Mitsubishi Chemical Group And Two More Top Dividend Stocks

Amidst a backdrop of fluctuating market conditions, Japan's stock markets have recently faced challenges, with the Nikkei 225 and TOPIX indices experiencing declines. This uncertain environment underscores the importance of considering stable investment options such as dividend stocks, which can offer potential for regular income and long-term value growth. In this context, companies like Mitsubishi Chemical Group stand out as noteworthy considerations for those looking to navigate Japan's complex market landscape effectively.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.80% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.49% | ★★★★★★ |

Yahagi ConstructionLtd (TSE:1870) | 3.68% | ★★★★★★ |

Globeride (TSE:7990) | 3.67% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.47% | ★★★★★★ |

Kuriyama Holdings (TSE:3355) | 3.55% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.02% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 378 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

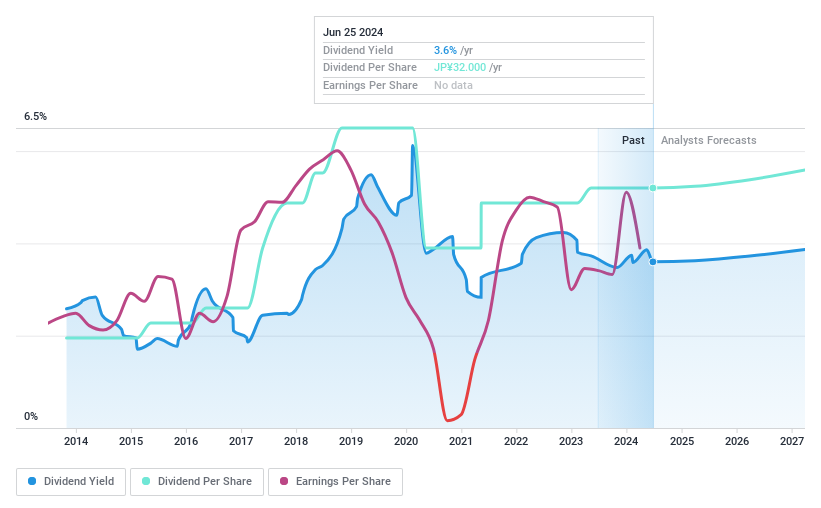

Mitsubishi Chemical Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Chemical Group Corporation operates globally, offering a diverse range of products including performance products, chemicals, industrial gases, and healthcare items, with a market capitalization of approximately ¥1.26 trillion.

Operations: Mitsubishi Chemical Group Corporation generates revenue from several key segments: Basic Materials at ¥1.05 billion, Industrial Gases at ¥1.26 billion, Specialty Materials at ¥1.23 billion, Health Care at ¥0.44 billion, and MMA at ¥0.29 billion.

Dividend Yield: 3.6%

Mitsubishi Chemical Group has maintained a consistent dividend, with a recent increase to JPY 16.00 per share for the fiscal year ended March 31, 2024, up from JPY 15.00 the previous year. Despite a volatile dividend history over the past decade, current dividends are well-supported by earnings and cash flows with payout ratios of 38.1% and 23.9%, respectively. However, the company's high level of debt may pose challenges to future dividend sustainability despite trading at a significant discount to estimated fair value.

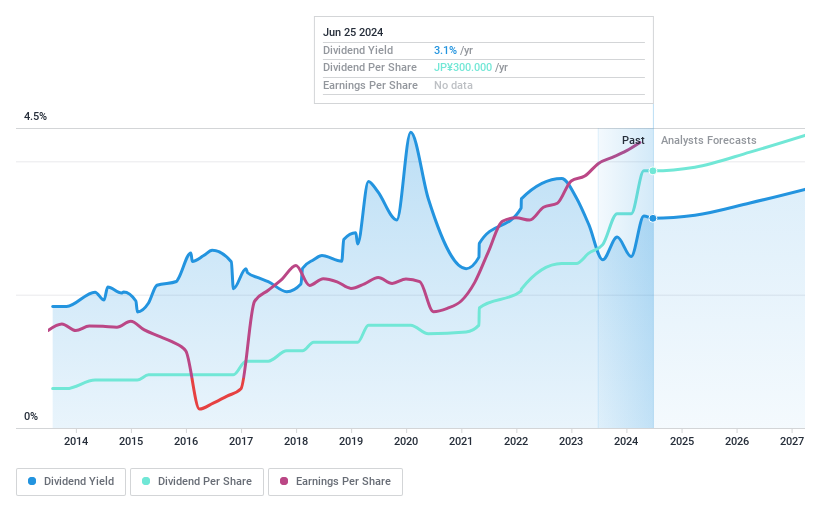

Toyota Tsusho

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Tsusho Corporation operates globally in diverse sectors including metals, automotive parts and logistics, mobility, machinery, energy and project management, chemicals and electronics, as well as food and consumer services, with a market capitalization of approximately ¥3.36 trillion.

Operations: Toyota Tsusho Corporation generates revenue from various segments including ¥2.82 billion from metals, ¥1.57 billion from its Africa operations, ¥0.99 billion from mobility, ¥2.10 billion from chemicals and electronics, ¥1.26 billion from global parts and logistics, ¥0.69 billion from the food and lifestyle industry, and ¥0.81 billion from machinery, energy, and plant projects.

Dividend Yield: 3.1%

Toyota Tsusho's recent dividend increase to ¥280.00 per share reflects a positive adjustment based on improved profits, with earnings up to ¥331.44 billion. Despite historically volatile dividends, the current payout is supported by a low payout ratio of 29.7% and cash flow coverage at 30.7%. However, its dividend yield of 3.15% remains below the top quartile in Japan's market, and ongoing fluctuations in dividend consistency could concern investors seeking stable returns.

Navigate through the intricacies of Toyota Tsusho with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Toyota Tsusho's share price might be too optimistic.

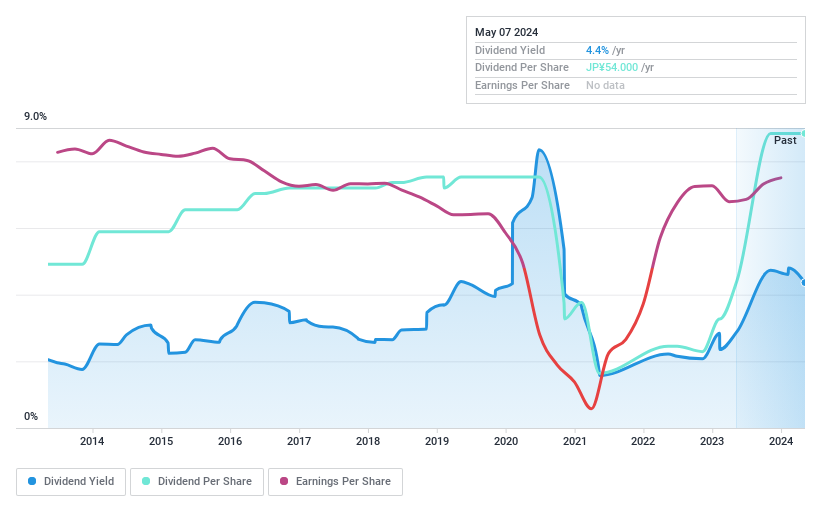

AOKI Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AOKI Holdings Inc., operating in Japan, engages in diverse sectors including fashion, anniversary and bridal services, entertainment, and real estate rental with a market capitalization of approximately ¥112.93 billion.

Operations: AOKI Holdings Inc. generates revenue primarily from its fashion business (¥100.04 billion), followed by entertainment (¥75.55 billion), anniversary and bridal services (¥10.26 billion), and real estate leasing (¥6.05 billion).

Dividend Yield: 4.1%

AOKI Holdings has shown a notable increase in dividends, announcing a rise to JPY 37.00 per share for FY 2024, up from JPY 13.00 the previous year, with expectations of JPY 40.00 for FY 2025. Despite historical volatility in dividend payments, recent increases are supported by solid earnings growth of 34.5% over the past year and a sustainable payout ratio of 55.5%. However, investors should note the inconsistent dividend track record over the past decade and consider this alongside recent positive developments.

Key Takeaways

Click through to start exploring the rest of the 375 Top Dividend Stocks now.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:4188 TSE:8015 and TSE:8214.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance