MedTech Stocks' Q2 Earnings Due on Jul 26: DGX, TMO and More

The second-quarter earnings season for the Medical sector has kicked off. Per the latest Earnings Preview, quarterly results so far have improved year over year despite the ongoing macroeconomic headwinds in the form of worldwide inflationary pressure and unfavorable foreign exchange headwind. Going by the sector’s scorecard, 3.4% of the companies in the Medical sector, constituting 12.3% of the sector’s market capitalization, reported earnings till Jul 19. Of these, 100% beat earnings and revenue estimates. Earnings improved 9.3% year over year on 14% higher revenues.

However, overall, second-quarter earnings of the Medical sector are expected to plunge 18.6% despite 3.4% revenue growth. This compares with the first-quarter earnings decline of 17.9% on revenue growth of 4%.

The projection reflects the ongoing global inflationary pressure, which has resulted in an extremely tough situation related to raw material and labor cost as well as freight charges, putting the industry in a tight spot again. The majority of the players within this space witnessed a rise in raw material costs and other expense pressure through the second-quarter months. Added to this, labor-supply constraints due to an increase in labor costs and global supply-chain hazards are expected to have moderated the growth process.

MedTech Quarterly Synopsys

Replicating the market-wide trend, MedTech or the Zacks-defined Medical Products companies’ collective business growth in the second quarter is likely to have been significantly dampened by the ongoing macroeconomic threat in the United States and outside. Through the second-quarter months, the companies, which are into international trade, are expected to have faced severe currency headwind. During this period, the U.S. dollar remained strong compared to several foreign currencies, which is expected to have had an unfavorable impact on sales.

Further, in Medical Device, going by the industry-wide trend, logistical challenges and increasing unit costs are likely to have weighed heavily on the corporate profitability of stocks across the board. On the other hand, the tightened monetary policy starkly altered consumer preferences and once again put the demand for the non-essential category line of medical device businesses on the back foot. This might have, in a way, shrunk the companies’ revenues in the second quarter compared to the prior quarter.

Also, diagnostic testing companies might have shown a severe year-over-year decline in testing demand, compared to a strong comparison in the year-ago period on the rise in new cases in select geographies.

Medical device companies like Quest Diagnostics DGX, Thermo Fisher Scientific TMO, Edwards Lifesciences EW and Align Technology ALGN are likely to have been influenced by these abovementioned factors in the second quarter.

On a positive note, companies’ successful addressing of a couple of years’ pent-up demand is likely to have led to higher year-over-year growth within the legacy base businesses. During the post-pandemic phase, the key focus of medical device R&D has again shifted from COVID-related PPE, testing and distant care options to point-of-care testing, heavy as well as minimally invasive implants, elective procedures and so forth. Accordingly, legacy base business recovery and testing demand of the companies through the months of the second quarter are expected to have been impressive. Meanwhile, AI and robotics for the medical Internet of Things (IoT), which rose to the limelight during the pandemic phase, remained popular.

Let's take a look at four MedTech players scheduled to announce second-quarter results on Jul 26.

Quest Diagnostics: During the first quarter of 2023, Quest Diagnostics’ COVID-19 testing revenues nosedived to a large extent, with the continuous decline in testing volumes. The company witnessed a downward trend in the demand for COVID-19 molecular testing volumes earlier than anticipated. For the remaining half of the year, Quest Diagnostics’ revised guidance assumes modest COVID-19 revenues following the end of the public health emergency in May. This is likely to be reflected in the second-quarter results.

(Read more: Quest Diagnostics to Post Q2 Earnings: What's in Store?)

The Zacks Consensus Estimate for total revenues of $2.24 billion for the second quarter suggests an 8.6% decline from the prior-year quarter’s reported figure. The consensus mark for DGX’s earnings of $2.23 per share indicates a 5.5% decline from the year-ago quarter’s reported figure.

Per our proven model, a stock with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates. This is not the case as you can see below.

DGX has an Earnings ESP of -0.95% and carries a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

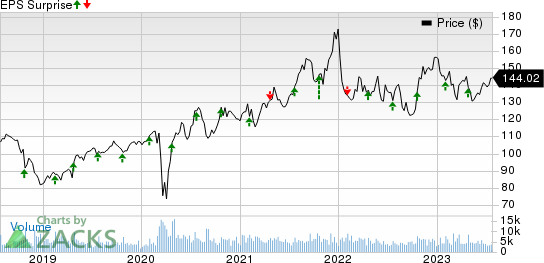

Quest Diagnostics Incorporated Price and EPS Surprise

Quest Diagnostics Incorporated price-eps-surprise | Quest Diagnostics Incorporated Quote

Thermo Fisher: Similar to the last reported quarter, Thermo Fisher’s Analytical Instruments segment is expected to have generated strong sales, banking on chromatography and mass spectrometry and the electron microscopy businesses. The company is expected to have recorded growth, driven by a favorable business mix and new launches. The launch of Invitrogen DynaGreen — microplastic-free magnetic beads for protein purification — backed by strong customer adoption, is also expected to have contributed to the second-quarter top line.

(Read more: What's in Store for Thermo Fisher in Q2 Earnings?)

The Zacks Consensus Estimate for Thermo Fisher’s second-quarter revenues is pegged at $10.99 billion, which implies a rise of 0.2% from the year-ago figure. The consensus estimate for earnings per share is pegged at $5.43, suggesting a fall of 1.45% from the prior-year reported figure.

TMO has an Earnings ESP of +0.21% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

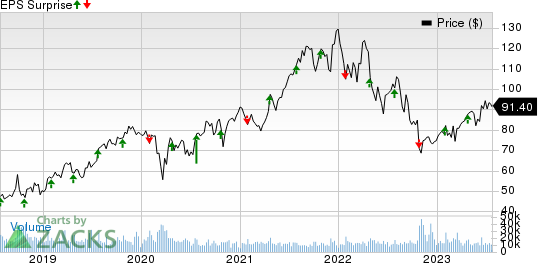

Thermo Fisher Scientific Inc. Price and EPS Surprise

Thermo Fisher Scientific Inc. price-eps-surprise | Thermo Fisher Scientific Inc. Quote

Edwards Lifesciences: In Critical Care, continued demand for its state-of-the-art HemoSphere monitoring platform and Smart Recovery is likely to be reflected in the second-quarter results of Edwards Lifesciences. An increase in hospital visits with an improvement in the market scenario is likely to have benefited HemoSphere sales, thus adding to the top line. Growth is also expected to have been led by strong adoption of the company’s Acumen IQ sensor and finger cuff, featuring the Hypotension Prediction Index algorithm.

(Read more: What's in Store for Edwards Lifesciences in Q2 Earnings?)

The Zacks Consensus Estimate for Edwards Lifesciences’ second-quarter revenues is pegged at $1.50 billion, which implies a 9.5% improvement from the year-ago figure. The consensus estimate for earnings per share is pegged at 65 cents, suggesting a 3.2% improvement from the prior-year reported figure.

EW has an Earnings ESP of -1.03% and a Zacks Rank #3.

Edwards Lifesciences Corporation Price and EPS Surprise

Edwards Lifesciences Corporation price-eps-surprise | Edwards Lifesciences Corporation Quote

Align Technology: Similar to the first quarter, ALGN is likely to have witnessed stability across all regions for the Clear Aligner business and a favorable average selling price. Revenues from non-case products are expected to have been driven by continued growth from the Invisalign Doctors Subscription Program and Vivera Retainers in commerce sales, which include everything from a liner case to whitening and cleaning products.

(Read more: Align Technology to Post Q2 Earnings: What's in Store?)

The Zacks Consensus Estimate for second-quarter earnings of $2.02 per share implies a 22.7% rise from the year-ago reported figure. The consensus estimate for revenues is pegged at $985.9 million, suggesting a 1.7% rise from the prior-year reported number.

ALGN has an Earnings ESP of 0.00% and a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Align Technology, Inc. Price and EPS Surprise

Align Technology, Inc. price-eps-surprise | Align Technology, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance