Merck's (MRK) Keytruda-Lynparza Combo Fails Lung Cancer Study

Merck MRK announced that it will stop the phase III KEYLYNK-008 study evaluating the combination of its blockbuster drugs Keytruda and Lynparza as a potential treatment for patients with metastatic squamous non-small cell lung cancer (NSCLC).

This decision is based on the recommendation of an independent data monitoring committee (IDMC) after completing its third interim analysis of data from the KEYLYNK-008 study. During this analysis, the committee found that treatment with the Keytruda-Lynparza combination failed to show an improvement in overall survival (OS), one of the study’s dual primary endpoints.

The treatment combination had failed to achieve statistical significance in progression-free survival (PFS), the study’s other dual primary endpoint, during the second interim data analysis. However, there was a numerical improvement reported in the data.

Merck plans to inform the study investigators about the IDMC recommendation and advise study participants to their physicians for treatment. Management intends to present data from the KEYLYNK-008 study at a future medical meeting.

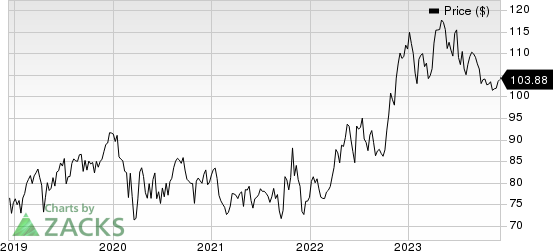

The stock has lost 6.4% year to date against the industry’s 4.4% growth.

Image Source: Zacks Investment Research

This is not the first time the Keytruda-Lynparza combination suffered a setback. Last year, Merck stopped the phase III KEYLYNK-010 study evaluating the combination in patients with metastatic castration-resistant prostate cancer (mCRPC). The KEYLYNK-010 failed to achieve its primary endpoints of OS and radiographic PFS.

Lynparza, a PARP inhibitor, has been developed by Merck in collaboration with AstraZeneca AZN. Lynparza is approved for four cancer types — ovarian, breast, prostate and pancreatic.

The profit-sharing deal between AstraZeneca and Merck was inked in 2017. Apart from Lynparza, the Merck-AstraZeneca deal also includes Koselugo.

An anti-PD-1 therapy, Keytruda is a revenue driver for Merck. The drug is approved for several types of cancer, contributing around 46% to MRK’s total revenues in the first nine months of 2023. Keytruda is authorized to treat eight indications in earlier-stage cancers in the United States. Merck’s Keytruda continuously grows and expands into new indications and markets globally.

In the nine months ended September 2023, Merck recorded $18.4 billion in sales from Keytruda, up 19% year over year. Drug sales are gaining from continued strong momentum in metastatic indications and rapid uptake across recent earlier-stage launches. Keytruda is consistently growing and expanding into new indications and markets globally.

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Stocks to Consider

Merck currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include CytomX Therapeutics CTMX and Novo Nordisk NVO, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, CytomX Therapeutics’ estimates for 2023 have improved from a loss of 37 cents per share to earnings of 2 cents. During the same period, loss estimates per share for 2024 have narrowed from 51 cents to 6 cents. Shares of CytomX have lost 8.8% in the year-to-date period.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.51 to $2.63. During the same period, the earnings estimates for 2024 have risen from $2.95 to $3.14. Shares of NVO have surged 43.1% in the year-to-date period.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an earnings surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance