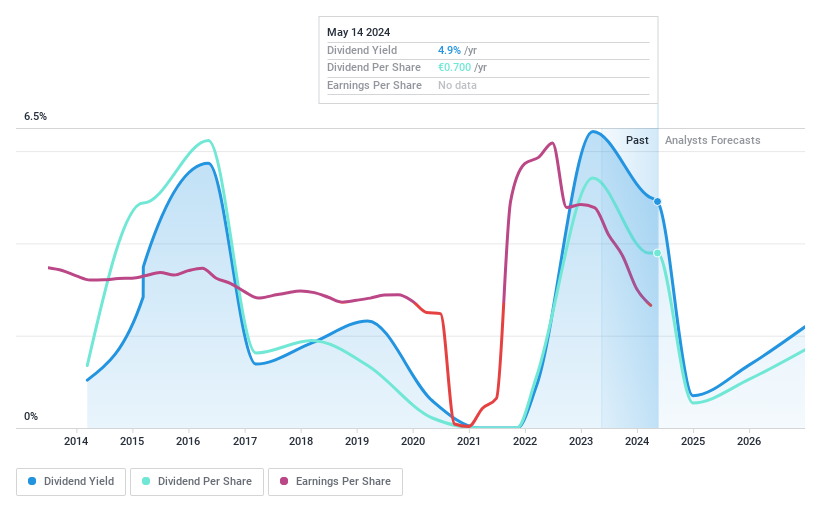

K+S

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: K+S Aktiengesellschaft operates globally as a supplier of mineral products for various sectors including agricultural, industrial, and consumer markets, with a market capitalization of approximately €2.28 billion.

Operations: K+S Aktiengesellschaft generates its revenue primarily from the Europe+ operating unit, which contributed €3.67 billion.

Dividend Yield: 5.5%

K+S Aktiengesellschaft experienced a significant decline in sales and net income in the recent quarters, with Q1 2024 sales dropping to €988 million and net income to €18.6 million from much higher figures a year prior. Despite these challenges, the company maintains a dividend of €0.70, although its sustainability is questionable given the unprofitability and inadequate coverage by earnings or free cash flow. The past share buyback program may offer some investor confidence, but overall dividend reliability remains uncertain due to historical volatility and current financial pressures.

Navigate through the intricacies of K+S with our comprehensive dividend report here.

Our valuation report unveils the possibility K+S' shares may be trading at a premium.

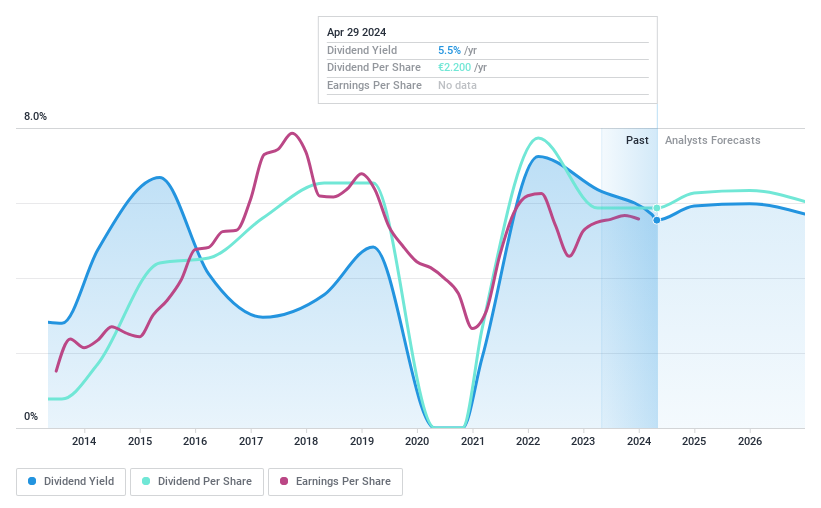

WashTec

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG specializes in providing car wash solutions across Germany, Europe, North America, and the Asia Pacific, with a market capitalization of approximately €0.55 billion.

Operations: WashTec AG generates revenue primarily from its operations in North America, contributing €98.39 million.

Dividend Yield: 5.4%

WashTec AG's dividend yield stands at 5.39%, ranking in the top 25% of German dividend payers. However, its payout ratio is high at 106.6%, indicating dividends are not well covered by earnings, though they are supported by a more reasonable cash payout ratio of 53.5%. Despite a historical increase in dividends, their reliability has been compromised by volatility over the past decade. Recent financials show a slight decline with Q1 2024 sales and net income dropping to €100.76 million and €3.12 million respectively from higher figures last year, suggesting potential pressure on future payouts.

Turning Ideas Into Actions

Click this link to deep-dive into the 33 companies within our Top Dividend Stocks screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MLP XTRA:SDF and XTRA:WSU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance