What to Know about Singapore Exchange’s Latest ETF: Lion-OCBC Securities APAC Financials Dividend Plus ETF

On May 13th, Singapore Exchange (SGX: S68) introduced the listing of Lion-OCBC Securities APAC Financials Dividend Plus ETF (SGX: YLD).

This ETF follows the performance of 30 of the largest financial institutions listed in the Asia Pacific (APAC) region.

The ETF is based on the iEdge APAC Financials Dividend Plus Index, offering investors exposure to some of the largest players in the financial sector across APAC.

Investing in ETFs like this offers several advantages such as risk minimisation, diversification, and easy accessibility for investors.

Our article on ETFs aims to shed a better understanding into ETFs as an asset class.

Likewise, this article will guide you on how to effectively screen ETFs of your choice.

Details of this new ETF

The Lion-OCBC Securities APAC Financials Dividend Plus ETF is the world’s first ETF tracking APAC’s financial sector, with assets under management (AUM) of S$47 million at launch.

There are a total of 30 stocks, with the top 10 constituting just over half of overall weightage.

Heavyweights that we are all familiar with, like DBS Group (SGX: D05) and OCBC (SGX: O39) are some of the companies that make up this ETF.

Furthermore, this ETF includes financial institutions across a wide range of countries, such as Australia, Japan, and Hong Kong.

The ETF is not primarily focused on banking and contains other sectors such as insurance and investments as well.

The total expense ratio of this ETF is 0.50% per annum. This is relatively higher compared with some of the most popular ETFs listed in SGX, with TERs ranging from 0.09% to 0.40%.

However, the ETF promises a quarterly distribution for the first 2 years of at least 5% per annum of the issue price (S$1.00) with the first distribution expected in September this year.

Subsequently, from the third year onwards, quarterly distributions of approximately 5% per annum of the net asset value minus expenses will be dished out.

Growth prospects

The ETF aims to mirror the performance of iEdge APAC Financials Dividend Plus Index, focusing on investment opportunities in emerging markets across the APAC region.

It includes emerging economies like Indonesia and Thailand which are expected to contribute to the region’s financial growth and offer potential upside to investors.

Macroeconomic indicators also point to a more robust performance expected for the APAC region.

Anticipated rate cuts in the US could boost investment activity in APAC, leading to increased capital flowing into wealth management and insurance businesses.

Likewise, the Bank of Japan is gradually eyeing interest rate hikes, which will help to boost earnings in Japan’s banking sector.

Singapore’s banking outlook remains stable, although net interest margins may dip slightly in line with interest rate cut expectations.

APAC financial institutions are currently trading at attractive valuations.

They are trading at a Price to Earnings (P/E) ratio of just 10.3x, whereas companies in the Straits Times Index (SGX: ^STI) are trading at an average P/E ratio of 16.5x.

The current net dividend yield for APAC financial institutions is 5.91%, which is higher than the 5.13% yield for companies listed on the STI.

Risk analysis

Investors may also want to consider several risks specific to this ETF.

As mentioned earlier, a higher than average expense ratio can diminish returns.

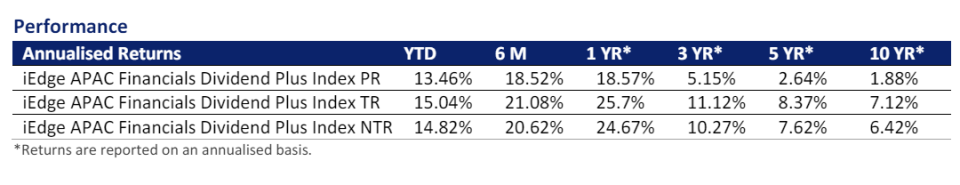

Looking at the historical performance of the iEdge APAC Financials Dividend Plus Index, returns have been somewhat lacklustre.

Source: SGX Indices

While its one-year performance has been strong, the total annualised return over the last decade came in at 6.42%.

Many indices have outperformed this ETF.

For example, the S&P 500 INDEX (^SPX) has achieved a 12.4% ten-year annualised net total return.

Likewise, the iEdge Southeast Asia+ TECH Index (SGX: SQU) has delivered a 9.23% ten-year annualised net total return.

Investing heavily in one specific industry also introduces concentration risk.

While the financial industry in APAC remains stable, there are still headwinds.

Current stresses in the Chinese banking sector due to the property crisis have led to an increase in bad loans.

For example, Industrial & Commercial Bank of China (SEHK: 1398), one of the constituents of the ETF, reported a 2.8% year on year decline in net profit for the first quarter report of fiscal year 2024 (FY2024).

Non-performing loans also went up 4.9% year over year to RMB 370.9 billion.

Additionally, recent cuts to China’s five-year loan prime rate in February will likely compress net interest margins further for Chinese banks.

These are some important risk factors that could undermine the potential returns of this ETF.

This could be the fastest way to jump from a “newbie” investor to a seasoned pro. Our beginner’s guide shows everything you need to know to buy your first stock and beyond. Click here to download it for free today.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Aw Kai Rui does not own any of the stocks and ETFs mentioned in this article.

The post What to Know about Singapore Exchange’s Latest ETF: Lion-OCBC Securities APAC Financials Dividend Plus ETF appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance