Merck's (MRK) Chronic Cough Drug Gets Another CRL From FDA

Merck MRK announced that the FDA had issued a complete response letter (CRL) to its new drug application (“NDA”) for its oral P2X3 receptor antagonist, gefapixant. The NDA sought approval for the drug to treat refractory chronic cough (RCC) or unexplained chronic cough (UCC) in adults.

Per the CRL, the FDA concluded that the data supported by Merck for gefapixant did not provide sufficient evidence to prove its clinical benefit in treating RCC and UCC.The CRL did not raise any safety concerns over gefapixant use. Merck is reviewing the FDA’s feedback to determine the next steps.

This decision is in line with the negative recommendation issued by an FDA advisory committee on the gefapixant NDA last month. The committee members voted 12-to-1 that the evidence does not demonstrate that the drug provides a clinically meaningful benefit to adults with RCC and UCC.

This is the second time that the FDA has declined to approve the gefapixant NDA. The agency had previously issued a CRL last year requesting Merck to submit additional information regarding the measurement of gefapixant’s efficacy.

In September, Merck received approval for gefapixant in the European Union to treat RCC or UCC. The drug is being marketed under the trade name Lyfnua. It received its first approval in Japan in January 2022.

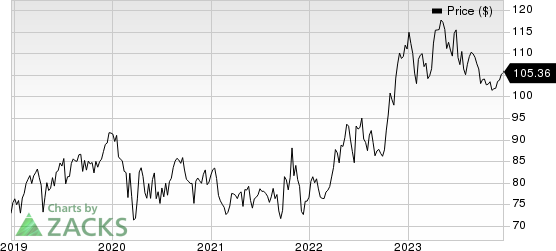

Merck’s shares have lost 5.0% year to date against the industry’s 5.6% growth.

Image Source: Zacks Investment Research

Chronic cough is defined as a cough lasting longer than eight weeks. RCC is a cough that persists despite appropriate treatment of underlying conditions such as asthma or gastroesophageal reflux disease. On the other hand, UCC is a cough where the underlying cause cannot be identified despite a thorough evaluation. Currently, there are no approved treatments for RCC or UCC indication in the United States.

The above news is likely to benefit GSK plc GSK, which is evaluating its own investigational chronic cough drug in late-stage development. The drug, named camlipixant, was added by GSK after it acquired Bellus Health in June.

A P2X3 antagonist, GSK is evaluating camlipixant as a late-stage development program for the first-line treatment of adult patients with RCC. GSK expects to launch its RCC drug commercially in 2026.

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Key Picks

Merck currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Galapagos GLPG and Novo Nordisk NVO. While Galapagos sports a Zacks Rank #1 (Strong Buy) at present, Novo Nordisk carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, Galapagos’ estimates for 2023 have improved from a loss of $1.96 per share to 79 cents. During the same period, loss estimates per share for 2024 have narrowed from $3.22 to $1.68. Galapagos’ shares have lost 12.1% in the year-to-date period.

Galapagos’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 91.97%. In the last reported quarter, Galapagos’ earnings beat estimates by 140.78%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.57 to $2.61. During the same period, the earnings estimates for 2024 have risen from $2.99 to $3.10. Shares of NVO have surged 49.7% in the year-to-date period.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an average surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Galapagos NV (GLPG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance