McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include:

349.0 m of 0.77% Cu, including 232.0 m of 0.86% Cu (AZ23292)

382.5 m of 0.54% Cu, including 74.0 m of 0.86% Cu (AZ23277)

TORONTO, May 16, 2024 (GLOBE NEWSWIRE) -- McEwen Copper Inc., 47.7% owned by McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to provide the assay results from the currently completed drill season at the Los Azules project in Argentina. The prime objectives of this season’s infill drilling campaign were: 1. to confirm the size and grade of the deposit as compared to the 2023 PEA estimate and upgrade the resource categories for the upcoming feasibility study; 2. test for extensions of mineralization beyond the current pit shell; and 3. explore our large property package for other mineralized areas.

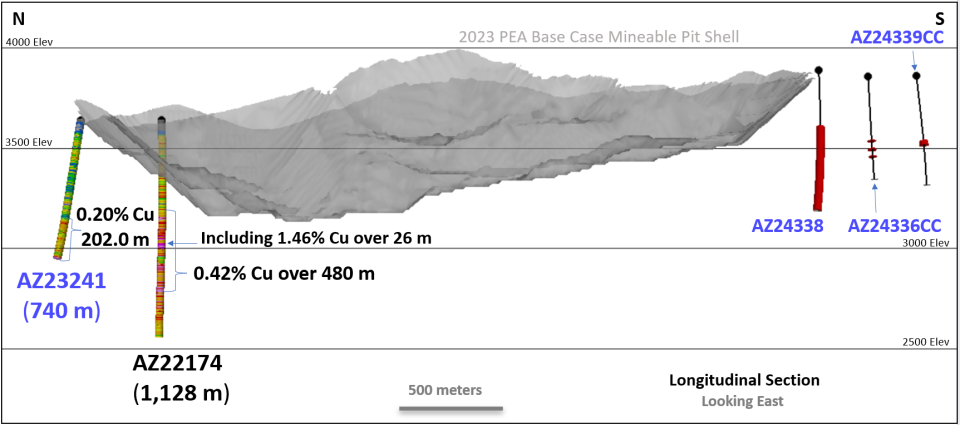

Based on the assay results received to date, our first objective appears to have been met. Initial interpretation suggests that our infill drilling will result in an increase in Measured and Indicated resources and an overall mineral inventory within 5% of the PEA estimate. Testing for extensions beyond the planned pit has successfully encountered mineralization both to the north and to the south. Primary mineralization was intercepted (202.0 m of 0.20% Cu) over 400 meters north of last year’s deep exploration hole, confirming its extension at depth a significant distance to the north. Exploration south of the planned pit has intercepted the principal mineralized intrusive more than 700 meters south of previous drill intercepts and indicates that prospective intrusives continue well to the south of the pit.

Exploration over our property has produced an intriguing target, late in the season. Initial results of a concession-wide regional mapping and sampling campaign have identified strong evidence of a large porphyry system 3 kilometers east of the Los Azules deposit. Porphyry-style veining and quartz vein stockworks with copper oxide mineralization have been recognized within this new target, with assay results pending.

Additionally, this news release covers all results from the first half of the 2023-24 drill program (see Table 1). Final results will be published when all the geochemistry is completed.

The objective of the 2023-2024 drilling campaign is to collect all the necessary information to support the completion of the Los Azules Feasibility Study by early 2025. This information continues to arrive and will be processed in the following months. Resource drilling is focused on converting all the mineralization to be mined in the first 5 years to Measured and Indicated resource, to increase confidence during the payback period. Geotechnical, metallurgical, hydrogeological, exploration, and condemnation drilling are also being performed.

Highlights

Hole AZ23292 returned an intercept of 349 m of 0.77% Cu (approx. true thickness). The Enriched zone portion of this hole extends over 346 meters and includes an intercept of 232 m of 0.86% Cu.

Hole AZ23277 has an intercept of 382.5 m of 0.54% Cu (approx. true thickness). The Enriched zone portion of this hole extends over 306 meters with a grade of 0.61% Cu and includes an intercept of 74 m of 0.86% Cu.

Results

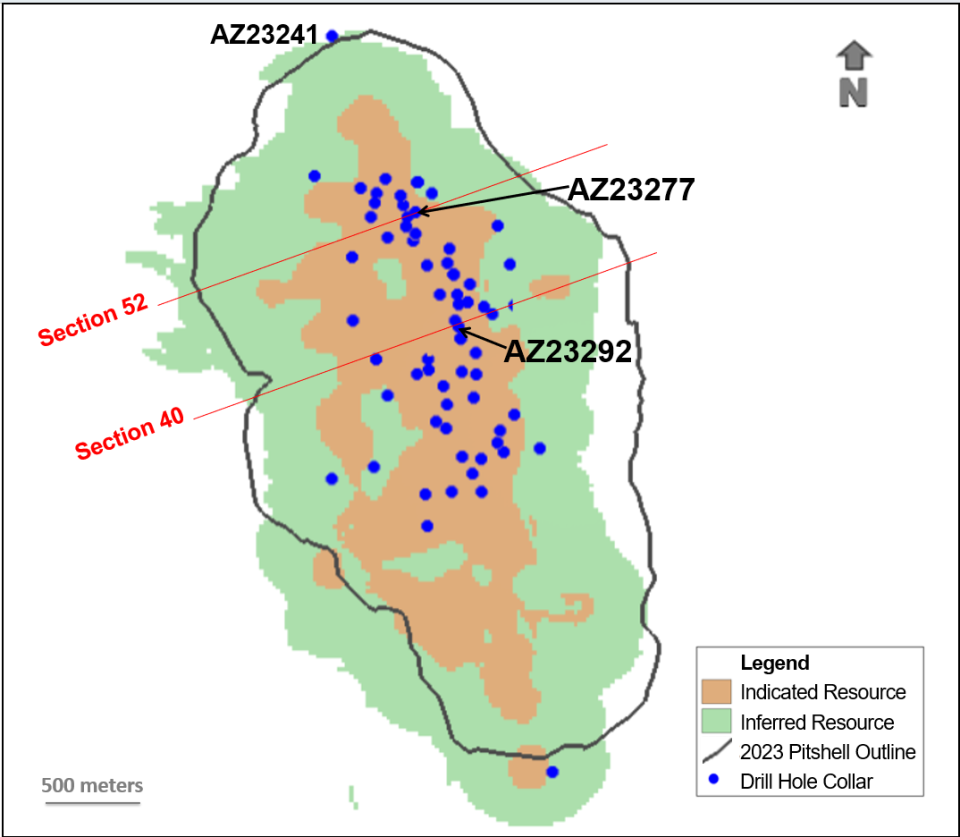

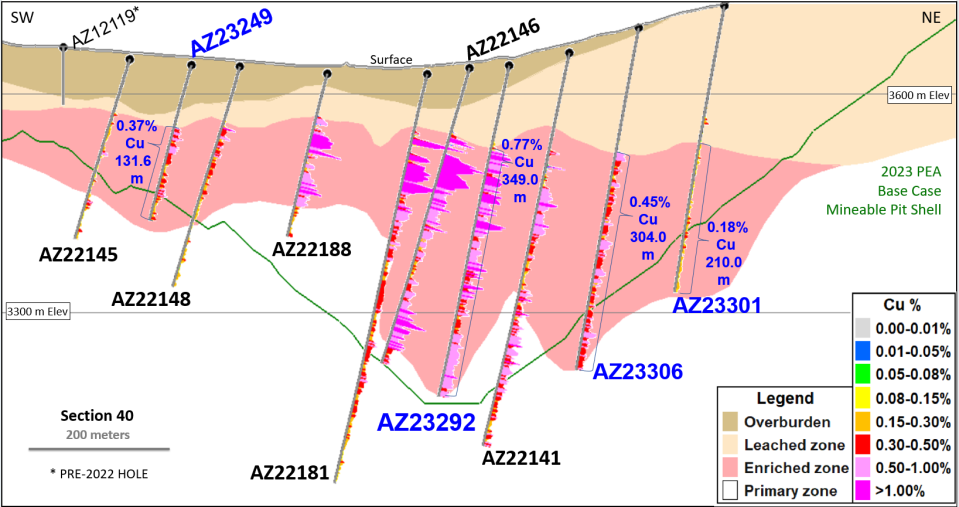

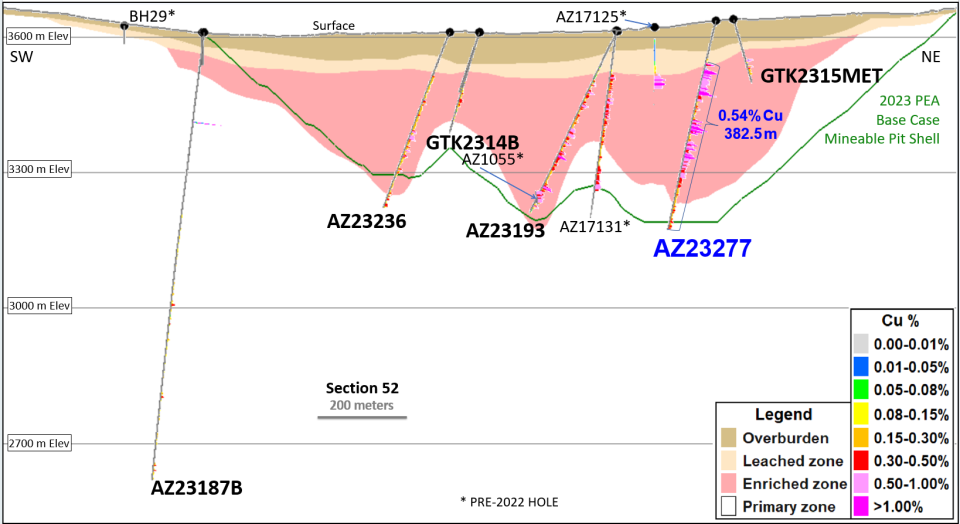

Results are summarized in two schematic cross sections (Figures 2 and 3), which include simplified interpretations of the Overburden, Leached, Enriched and Primary zones. The Enriched mineral zone refers to the enrichment of a copper deposit by precipitation-derived water circulation that carries copper minerals downward through the rocks to accumulate in a thick, often horizontal “blanket”. Immediately above the Enriched zone is the Leached zone, from which copper was removed and transported. Weathering and oxidation often aid in this process. Below the Enriched zone, the Primary (or Hypogene) zone is formed by ascending copper-rich fluids having a much deeper magmatic origin. The green line on the sections indicates the pit floor of the 30-year pit shell from the 2023 NI 43-101 Preliminary Economic Assessment (PEA).

Figure 1 presents a plan view of the location of two sections and the holes reported. Adjacent cross sections are located 50 m apart from each other, starting with the lowest numbered section at the south end of the deposit and progressing to the north.

Figure 1 – Plan View Location of Cross-sections and Drill Holes Reported in this News Release

Figure 2 displays an intercept of 349 m grading 0.77% Cu (AZ23292) and includes 232 m grading 0.86% Cu within the Enriched zone. This hole extends higher-grade Enriched zone mineralization in the center of the section to the east and at depth.

Figure 2 - Section 40 - Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Figure 3 highlights a 382.5 m interval grading 0.54% Cu (AZ23277) and includes an interval of 74 m grading 0.86% Cu within the Enriched zone. This hole extends higher-grade mineralization in the eastern portion of the Enriched zone to the east and at depth.

Figure 3 - Section 52 - Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Growing the Deposit

Exploration hole AZ23241 (Figure 4) intersected a long interval of low-grade mineralization in the Primary Zone (202.0 m of 0.20% Cu) and began to enter higher-grade mineralization at the end of the hole (12.0 m of 0.44% Cu). This hole is located completely outside of the 2023 PEA base case mineable pit shell. This hole is over 400 meters to the north of exploration hole AZ22174, also located outside of the 2023 PEA base case mineable pit shell, which encountered 1,052.0 m of 0.29% Cu including 480 m of 0.42% Cu (Figure 4). These intercepts suggest that primary mineralization continues at depth a significant distance to the north. Exploration drilling south of the deposit has extended the presence of the early mineral porphyry more than 700 meters south of previous drilling and well outside of the southern pit boundary. This porphyry is host for the majority of the mineralization at Los Azules and encountering it a significant distance farther south indicates that the deposit may also continue in this direction. Assays for these holes are pending.

A comprehensive structural model for the deposit has been completed that will provide a better understanding of structural controls on the deposit and aid in future exploration work. Field verification of a previous property-wide structural study using satellite information was carried out in January and has refined the identification of nearby exploration targets.

Figure 4 – North-South Longitudinal Section (Looking East) With Deep Exploration Holes to the North and Exploration Holes to the South With Early Mineral Porphyry Shown in Red

Indications of Another Porphyry Copper System Nearby

To date, geological mapping and geochemical sampling has been focused primarily near the Los Azules deposit and only covers roughly 40% of our large concession. To address this limitation, a mapping and sampling campaign was begun in December, to obtain 100% coverage of our concession.

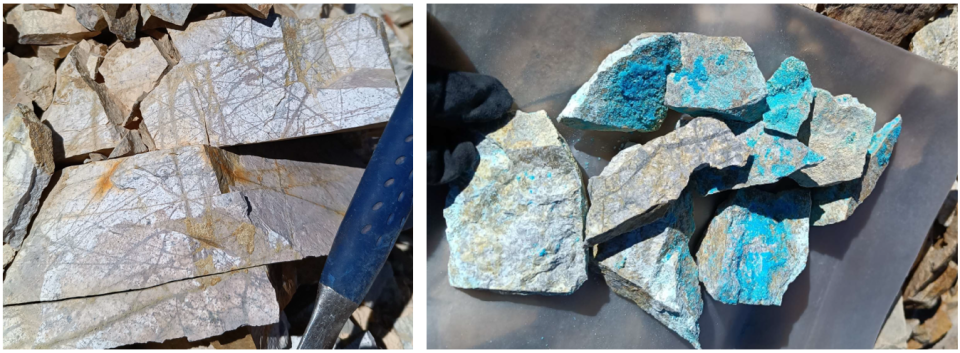

Early results of this work have identified a large new porphyry system 3 kilometers east of Los Azules. Preliminary work has identified porphyry-style veining and alteration, indicating the presence of a porphyry copper system. Areas with strong quartz vein stockworking and the recognition of copper oxides at surface add to the prospectiveness of this newly identified area (Figure 5).

Figure 5 – Quartz Stockwork Veining and Copper Oxides Identified at Surface in Porphyry Copper System 3 Kilometers East of Los Azules

Table 1 summarizes copper (Cu), gold (Au) and silver (Ag) assay results received from October 2023 to December 31, 2023.

Table 1 – Recent Los Azules Drilling Results

Hole-ID | Section | Predominant | From | To | Length | Cu | Au | Ag | Comment |

AZ23238 | 50-51 | Total | 102.0 | 201.0 | 99.0 | 1.02 | 0.07 | 2.75 |

|

|

| Enriched | 102.0 | 201.0 | 99.0 | 1.02 | 0.07 | 2.75 |

|

AZ23239 | 35 | Total | 48.0 | 225.5 | 177.5 | 0.61 | 0.07 | 1.61 |

|

|

| Enriched | 48.0 | 225.5 | 177.5 | 0.61 | 0.07 | 1.61 | Incl. 86.0m of 0.76% Cu |

AZ23240 | 41 | Total | 104.0 | 224.5 | 120.5 | 0.98 | 0.11 | 1.53 |

|

|

| Enriched | 104.0 | 224.5 | 120.5 | 0.98 | 0.11 | 1.53 | Incl. 112.5m of 1.04% Cu |

AZ23241 | 71 | Total | 18.0 | 740.0 | 722.0 | 0.11 | 0.01 | 0.63 |

|

|

| Enriched | 18.0 | 300.0 | 282.0 | 0.07 | 0.01 | 0.60 |

|

|

| Primary | 538.0 | 740.0 | 202.0 | 0.20 | 0.01 | 0.72 | Incl. 12.0m of 0.44% Cu |

AZ23242 | 45 | Total | 86.0 | 200.0 | 114.0 | 0.92 | 0.08 | 1.77 |

|

|

| Enriched | 86.0 | 200.0 | 114.0 | 0.92 | 0.08 | 1.77 |

|

AZ23243 | 46 | Total | 82.0 | 150.0 | 68.0 | 0.53 | 0.04 | 1.26 |

|

|

| Enriched | 82.0 | 150.0 | 68.0 | 0.53 | 0.04 | 1.26 |

|

AZ23244A | 43-44 | Total | 92.0 | 230.3 | 138.3 | 0.54 | 0.05 | 1.66 |

|

|

| Enriched | 92.0 | 230.3 | 138.3 | 0.54 | 0.05 | 1.66 | Incl. 112.0m of 0.63% Cu |

AZ23245 | 43 | Total | 86.0 | 220.7 | 134.7 | 0.99 | 0.06 | 1.74 |

|

|

| Enriched | 86.0 | 220.7 | 134.7 | 0.99 | 0.06 | 1.74 |

|

AZ23246 | 39-38 | Total | 123.0 | 235.1 | 112.1 | 1.04 | 0.11 | 2.34 |

|

|

| Enriched | 123.0 | 235.1 | 112.1 | 1.04 | 0.11 | 2.34 | Incl. 81.1m of 1.15% Cu |

AZ23248 | 42 | Total | 98.0 | 227.0 | 129.0 | 0.87 | 0.08 | 1.71 |

|

|

| Enriched | 98.0 | 227.0 | 129.0 | 0.87 | 0.08 | 1.71 | Incl. 93.0m of 1.02% Cu |

AZ23249 | 40 | Total | 88.0 | 219.6 | 131.6 | 0.37 | 0.05 | 1.08 |

|

|

| Enriched | 88.0 | 219.6 | 131.6 | 0.37 | 0.05 | 1.08 | Incl. 52.0m of 0.46% Cu |

AZ23250 | 38 | Total | 114.0 | 210.0 | 96.0 | 0.69 | 0.06 | 1.05 |

|

|

| Enriched | 114.0 | 210.0 | 96.0 | 0.69 | 0.06 | 1.05 |

|

AZ23251 | 56 | Total | 82.0 | 430.8 | 348.8 | 0.37 | 0.05 | 1.65 |

|

|

| Enriched | 82.0 | 198.0 | 116.0 | 0.40 | 0.03 | 1.10 | Incl. 40.0m of 0.67% Cu |

|

| Primary | 198.0 | 430.8 | 232.8 | 0.36 | 0.06 | 1.93 |

|

AZ23252 | 54 | Total | 86.0 | 172.1 | 86.1 | 0.52 | 0.07 | 1.22 |

|

|

| Enriched | 86.0 | 172.1 | 86.1 | 0.52 | 0.07 | 1.22 |

|

AZ23253 | 36 | Total | 96.0 | 307.0 | 211.0 | 0.28 | 0.01 | 0.35 |

|

|

| Enriched | 96.0 | 290.0 | 194.0 | 0.29 | 0.01 | 0.36 |

|

|

| Primary | 290.0 | 307.0 | 17.0 | 0.19 | 0.02 | 0.25 |

|

AZ23254 | 41 | Total | 147.5 | 200.0 | 52.5 | 0.27 | 0.05 | 2.23 |

|

|

| Enriched | 147.5 | 200.0 | 52.5 | 0.27 | 0.05 | 2.23 | Incl. 18.5m of 0.57% Cu |

AZ23255 | 45 | Total | 120.5 | 253.7 | 133.2 | 0.55 | 0.04 | 1.36 |

|

|

| Enriched | 120.5 | 253.7 | 133.2 | 0.55 | 0.04 | 1.36 | Incl. 64.0m of 0.74% Cu |

AZ23257 | 39 | Total | 87.0 | 202.0 | 115.0 | 0.28 | 0.04 | 1.50 |

|

|

| Enriched | 87.0 | 202.0 | 115.0 | 0.28 | 0.04 | 1.50 | Incl. 24.0m of 0.60% Cu |

AZ23258A | 28 | Total | 62.0 | 347.0 | 285.0 | 0.50 | 0.05 | 0.95 |

|

|

| Enriched | 62.0 | 300.0 | 238.0 | 0.56 | 0.06 | 0.87 | Incl. 142.0m of 0.63% Cu |

|

| Primary | 300.0 | 347.0 | 47.0 | 0.22 | 0.03 | 1.34 |

|

AZ23259MET | 50 | Total | 115.0 | 347.0 | 232.0 | 0.46 | 0.02 | 0.93 |

|

|

| Enriched | 115.0 | 334.0 | 219.0 | 0.48 | 0.02 | 0.96 | Incl. 114.0m of 0.73% Cu |

|

| Primary | 334.0 | 347.0 | 13.0 | 0.12 | 0.02 | 0.55 |

|

AZ23260 | 32 | Total | 102.0 | 313.0 | 211.0 | 0.40 | 0.03 | 1.05 |

|

|

| Enriched | 102.0 | 313.0 | 211.0 | 0.40 | 0.03 | 1.05 | Incl. 56.0m of 0.71% Cu |

AZ23261 | 33 | Total | 98.0 | 299.0 | 201.0 | 0.40 | 0.03 | 0.74 |

|

|

| Enriched | 98.0 | 299.0 | 201.0 | 0.40 | 0.03 | 0.74 | Incl. 20.0m of 0.81% Cu |

AZ23262 | 36 | Total | 98.0 | 191.0 | 93.0 | 0.45 | 0.07 | 0.79 |

|

|

| Enriched | 98.0 | 191.0 | 93.0 | 0.45 | 0.07 | 0.79 | Incl. 46.0m of 0.59% Cu |

AZ23263 | 37 | Total | 170.0 | 318.5 | 148.5 | 0.59 | 0.09 | 2.26 |

|

|

| Enriched | 170.0 | 282.0 | 112.0 | 0.64 | 0.07 | 1.77 |

|

|

| Primary | 282.0 | 318.5 | 36.5 | 0.47 | 0.14 | 3.77 |

|

AZ23264 | 55 | Total | 78.5 | 276.0 | 197.5 | 0.63 | 0.10 | 2.91 |

|

|

| Enriched | 78.5 | 268.0 | 189.5 | 0.64 | 0.10 | 2.93 | Incl. 64.0m of 0.91% Cu |

|

| Primary | 268.0 | 276.0 | 8.0 | 0.32 | 0.10 | 2.47 |

|

AZ23265 | 54 | Total | 150.2 | 281.0 | 130.8 | 0.48 | 0.06 | 1.05 |

|

|

| Enriched | 150.2 | 281.0 | 130.8 | 0.48 | 0.06 | 1.05 | Incl. 77.8m of 0.57% Cu |

AZ23267 | 29 | Total | 66.0 | 218.0 | 152.0 | 0.51 | 0.06 | 0.79 |

|

|

| Enriched | 66.0 | 218.0 | 152.0 | 0.51 | 0.06 | 0.79 | Incl. 110m of 0.63% Cu |

AZ23268 | 50 | Total | 102.0 | 249.5 | 147.5 | 0.35 | 0.02 | 1.01 |

|

|

| Enriched | 102.0 | 249.5 | 147.5 | 0.35 | 0.02 | 1.01 |

|

AZ23269 | 31 | Total | 122.0 | 222.5 | 100.5 | 0.55 | 0.05 | 1.66 |

|

|

| Enriched | 122.0 | 222.5 | 100.5 | 0.55 | 0.05 | 1.66 |

|

AZ23271 | 26 | Total | 192.0 | 393.5 | 201.5 | 0.15 | 0.01 | 0.60 |

|

|

| Enriched | 192.0 | 390.0 | 198.0 | 0.16 | 0.01 | 0.58 |

|

|

| Primary | 390.0 | 393.5 | 3.5 | 0.07 | 0.04 | 1.66 |

|

AZ23273 | 25 | Total | 64.0 | 289.0 | 225.0 | 0.50 | 0.08 | 1.37 |

|

|

| Enriched | 64.0 | 289.0 | 225.0 | 0.50 | 0.08 | 1.37 | Incl. 120m of 0.77% Cu |

AZ23274 | 53 | Total | 72.0 | 207.4 | 135.4 | 0.81 | 0.06 | 2.24 |

|

|

| Enriched | 72.0 | 207.4 | 135.4 | 0.81 | 0.06 | 2.24 |

|

AZ23275 | 33 | Total | 60.0 | 216.5 | 156.5 | 0.91 | 0.08 | 1.44 |

|

|

| Enriched | 60.0 | 208.0 | 148.0 | 0.93 | 0.08 | 1.44 | Incl. 78m of 1.19% Cu |

|

| Primary | 208.0 | 216.5 | 8.5 | 0.63 | 0.07 | 1.43 |

|

AZ23276 | 53 | Total | 104.0 | 209.8 | 105.8 | 0.38 | 0.05 | 1.21 |

|

|

| Enriched | 104.0 | 209.8 | 105.8 | 0.38 | 0.05 | 1.21 | Incl. 58m of 0.57% Cu |

AZ23277 | 52 | Total | 94.0 | 476.5 | 382.5 | 0.54 | 0.10 | 2.33 |

|

|

| Enriched | 94.0 | 400.0 | 306.0 | 0.61 | 0.11 | 2.62 | Incl. 74m of 0.86% Cu |

|

| Primary | 400.0 | 476.5 | 76.5 | 0.25 | 0.06 | 1.20 |

|

AZ23279 | 53 | Total | 55.8 | 192.5 | 136.7 | 0.41 | 0.06 | 2.50 |

|

|

| Enriched | 55.8 | 192.5 | 136.7 | 0.41 | 0.06 | 2.50 |

|

AZ23280 | 56 | Total | 34.0 | 485.5 | 451.5 | 0.33 | 0.05 | 1.72 |

|

|

| Enriched | 34.0 | 485.5 | 451.5 | 0.33 | 0.05 | 1.72 | Incl. 80m of 0.56% Cu |

AZ23282A | 30 | Total | 166.0 | 354.5 | 188.5 | 0.15 | 0.00 | 0.40 |

|

|

| Enriched | 166.0 | 354.5 | 188.5 | 0.15 | 0.00 | 0.40 |

|

AZ23283 | 25 | Total | 165.0 | 342.5 | 177.5 | 0.70 | 0.06 | 1.82 |

|

|

| Enriched | 165.0 | 342.5 | 177.5 | 0.70 | 0.06 | 1.82 | Incl. 112m of 0.91% Cu |

AZ23284 | 27 | Total | 55.3 | 264.8 | 209.5 | 0.52 | 0.11 | 1.37 |

|

|

| Enriched | 55.3 | 236.0 | 180.7 | 0.54 | 0.11 | 1.36 | Incl. 112m of 0.67% Cu |

|

| Primary | 236.0 | 264.8 | 28.8 | 0.44 | 0.09 | 1.46 |

|

AZ23285 | 59 | Total | 90.0 | 256.6 | 166.6 | 0.10 | 0.01 | 0.64 |

|

|

| Enriched | 90.0 | 174.0 | 84.0 | 0.14 | 0.01 | 0.68 |

|

|

| Primary | 174.0 | 256.6 | 82.6 | 0.08 | 0.00 | 0.59 |

|

AZ23286 | 48 | Total | 143.2 | 329.0 | 185.8 | 0.09 | 0.02 | 0.68 |

|

|

| Enriched | 143.2 | 258.0 | 114.8 | 0.08 | 0.02 | 0.86 |

|

|

| Primary | 258.0 | 329.0 | 71.0 | 0.11 | 0.02 | 0.38 |

|

AZ23289 | 49 | Total | 152.0 | 278.0 | 126.0 | 0.73 | 0.06 | 2.76 |

|

|

| Enriched | 152.0 | 278.0 | 126.0 | 0.73 | 0.06 | 2.76 |

|

AZ23290 | 51 | Total | 136.0 | 260.1 | 124.1 | 0.53 | 0.05 | 1.63 |

|

|

| Enriched | 136.0 | 260.1 | 124.1 | 0.53 | 0.05 | 1.63 |

|

AZ23291 | 47 | Total | 102.0 | 241.5 | 139.5 | 0.67 | 0.06 | 3.26 |

|

|

| Enriched | 102.0 | 241.5 | 139.5 | 0.67 | 0.06 | 3.26 | Incl. 60m of 0.89% Cu |

AZ23292 | 40 | Total | 114.0 | 463.0 | 349.0 | 0.77 | 0.10 | 2.11 |

|

|

| Enriched | 114.0 | 460.0 | 346.0 | 0.77 | 0.10 | 2.09 | Incl. 232m of 0.86% Cu |

|

| Primary | 460.0 | 463.0 | 3.0 | 0.72 | 0.30 | 3.93 |

|

AZ23293 | 44 | Total | 73.0 | 382.7 | 309.7 | 0.28 | 0.03 | 1.99 |

|

|

| Enriched | 73.0 | 218.0 | 145.0 | 0.38 | 0.06 | 3.57 | Incl. 56m of 0.66% Cu |

|

| Primary | 218.0 | 382.7 | 164.7 | 0.20 | 0.01 | 0.60 |

|

AZ23294 | 30 | Total | 90.0 | 218.0 | 128.0 | 0.41 | 0.15 | 6.78 |

|

|

| Enriched | 90.0 | 218.0 | 128.0 | 0.41 | 0.15 | 6.78 | Incl. 16m of 0.74% Cu |

AZ23297A | 47 | Total | 74.0 | 360.5 | 286.5 | 0.42 | 0.05 | 1.35 |

|

|

| Enriched | 74.0 | 360.5 | 286.5 | 0.42 | 0.05 | 1.35 | Incl. 26m of 0.73% Cu |

AZ23298 | 5a | Total | 294.0 | 600.5 | 306.5 | 0.16 | 0.03 | 1.29 |

|

|

| Enriched | 294.0 | 396.0 | 102.0 | 0.20 | 0.03 | 0.66 |

|

|

| Primary | 396.0 | 600.5 | 204.5 | 0.15 | 0.03 | 1.61 |

|

AZ23299B | 23 | Total | 94.0 | 310.0 | 216.0 | 0.21 | 0.25 | 1.41 |

|

|

| Enriched | 94.0 | 254.0 | 160.0 | 0.24 | 0.31 | 1.71 |

|

|

| Primary | 254.0 | 310.0 | 56.0 | 0.12 | 0.07 | 0.56 |

|

AZ23300 | 42 | Total | 102.0 | 241.0 | 139.0 | 1.01 | 0.08 | 2.43 |

|

|

| Enriched | 102.0 | 241.0 | 139.0 | 1.01 | 0.08 | 2.43 |

|

AZ23301 | 40 | Total | 188.0 | 398.0 | 210.0 | 0.18 | 0.02 | 0.81 |

|

|

| Enriched | 188.0 | 398.0 | 210.0 | 0.18 | 0.02 | 0.81 |

|

AZ23303 | 30 | Total | 106.0 | 285.0 | 179.0 | 0.53 | 0.05 | 5.48 |

|

|

| Enriched | 106.0 | 234.0 | 128.0 | 0.62 | 0.07 | 7.16 | Incl. 92m of 0.78% Cu |

|

| Primary | 234.0 | 285.0 | 51.0 | 0.31 | 0.01 | 1.27 |

|

AZ23304 | 44 | Total | 134.0 | 387.5 | 253.5 | 0.17 | 0.02 | 0.58 |

|

|

| Enriched | 134.0 | 387.5 | 253.5 | 0.17 | 0.02 | 0.58 |

|

AZ23306 | 40 | Total | 172.0 | 476.0 | 304.0 | 0.45 | 0.05 | 1.34 |

|

|

| Enriched | 172.0 | 476.0 | 304.0 | 0.45 | 0.05 | 1.34 |

|

AZ23307 | 55 | Total | 134.0 | 184.8 | 50.8 | 0.18 | 0.03 | 0.52 |

|

|

| Enriched | 134.0 | 184.8 | 50.8 | 0.18 | 0.03 | 0.52 |

|

AZ23309 | 28 | Total | 88.0 | 299.0 | 211.0 | 0.45 | 0.03 | 1.13 |

|

|

| Enriched | 88.0 | 266.0 | 178.0 | 0.49 | 0.03 | 1.22 | Incl. 26m of 0.92% Cu |

|

| Primary | 266.0 | 299.0 | 33.0 | 0.22 | 0.04 | 0.69 |

|

AZ23310 | 26 | Total | 74.0 | 369.6 | 295.6 | 0.20 | 0.03 | 0.83 |

|

|

| Enriched | 74.0 | 369.6 | 295.6 | 0.20 | 0.03 | 0.83 |

|

AZ23311 | 44 | Total | 94.0 | 513.0 | 419.0 | 0.40 | 0.03 | 1.12 |

|

|

| Enriched | 94.0 | 276.0 | 182.0 | 0.39 | 0.01 | 0.38 | Incl. 52m of 0.54% Cu |

|

| Primary | 276.0 | 513.0 | 237.0 | 0.40 | 0.04 | 1.69 | Incl. 66m of 0.79% Cu |

AZ23312 | 55 | Total | 114.0 | 212.5 | 98.5 | 0.36 | 0.02 | 0.50 |

|

|

| Enriched | 114.0 | 194.0 | 80.0 | 0.41 | 0.02 | 0.55 | Incl. 26m of 0.74% Cu |

|

| Primary | 194.0 | 212.5 | 18.5 | 0.15 | 0.02 | 0.28 |

|

AZ23314 | 37 | Total | 102.0 | 316.5 | 214.5 | 0.64 | 0.06 | 1.10 |

|

|

| Enriched | 102.0 | 300.0 | 198.0 | 0.66 | 0.06 | 1.12 | Incl. 84m of 0.89% Cu |

|

| Primary | 300.0 | 316.5 | 16.5 | 0.36 | 0.05 | 0.81 |

|

AZ23315 | 37 | Total | 72.0 | 206.4 | 134.4 | 0.32 | 0.10 | 1.84 |

|

|

| Enriched | 72.0 | 206.4 | 134.4 | 0.32 | 0.10 | 1.84 | Incl. 72.4m of 0.57% Cu |

Technical information

The technical content of this press release has been reviewed and approved by Darren King, Director of Exploration of McEwen Copper, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

All samples were collected in accordance with generally accepted industry standards. Drill core samples, usually taken at 2 m intervals, were split and submitted to the Alex Stewart International laboratory located in the Province of Mendoza, Argentina, for the following assays: gold determination using fire fusion assay and an atomic absorption spectroscopy finish (Au4-30); a 39 multi-element suite using ICP-OES analysis (ICP-AR 39); copper content determination using a sequential copper analysis (Cu-Sequential LMC-140). An additional 19-element analysis (ICP-ORE) was performed for samples with high sulphide content and that exceeded the limits of the ICP-OES analysis.

The company conducts a Quality Assurance/Quality Control program in accordance with NI 43-101 and industry best practices using a combination of standards and blanks on approximately one out of every 25 samples. Results are monitored as final certificates are received, and any re-assay requests are sent back immediately. Pulp and preparation sample analyses are also performed as part of the QAQC process. Approximately 5% of the sample pulps are sent to a secondary laboratory for control purposes. In addition, the laboratory performs its own internal QAQC checks, with results made available on certificates for Company review.

Table 2 – Hole Locations and Lengths for Los Azules Drilling Results

HOLE-ID | Azimuth | Dip | Length | Loc X | Loc Y | Loc Z |

AZ23238 | 205 | -71 | 201.00 | 2383108.93 | 6559892.69 | 3618.48 |

AZ23239 | 90 | -73 | 225.50 | 2383291.79 | 6559109.63 | 3638.32 |

AZ23240 | 250 | -70 | 224.50 | 2383349.87 | 6559430.59 | 3635.63 |

AZ23241 | 250 | -70 | 740.00 | 2382746.14 | 6560826.06 | 3653.29 |

AZ23242 | 257 | -72 | 200.00 | 2383341.59 | 6559657.16 | 3634.88 |

AZ23243 | 47 | -80 | 150.00 | 2383312.1 | 6559713.31 | 3627.57 |

AZ23244A | 250 | -75 | 230.30 | 2383422.55 | 6559609.27 | 3664.48 |

AZ23245 | 270 | -73 | 220.70 | 2383360.72 | 6559558.82 | 3637.93 |

AZ23246 | 236 | -69 | 235.10 | 2383377.45 | 6559341.84 | 3639.54 |

AZ23248 | 242 | -72 | 227.00 | 2383367.74 | 6559510.9 | 3638.59 |

AZ23249 | 248 | -74 | 219.60 | 2382962.63 | 6559241.34 | 3638.21 |

AZ23250 | 238 | -74 | 210.00 | 2383217.21 | 6559241.98 | 3631.86 |

AZ23251 | 250 | -80 | 430.75 | 2383008.71 | 6560126.27 | 3626.21 |

AZ23252 | 216 | -70 | 172.10 | 2382956.7 | 6560008.3 | 3617.5 |

AZ23253 | 70 | -77 | 307.00 | 2383018.5 | 6559063.1 | 3655.9 |

AZ23254 | 251 | -68 | 200.00 | 2383490.5 | 6559498.8 | 3682.1 |

AZ23255 | 70 | -76 | 253.70 | 2383341.6 | 6559657.1 | 3646.8 |

AZ23257 | 60 | -70 | 202.00 | 2383376.7 | 6559342.8 | 3650.5 |

AZ23258A | 250 | -74 | 83.00 | 2383557 | 6558832 | 3663.9 |

AZ23259MET | 250 | -74 | 347.00 | 2382844.65 | 6559742.72 | 3604.22 |

AZ23260 | 250 | -83 | 313.00 | 2383256.27 | 6558935.42 | 3666.58 |

AZ23261 | 250 | -72 | 299.00 | 2383310.44 | 6559019.34 | 3645.87 |

AZ23262 | 54 | -85 | 191.00 | 2383383.41 | 6559180.01 | 3642.08 |

AZ23263 | 250 | -68 | 318.50 | 2383451.34 | 6559272.72 | 3647.94 |

AZ23264 | 70 | -75 | 276.00 | 2382965.36 | 6560055.22 | 3611.83 |

AZ23265 | 70 | -74 | 281.00 | 2383082.7 | 6560043.5 | 3628.43 |

AZ23267 | 246 | -67 | 218.00 | 2383570.34 | 6558891.55 | 3657.03 |

AZ23268 | 70 | -72 | 249.50 | 2383155.92 | 6559856.86 | 3620.7 |

AZ23269 | 50 | -70 | 222.50 | 2383305.74 | 6558902.25 | 3658.88 |

AZ23271 | 250 | -73 | 393.50 | 2383765.83 | 6558804.49 | 3697.56 |

AZ23273 | 250 | -73 | 289.00 | 2383435.28 | 6558680.31 | 3666.67 |

AZ23274 | 70 | -69 | 207.40 | 2382936.99 | 6559938.48 | 3600.47 |

AZ23275 | 270 | -68 | 216.50 | 2383441.31 | 6559053.13 | 3649.14 |

AZ23276 | 250 | -73 | 209.80 | 2383236.54 | 6560054.57 | 3638.55 |

AZ23277 | 250 | -76 | 476.50 | 2383155.65 | 6559962.6 | 3624.46 |

AZ23279 | 250 | -69 | 192.50 | 2383096.12 | 6559997.05 | 3621.08 |

AZ23280 | 70 | -80 | 485.50 | 2382886.31 | 6560080.64 | 3604.87 |

AZ23282A | 70 | -77 | 354.50 | 2383640.7 | 6558970 | 3670.87 |

AZ23283 | 70 | -73 | 342.50 | 2383333.26 | 6558591.57 | 3672.27 |

AZ23284 | 218 | -72 | 264.80 | 2383478.28 | 6558753.12 | 3656.6 |

AZ23285 | 189 | -73 | 256.60 | 2382660.09 | 6560140.26 | 3592.24 |

AZ23286 | 250 | -71 | 329.00 | 2383559.06 | 6559895.32 | 3663.26 |

AZ23289 | 232 | -69 | 278.00 | 2383144.1 | 6559821.65 | 3618.66 |

AZ23290 | 250 | -69 | 260.10 | 2383018.48 | 6559838.85 | 3609.93 |

AZ23291 | 256 | -61 | 241.50 | 2383211.83 | 6559701.44 | 3619.15 |

AZ23292 | 250 | -79 | 463.00 | 2383366.47 | 6559401.53 | 3637.6 |

AZ23293 | 250 | -79 | 382.70 | 2382848.48 | 6559430.82 | 3629.84 |

AZ23294 | 70 | -73 | 218.00 | 2382951.62 | 6558714.14 | 3677.95 |

AZ23297A | 90 | -67 | 360.50 | 2383321.5 | 6559783.34 | 3626.56 |

AZ23298 | 250 | -70 | 600.50 | 2383827.28 | 6557218.92 | 3837.42 |

AZ23299B | 56 | -73 | 310.00 | 2383214.16 | 6558423.55 | 3683.88 |

AZ23300 | 250 | -73 | 241.00 | 2383411.5 | 6559520.86 | 3651.4 |

AZ23301 | 250 | -80 | 398.00 | 2383641.55 | 6559506.34 | 3719.38 |

AZ23303 | 70 | -73 | 285.00 | 2382745.01 | 6558655.69 | 3744.74 |

AZ23304 | 250 | -76 | 387.50 | 2383619.16 | 6559706.95 | 3704.2 |

AZ23306 | 250 | -80 | 476.00 | 2383532.54 | 6559463.46 | 3689.28 |

AZ23307 | 127 | -65 | 184.80 | 2383162.23 | 6560107.98 | 3662.57 |

AZ23309 | 250 | -75 | 299.00 | 2383384.57 | 6558763.83 | 3663.04 |

AZ23310 | 63 | -74 | 369.60 | 2383203.62 | 6558579.65 | 3671.41 |

AZ23311 | 70 | -73 | 513.00 | 2382847.94 | 6559431.92 | 3629.79 |

AZ23312 | 70 | -76 | 212.50 | 2383168.16 | 6560109.28 | 3662.59 |

AZ23314 | 70 | -73 | 316.50 | 2383163.31 | 6559169.16 | 3652.25 |

AZ23315 | 70 | -71 | 206.40 | 2383220.02 | 6559188.86 | 3642.63 |

Coordinates listed in Table 2 based on Gauss Kruger - POSGAR 94 Zone 2 | ||||||

| ||||||

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company which owns 100% of the large, advanced-stage Los Azules copper project, located in the San Juan province, Argentina. McEwen Copper is a 47.7%-owned private subsidiary of McEwen Mining, which has the ticker MUX on NYSE and TSX.

Los Azules is being designed to be distinctly different from a conventional copper mine, consuming significantly less water, emitting much lower carbon and progressing towards carbon neutral by 2038, and being powered by 100% renewable electricity once in operation. In June 2023, an updated Preliminary Economic Assessment (PEA) was released, which projects a long life of mine, short payback period, low production cost per pound, high annual copper production and a 21.2% after-tax IRR.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. McEwen Mining also holds a 47.7% interest in McEwen Copper, which is developing the large, advanced-stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing the share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has a personal investment in the companies of US$220 million. His annual salary is US$1.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!!

|

|

|

|

|

|

|

| WEB SITE |

| SOCIAL MEDIA |

|

|

|

|

| McEwen Mining | Facebook: |

| ||

|

|

| LinkedIn: |

| ||

| CONTACT INFORMATION |

| Twitter: |

| ||

| 150 King Street West |

| Instagram: |

| ||

| Suite 2800, PO Box 24 |

|

|

|

|

|

| Toronto, ON, Canada |

| McEwen Copper | Facebook: |

| |

| M5H 1J9 |

| LinkedIn: |

| ||

|

|

| Twitter: |

| ||

| Relationship with Investors: |

| Instagram: |

| ||

| (866)-441-0690 - Toll free line |

|

|

|

|

|

| (647)-258-0395 |

| Rob McEwen | Facebook: |

| |

| Mihaela Iancu ext. 320 |

| LinkedIn: |

| ||

|

| Twitter: |

| |||

|

|

|

|

|

|

|

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/33c694f2-b6ae-456d-a566-32248720fdce

https://www.globenewswire.com/NewsRoom/AttachmentNg/16722842-96dd-4a47-beac-2263e2b7337a

https://www.globenewswire.com/NewsRoom/AttachmentNg/8146c956-b3b7-446f-a436-9f7bf9c98461

https://www.globenewswire.com/NewsRoom/AttachmentNg/23733c85-b899-4512-a8b4-5fc735c5f6bb

https://www.globenewswire.com/NewsRoom/AttachmentNg/fcde6690-9948-4c5a-b459-d2cac0c41ebd

Yahoo Finance

Yahoo Finance