Microsoft Is Outpacing Apple in Innovation and Growth

I last covered Microsoft Corp. (NASDAQ:MSFT) in December, and I allocated a buy rating to the stock. At this time, I believe it offers significantly stronger future price return potential and exposure to diversified innovation than Apple Inc. (NASDAQ:AAPL). I have, therefore, performed deeper research into the structural differences between the two companies. Therefore, this thesis provides a comparative analysis of the two companies to determine which has the highest competitive benefit moving forward.

Assessing the structure of Microsoft versus Apple

There are distinct differences structurally between Microsoft and Apple, which contribute to why I think Apple may benefit from a slight readjustment at this time toward how Microsoft operates. Consider the following table:

Microsoft | Apple | |

Structure | Product-based | Function-based |

Decisions | Semi-autonomous | Highly centralized |

Products | Broad portfolio | Integrated ecosystem |

Culture | Matrix structure | Innovation-driven |

Segments | Product lines | Functional areas |

I am not suggesting Apple become exactly like Microsoft, and in fact, much of what made Apple magical is its highly innovative ecosystem approach. In essence, it has been a culture of innovation since Steve Jobs founded it. However, without his genius, I think a more typical matrix structure would be well-received by shareholders at this time. That should not discount the importance of hiring the best talent for innovation, and I believe Apple has proven it still values this properly through its recent release of the Apple Vision Pro. However, let's not forget this product is nowhere near as revolutionary and popular as the iPhone was.

What Microsoft has going for it is its semi-autonomous divisions, which act as separate entities with their own budgets and resources, allow for a more targeted and efficient allocation of capital. In turn, this can optimize the returns on investment. There is also a greater emphasis on diversification with Microsoft, reducing dependency on single products, markets or brands and spreading out financial risk.

What I think Apple needs now is to balance the innovation it is known for with the financial prudence that has been developed over the long term by Bill Gates (Trades, Portfolio)' Microsoft, which I believe is more inspired by Warren Buffett (Trades, Portfolio) than by the radical creative approach of some other business leaders like Elon Musk and Jobs.

Analysis of essential differences contributing to financial results

There are several areas that suggest Apple may be lagging behind Microsoft.

First, in fiscal 2023, iPhone sales accounted for approximately 52% of Apple's total revenue. This heavy reliance on a single product made the company vulnerable to market saturation. In contrast, Microsoft's diverse revenue streams, including Office, LinkedIn, Azure, Windows, Surface and Xbox, mitigate this risk.

Microsoft Azure has been a key driver of growth for the company. The product's revenue grew by 27% in fiscal 2023. In contrast, Apple does not dominate the cloud market. It is, therefore, not exposed to the same growth potential.

Further, Apple also has lower research and development spending at this time. In fiscal 2023 it reported its R&D at about 7.80% of its total revenue. The same year, Microsoft reported R&D investments of around 12.80% of its total revenue. As its R&D investments are spread around multiple high-growth areas, this positions Microsoft for potentially higher levels of innovation and long-term growth.

Although Apple is still one of the most valuable companies in the world, its market capitalization growth has been slower compared to Microsoft in recent years. Microsoft has less vulnerability due to its diversified approach and, at this time, its long-term prosperity looks to be stronger.

The company has been conservative with acquisitions, limiting its expansion into new markets. Microsoft, on the other hand, has made several high-profile acquisitions, including LinkedIn, GitHub and Activision Blizzard.

Apple and Microsoft are both strong companies, but the latter is proving itself to be more fiscally prudent, with a nature of strategic acquisitions and diversification, which arguably sustains its moat for longer and builds it wider than Apple's more localized approach.

Value analysis

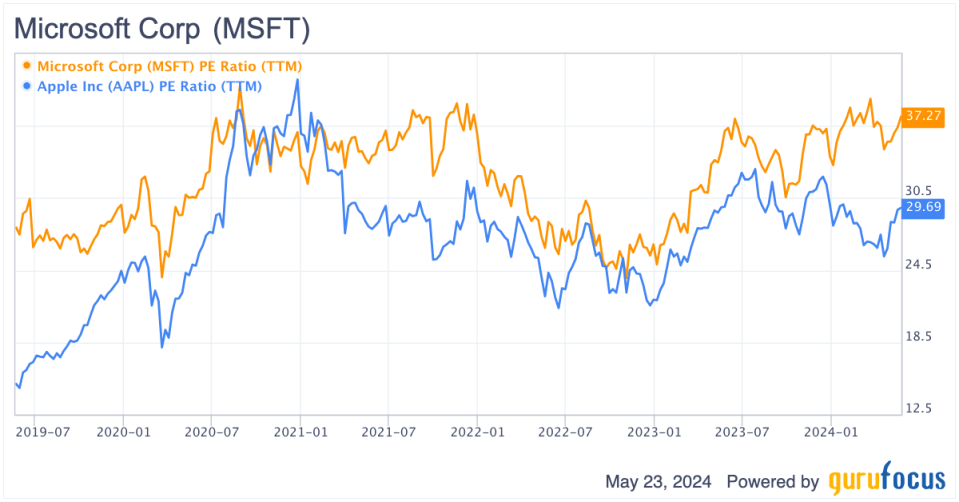

To begin my comparative value analysis, please consider the following graph, which compares Microsoft and Apple's trailing 12-month price-earnings ratios.

As we can see, Apple is just slightly lower valued than Microsoft at this time. This is arguably justified based on the operations analysis I presented above. The good news is I do not think either company looks overvalued compared to the wider industry:

Current P/E Ratio Without NRI | |

Microsoft | 37 |

Apple | 30 |

Amazon (NASDAQ:AMZN) | 50 |

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) | 27 |

Meta (NASDAQ:META) | 27 |

Tesla (NASDAQ:TSLA) | 69 |

In many respects, Apple and Microsoft offer a fair valuation, but Microsoft has much better growth potential. Therefore, I believe Microsoft is the better investment at this time.

Both Microsoft and Apple trade above what I estimate as intrinsic value, which can be elucidated in the following table:

Microsoft | Apple | |

Current EPS Without NRI | $11.56 | $6.43 |

Forecasted EPS Without NRI CAGR 2024-2034 | 15% | 10% |

Forecasted EPS Without NRI CAGR 2034-2044 | 7% | 5% |

Discount Rate | 10% | 10% |

Intrinsic Value Estimate | $304 | $114.50 |

Stock Price | $428 | $190.70 |

Overvaluation | 40.70% | 66.50% |

The table does not indicate that both companies are actually overvalued, as the analysis needs to consider the sentiment analysis I performed above. I believe each stock is likely fairly valued. However, Microsoft offers better growth prospects, which significantly improves its outlook in a discounted earnings model.

Risks of owning the stock

While this thesis clearly shows I believe Microsoft has a stronger future ahead of it than Apple at this time, there are significant risks that Microsoft is also going to have to navigate. One of the primary downsides that comes with the software company's diversified portfolio approach is that it may struggle with uniformity and integration risks, reducing the effectiveness of its overall ecosystem and potentially having a negative effect on the customer experience. This is what Jobs was clever in developing at Apple. Nonetheless, Microsoft could find its range of high-growth investments has a shorter half-life than a more integrated approach led by pioneering innovators. The issue here is I do not believe Apple has a Jobs equivalent at the helm at this time to continue to cultivate this direction of radical innovation to drive growth.

In addition, many innovators are not in the technology field for the money. In my opinion, the best talents are usually missionaries rather than capital allocators looking to profit from the stock. In essence, Microsoft could attract individuals who are more finance-oriented rather than creative, reducing the long-term magic fostered within the company over time and instead creating a less lucrative environment for technological advancement if it is not careful with how it sets up incentives and values within its culture.

Key elements

Apple is struggling with Jobs no longer at the helm of the company. In this new era, I believe Apple needs to strategically redirect itself and take some inspiration from the way Microsoft structures itself. Apple could use a more expansive acquisition and investment strategy with an approach similar to a holding company being introduced.

Apple's markets are saturated, and its iPhone accounted for 52% of its total revenue in fiscal 2023. The company had almost half the R&D spend relative to revenue compared to Microsoft that year. Microsoft has a broader portfolio, where its diversification protects shareholder value and exposes investors to higher growth opportunities.

Microsoft performs better than Apple in my discounted earnings analysis, but I believe both companies to be fairly valued at this time. However, for investors seeking higher growth, Microsoft seems to be the stronger long-term investment.

While Microsoft has a clever capital allocation strategy, it must be careful that it does not lose out on the best creative talent and that its customer experience does not suffer as a result of too much diversification and a loss of focus on the importance of ecosystem development.

Conclusion

Microsoft's prudent financial structure, which I believe was inspired by Buffett and adapted for the field of technology, places it in an incredibly strong position moving forward. Its diversified portfolio of investments exposes investors to higher levels of innovation and growth than Apple, in turn giving it a better valuation based on my discounted earnings analyses.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance